Embedded finance enables non-financial companies (non-financial institutions) to offer financial services to consumers. For example, consumers being able to make payments for their rides directly through the Uber mobile application. The smoothness embedded finance brings in executing financial activities, such as making payments, investing, or purchasing insurance, cannot be denied. It ensures better consumer experience, thus building customer loyalty and ensuring more income.

According to a survey by Solaris bank, more than 60% of consumers would prefer using a financial service from an e-commerce provider. While a research by Sopra banking estimates that adding embedded finance to their existing digital platforms could help companies reach a market cap of US$7tn by 2030.

Embedded finance is still in its growing and innovative stage. Thus, presenting significant opportunities for companies looking forward to adding embedded services to diversify their business offering and expand their business.

Let’s deep-dive more into understanding embedded finance, current market trends, and how it could help your business.

Difference between Embedded Finance or Embedded FinTech

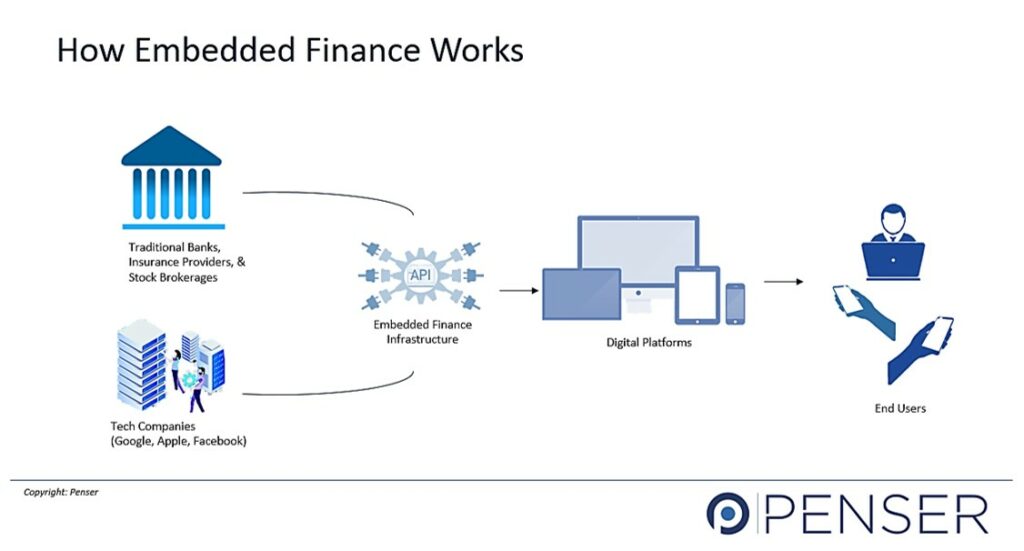

As mentioned above, ‘embedded finance’ is the integration of financial services to non-banking digital platforms to help them grow their product base or enhance customer service. While ‘embedded fintech’ is the integration of digital platforms by traditional banks or financial institutions to their existing banking infrastructure to help them align their services with the current consumer requirement.

With the help of embedded finance, financial technology companies can incorporate smart functionalities into traditional non-financial services. For instance, consumers can now make payments at the POS (point-of-sale) of the e-commerce website. They can also compare the benefits, premiums, and other details of insurance policies offered by different companies and choose an insurance policy that best fits their requirement. All of this is at the tip of the consumer’s fingertips while sitting on a train or a bus.

Embedded finance has made making financial decisions and buying financial products extremely convenient for consumers. This also brings down the need for cold sales calls since data analytics further allows target marketing which helps avoid unnecessary marketing costs and assures better sales.

Furthermore, Open Banking and other government initiatives make embedded finance increase competition for existing traditional banks and financial institutions. The addition of blockchain technology to non-banking companies’ financial services further augments the embedded finance sector by ensuring the layer of security and fraud prevention which was earlier a big threat and a question of concern for many consumers.

The growth of embedded finance could lead to traditional banks and financial institutions becoming obsolete unless they revamp their existing banking infrastructure. Banks can avoid this situation and collaborate with technology companies to improve customer engagement by incorporating financial products from fintech startups into their own platforms. For example, subscription-based services, wealth management, and cryptocurrency investing. This, embedding of fintech services by financial institutions to their platform is known as ‘embedded fintech’.

Embedded Finance Working and Use Cases

Embedded finance enables carrying out financial transactions through digital platforms. Basically, embedded finance serves as a common ground for traditional banks and financial institutions, and technology companies to collaborate and expand their services. It can be the embedding of payment gateways, lending services, insurance providers, or any other financial service, to a digital platform.

Embedded Finance Use Cases

Embedded Banking/ BaaS

Many banks are working in junction with fintech start-ups wherein banks provide their license, infrastructure, and product expertise, while the fintech partner provides the distribution networks for banks to grow their customer base. In conjunction with PSD2 and open banking, BaaS models have allowed banks to become primary players in embedded finance. However, BaaS has its challenges. Banks that lack the digital flexibility, infrastructure, and capital to provide BaaS could rely on ‘embedded fintech’ to build their customer base and remain significant in the current market where consumers prefer mobile banking.

Embedded Payments

Embedded payments enable making payments through fintech platforms or third-party applications. For example, when a consumer orders food through a mobile application installed on their smartphone and makes the payment through the application itself. The application offers various ways in which the consumer can make the payment, i.e., through their e-wallets or using credit or debits cards. Any non-financial platform, mobile application, or e-commerce website, that allows consumers to make direct payments from their platform have embedded payment API enabled.

Embedded Lending

Embedded lending includes services like BNPL (Buy Now Pay Later), which enable consumers to make payments for their purchases in installments. Merchants can enable embedded lending services at the point of sale (POS) on their e-commerce websites. Consumers, on the other hand, need to register and complete a KYC (Know Your Customer) identification process. Once the consumer is approved, they can choose their down payment amount and installment payment period. Embedded lending allows consumers to make multiple and/or large value purchases while merchants are able to increase sales by enabling embedded lending services on their platform.

Embedding lending is also available for B2B businesses that cannot pay their supplier in one go.

Embedded Insurance

Similar to other embedded financial services, embedded insurance offers transactional APIs and other technologies to provide insurance solutions in mobile applications, websites, and other digital platforms. For example, Tesla offers insurance services that Tesla car owners can use to buy the necessary coverage for their vehicle directly from Tesla instead of relying on a third party. This helps avoid the middle person fee, and also accelerates the insurance buying process since the documents are authenticated on the same platform within a few minutes.

Embedded Investments

Embedded investments enable different platforms enable customers to invest in stock markets through API-based brokerage firms. These APIs provide services ranging from opening a brokerage account, accessing their funds, trading, market data, IPOs, and managing their entire investment portfolio; everything related to their investments from one place.

Investors no longer need to reach out to a bank or authorized financial institution to apply for a brokerage account, fill the application, provide the required documents and then wait for a week or so until their documents are verified. Embedded investment platforms/APIs enable on-the-spot KYC, and document ID verification while opening an account on their platform. The entire process that earlier took weeks now takes a few seconds. Furthermore, investors no longer need to maintain several statements of their investments, since they can access all their investment-related information through the API-based brokerage firm itself.

Embedded Finance Trends 2021 & Global Market Review

Embedded finance has helped many digital businesses increase their sales and thereby improve revenue. Shopify was able to process more than US$14 bn. of gross payments in the third fiscal quarter of 2020 due to its partnership with Stripe’s Embedded Payments API. With the help of embedded payments, Uber is able to make payments to its drivers directly through its Instant Pay, embedded BaaS platform.

Currently, there are more than 1.3 bn. mobile payment users globally. This is further expected to grow significantly over the next five years; reflecting a 250% increase in revenue.

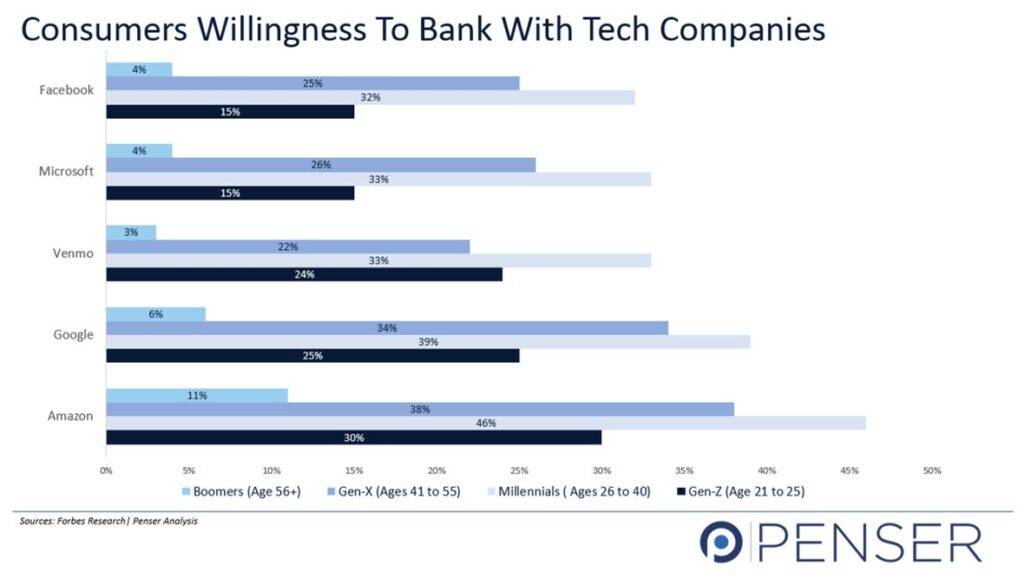

Many large tech companies, such as Amazon, Apple, Google, Facebook are offering e-wallets services to make digital payments directly through their platform.

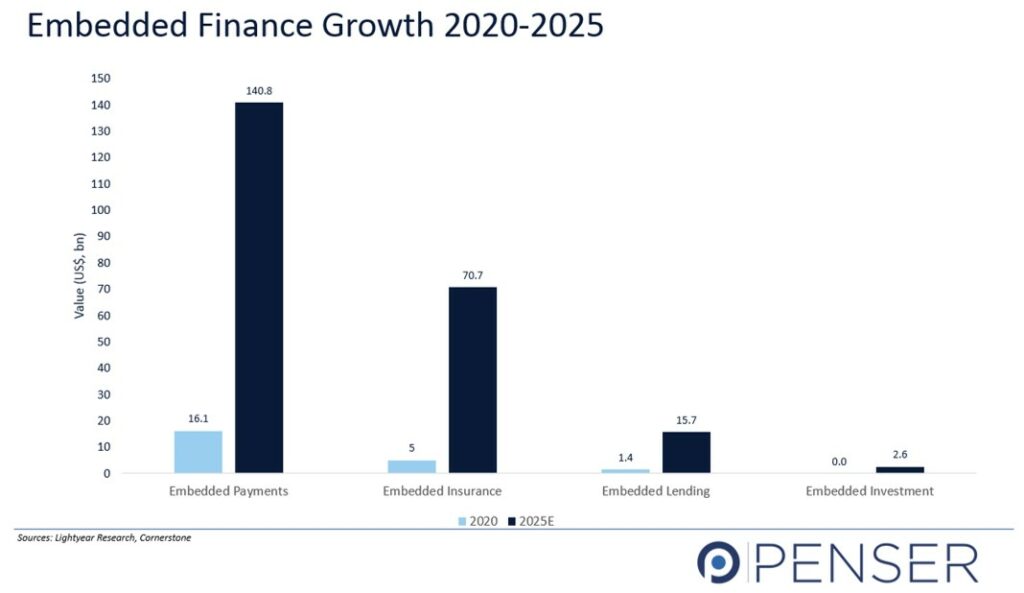

According to a survey by Lightyear Capital, Embedded Payments could generate a revenue of US$140.8bn by 2025, followed by embedded insurance adding US$70.7bn in revenue by 2025. US$15.7bn through embedded lending, and US$2.6bn through embedded investment and wealth management.

Thus, resulting in embedded finance growing and generating nearly US$230 billion in revenue by 2025, a US$22.5 billion increase from 2020.

Leading Embedded Finance Fintechs Players

Embedded BaaS Service Providers

BBVA, Solaris Bank, Bankable, Treezor, Clearbank, GreenDot, Starling Bank.

Embedded Payments Service Providers

Railsbank, Resolve Corp., Currency Cloud, PayNearMe, SoundPays, Wise (formerly Transferwise), Neuroware, and many more mobile payment service providers such as Apple, Google, Amazon, Venmo, etc.’

Embedded Lending Service Providers

Funding Options, iwoca, Just Cash Flow, Optimum Finance, YouLend provide loans. While platforms, such as Klarna, Affirm, AfterPay, Sezzle, Flipper can be integrated at the POS on a merchant’s website to provide installment payment option (BNPL).

Embedded Insurance Service Providers

Trov, Cover Genius, InsureMO, Boost, InnoPay are some of the leading embedded insurance service providers.

Embedded Investments Service Providers

Robinhood, WeBull, TradeStation, Groww, Lightyear, Platforum, MarketX provide online brokerage and trading solutions to retail consumers.

It is nothing less than obvious that adding an embedded financial service to the existing business platform significantly helps in building customer loyalty and thus growing the customer base. In today’s fast-paced world, convenience is the key. If a business is able to make a purchase or transaction as convenient and as easy as possible for a consumer in comparison to its competitors, it is going to gain a major share of the market which can help generate more and consistent revenue.

About Penser

Penser is a specialist fintech and payments consulting firm with experience working for clients in the digital payments, digital banking, and mobile payments sectors.

Embedded finance could be the solution to growing your digital business and ensuring stable revenue which can be difficult in these competitive times. If you wish to learn more about if and how embedded finance could help your business grow reach out to our team of highly skilled fintech professionals at hello@penser.co.uk.