Starting off with the idea of replacing paper money, cryptoassets (cryptocurrencies) have become more of an investment asset. The increasing application of cryptocurrencies and blockchain, especially in building and enhancing decentralized finance infrastructure, could be major reasons for this. With the current comparison of Bitcoin to Gold, Litecoin to Silver, and many institutional investors hedging from inflation with Bitcoin and other cryptoassets, it is only a matter of time before cryptocurrencies become an accepted asset class.

Importance of Investing and Diversification

Investing is important, if not critical, to make your money work for you. It is an opportunity for individuals to grow their wealth which in turn can help during unforeseen financial events and/or provide additional retirement income.

As important as investing is, it is equally important to diversify one’s investment portfolio, i.e., avoid putting all your eggs in one basket. This helps avoid any significant impact on a person’s finances in case an asset’s market value falls.

To ensure investment portfolio diversification, an investor should be aware of the various asset classes available. Asset classes that have stood the test of time, and new asset categories that are currently trending in the market, which could possibly boost one’s investment strategy and financial plan.

Cryptoassets – The Asset Class of the Millennials

Today, cryptocurrency is one of the most trending topics. According to a research paper published by an Economics Professor at Yale University – ‘Bitcoin should account for at least 6% of one’s portfolio. Those who are less enthusiastic about the world’s most popular cryptocurrency should hold 4% of it.’ Through this research, the professor concluded that digital currencies show a higher potential for return, despite their increased volatility.

According to research by Provoke Insights, 66% of millennials have more faith in cryptocurrency than the stock market. While 93% of the respondents would put more money in crypto if “traditional” financial institutions offered it, such as Fidelity or Charles Schwab.

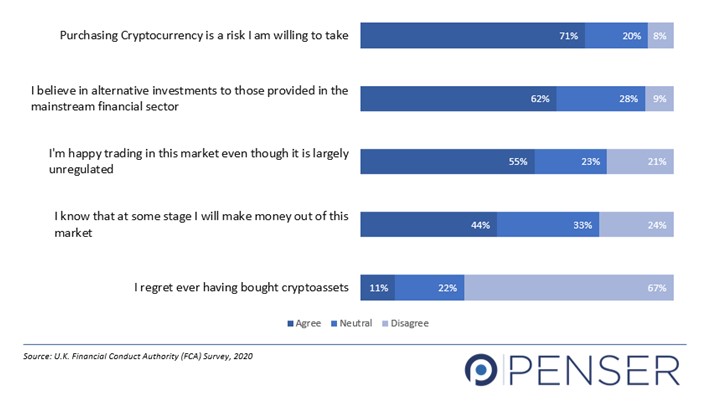

A recent U.K. FCA survey reveals that millennials, 35 to 44 years of age, and in full-time employment are more likely to consider buying cryptoassets in the future. 71% of the respondents are aware and accepting of the risks associated with cryptocurrency investment. 67% of the respondents do not regret investing in cryptoassets.

Why Cryptocurrency as an Investment?

Traditional investment advisors do not often agree with including cryptocurrency as a part of one’s investment portfolio, as it is highly volatile and therefore risky. One cannot deny that based on the same factors, cryptoassets when combined with traditional investment assets can significantly enhance an investment portfolio’s ability to achieve greater returns for a given level of risk.

Even 1% of crypto assets in a diversified portfolio could substantially improve returns, without negatively impacting the portfolio in case of downfall due to the high volatility factor.

Thus, being a crucial reason for considering cryptoassets for portfolio diversification.

Based on SwissOne’s analysis, crypto is a desirable asset that should be part of a diversified multi-asset portfolio. An allocation of 2%–5% in crypto assets is a sensible investment for low-risk portfolios. While the allocation could increase as much as 8%–20% in higher-risk models.

Diversifying Your Cryptoasset Portfolio

Given the current value of Bitcoin, many individuals consider it too late to invest in cryptocurrency. However, the cryptocurrency market comprises of other cryptocurrencies as well. Additionally, an individual does not need to buy a Bitcoin, they can even buy a fraction of it. The return is calculated on a pro-rata basis. For example, if the current value of Bitcoin is US$56665.70 (April 19, 2021), and a person bought US$1,000 worth of Bitcoin. Their share of the Bitcoin would be 1.76%, qualifying them for the same percentage return on the asset.

There are several other cryptocurrencies, such as Ether, Ripple, Stablecoin, Litecoin, and more in the market. Each cryptocurrency serves a different purpose. Depending on the usage, some cryptocurrencies could gain a more established market. Thereby being subject to less volatility than others.

Furthermore, investing in a range of cryptoassets helps balance the crypto portfolio. For example, if an individual invested only in one or two cryptoassets, the volatility of the assets could result in a negative value of the portfolio. However, if the portfolio is diversified with 8 to 10 different cryptoassets, then the fall in the value will not impact the portfolio since other cryptoassets would remain the same or increase in value.

Types of Cryptocurrency Diversification

As mentioned above, every cryptocurrency/cryptoasset serves a purpose. Some cryptoassets are useful in making payments, while others are turning useful in decentralized finance, data analytics, identification, etcetera. Depending on this usage, some cryptoassets may be more stable in terms of market value than others. This usage purpose also assures that cryptoassets are fully functional and not simply an object of gamble.

Some of the popular uses of cryptoassets are as follows:

Transactional Tokens

Tokens are cryptocurrencies designed to be used as digital currencies to be used for transactional purposes, such as making payments in exchange of goods & services, remittance. Example: Bitcoin.

Smart Contract Tokens

Smart contract tokens are protocols that enable creating smart contracts and peer-to-peer payments through decentralized finance (DeFi) applications (apps). Example: Ethereum, Binance Chain, or Polkadot

Utility Tokens

Cryptocurrencies integrated into an existing blockchain protocol and used to access its services are called utility tokens. If the particular utility becomes popular, the price of the cryptocurrency/crypto-asset increases. The value drops in case of issues with the utility service. Example: Filecoin, Dentacoin, Siacoin.

Security Tokens

Tokens that are presented to investors in an ICO (Initial Coin Offering) in exchange of the investment. It represents legal ownership of a digital or physical asset such as non-fungible assets (NFTs), other artwork, or real estate that have been verified on the blockchain.

Stablecoins

A stablecoin’s value is tied outside to another asset or currency. Stablecoins are often used to hedge against the market. They are of three types: fiat-collateralized, crypto-collateralized, and non-collateralized. Fiat-collateralized stablecoins are pegged to currencies such as the U.S. dollar.

Crypto-collateralized stablecoins are pegged against another cryptocurrency, for example, Dai. Fiat-collateralized makes Stablecoins less volatile. Example: Tether, Gemini Dollar, USDC, and PAXGold.

Yield-earning Tokens

By investing in these tokens, an individual is adding to the liquidity pool. This enables decentralized finance (DeFi) lending and borrowing. Yield earning tokens ensure a passive income of up to 20%. Example: USDC.

Diversifying one’s investment portfolio is a sensible way of making one’s money grow and work for them. It helps reduce risks and earn passive income. And cryptoassets is the new asset class to consider. Backed by blockchain technology, cryptoassets are proving to be useful in many sectors. From decentralized finance to healthcare, data analytics, energy, and various other fields.

The blockchain industry is growing stronger with improved financial infrastructure. Companies are providing institutional-grade custody services enabling professional and individual investors to manage and safeguard their crypto assets. Cryptoassets are slowly proving to be useful in many sectors. Thus, making the crypto ground firmer and more stable.

Penser is a specialist fintech and payments consulting firm with experience working for clients in the digital payments, card payments, and mobile payments sectors. We offer digital transformation, due diligence, and strategic planning services.

Contact us to find out how we can help boost your business.