Growing Fintech Adoption and Mergers & Acquisitions

The year 2020 was all about change; from lifestyle changes to how businesses operate. The pandemic resulted in many businesses accelerating their transformation strategies due to changes in consumer behaviour. One of the quickest ways to bring about business transformation is through mergers and acquisitions.

According to Refinitiv, a data research firm, companies spent close to $1.74 trillion on mergers and acquisitions of U.S. companies during the first six months of 2020. This is the highest amount spent on M&A in the last four decades. Approximately $1.28 trillion was spent on M&A in the first two quarters of 2019 and close to $511.79 billion in 2018.

The majority of mergers and acquisitions in 2020 were related to technology and financial services providers. The primary reason being companies trying to digitalize their businesses due to the sudden and drastic transition of consumers to digital platforms for shopping and banking because of the Covid-19 induced restrictions.

Global Adoption of Fintechs

The growth in adoption of digital services, such as e-commerce, digital payments (mobile payments, e-wallets, Buy Now Pay Later, and digital banking were almost latent, however, the global lockdown in 2020 has proven to be catalytic to the fintech adoption rate.

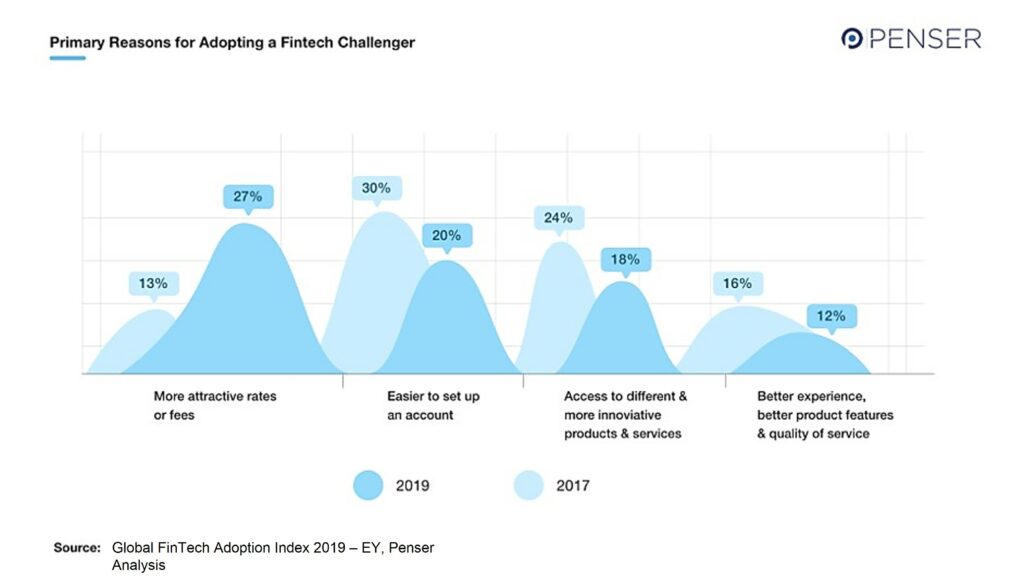

Currently, almost two-thirds of the retail banking customers across the world use a fintech product, such as mobile or e-wallet payments, or a financial service related to investments or financial advisory, loans, and mortgages. The addition of technology to finance has improved the way banks operate, and how consumers carry out financial transactions. The convenience that fintechs bring to basic banking and payments activities is what makes customers choose digital platforms over traditional methods. Almost 81% of the customers feel that fintechs offer faster services at a greater experience.

It is estimated that by 2022, 60% of global GDP will be digitized. Growth in almost every sector will be through digitally enhanced products and offerings.

Consumers Fintech Adoption Survey

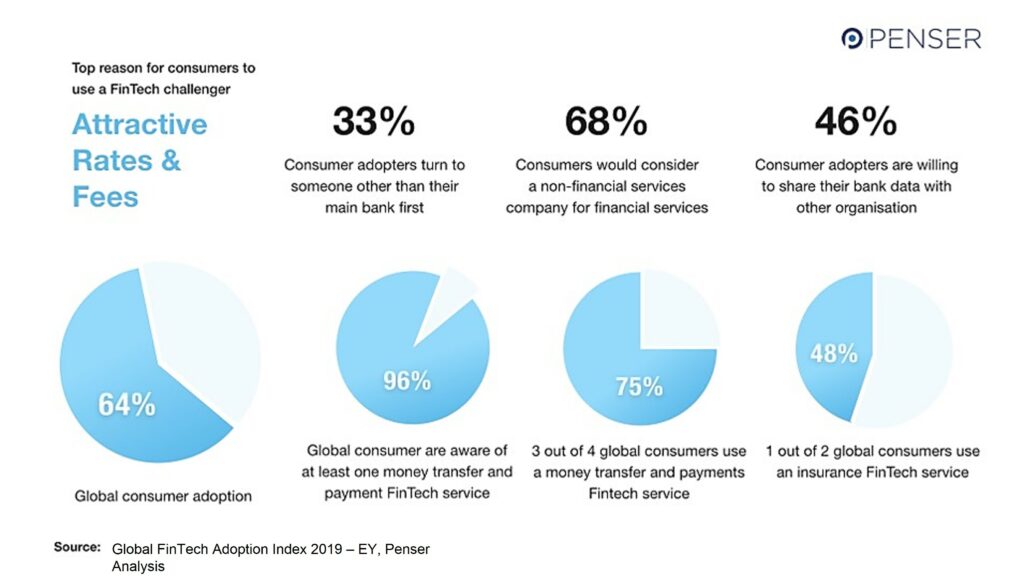

96% of global consumers are aware of at least one money transferring and payment fintech service provider. While one out of two consumers has used an insurance fintech service provider. The affordable pricing of financial products and services being a crucial factor in this increased acceptance rate.

Small To Medium-Sized Enterprises (SMEs) Fintech Adoption

Fintechs provide many services that make doing business easy for businesses, such as e-commerce websites, merchants, retailers. Globally, 25% of such businesses have adopted fintech services while 56% of SMEs have used at least one banking and fintech service provider. The availability of a plethora of services, functionalities, and features at affordable rates is the key reason for SMEs to adopt Fintechs.

FinTech has become a dominant industry around the world. Across the globe, countries are counting on fintech companies to help their economy recover from the pandemic-related crisis.

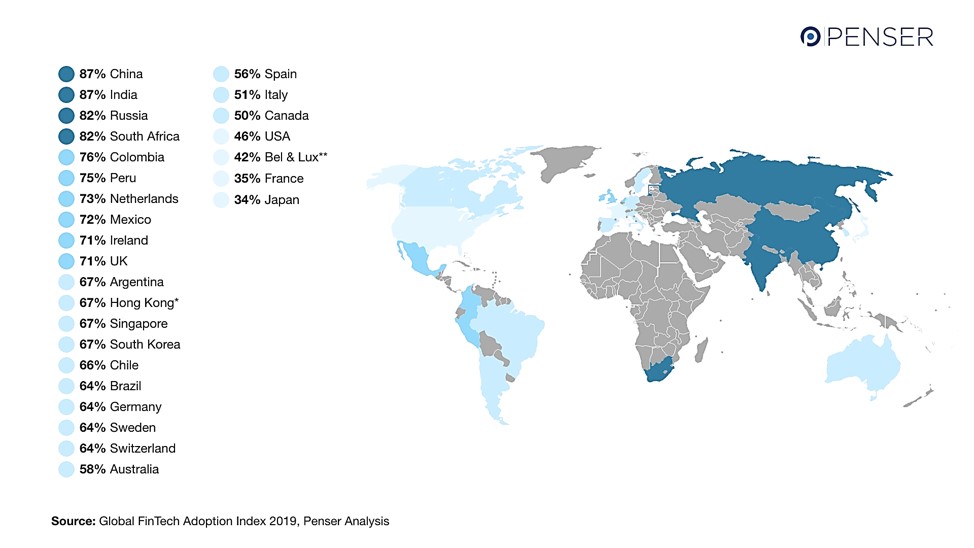

Emerging markets are leading the way with fintech adoption. The fintech adoption rate in China and India stands at 87%, while Russia and South Africa’s fintech adoption rate stands at 82%. According to E&Y research reports, the adoption of fintech services is growing faster than anticipated. Based on a 2017 survey, fintech adoption was expected to reach 52% by 2019. However, reality exceeded expectations, with the actual global fintech adoption rate in 2019 being 64%.

VC Investment and Mergers & Acquisitions in Fintechs

The year 2021 started with mergers and acquisitions in the fintech industry. A new fintech M&A is announced almost every month, if not every week, and this is expected to increase further. Many more such fintech mergers and acquisitions are expected throughout this year and in the coming years.

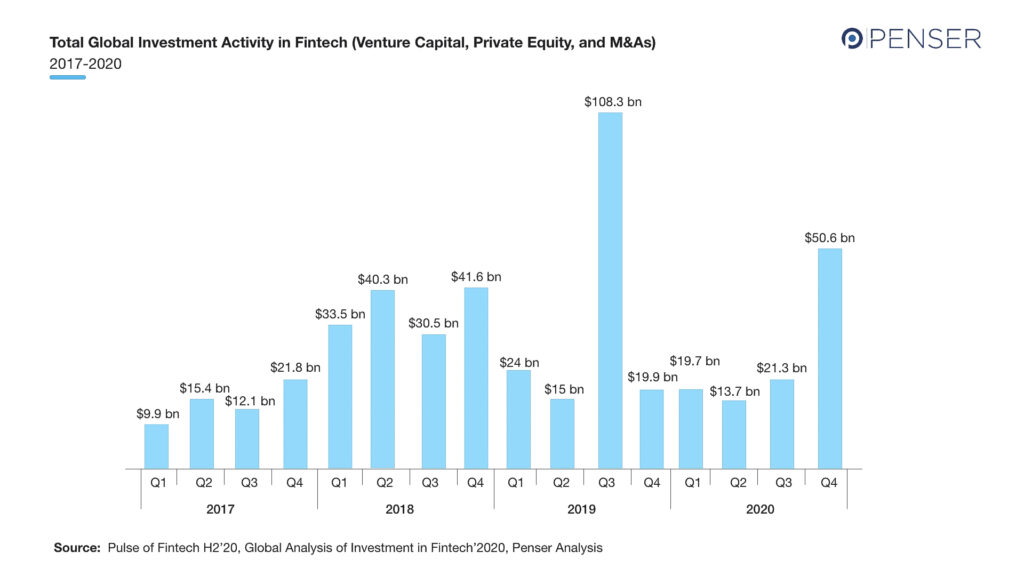

In 2020, during the pandemic, the fintech industry attracted close to US$42.3 bn in venture capital (VC) investment.

Robinhood, a US-based wealth-related fintech was able to raise close to US$1.3 billion in 2020 (US$ 600mn in July and US$ 668mn in October). This was the largest VC investment of 2020.

Digital banks also attracted several venture capitalists in 2020. Klarna, a Swedish digital bank, was able to raise US$ 650mn. While Revolut and Chime (a US-based fintech) raised close to US$ 580mn and US$ 533.8mn. respectively.

2020 has been the year where the digital banking and payments companies excelled exceptionally well. There were several fintech-related mergers and acquisitions during 2020. The year started with M&A activity at US$ 10.9bn but crossed US$ 50bn by the year-end.

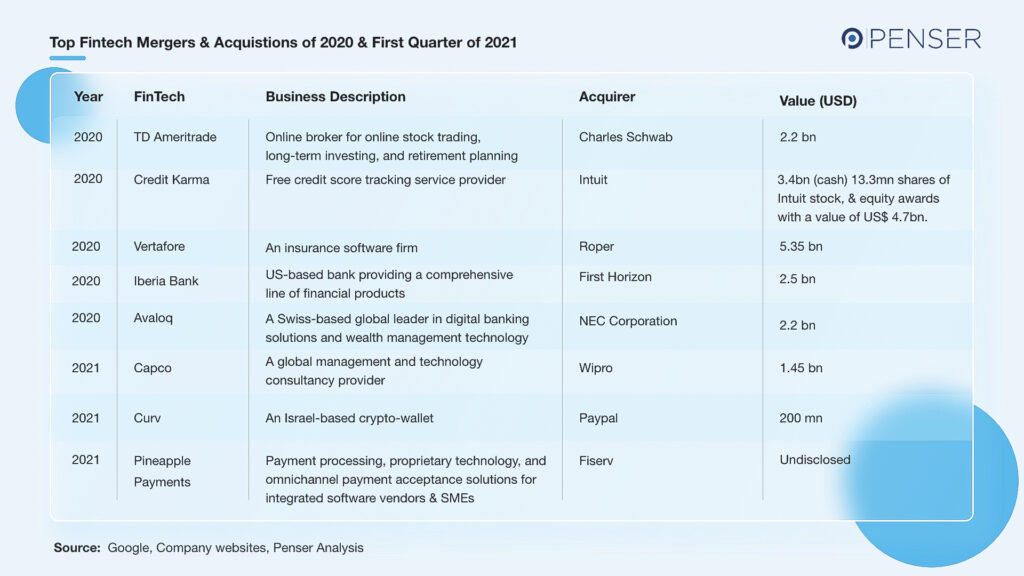

Some of the key (highly-valued) M&As of 2020 and H1’2021:

- The acquisition of TD Ameritrade by Charles Schwab for US$22 bn.

- Intuit’s acquisition of Credit Karma (free credit score tracking service provider) for US$ 3.4bn in cash, 13.3mn shares of Intuit stock, and equity awards with a value of US$ 4.7bn.

- Roper’s acquisition of Vertafore (an insurance software firm for US$ 5.35bn).

- First Horizon Bank’s acquisition of Iberia Bank for US$2.5 bn, and

- Avaloq’s, a Swiss-based global leader in digital banking solutions and wealth management technology, acquisition by Japan’s NEC Corporation for US$ 2.2bn.

Key Fintech M&A’s completed in the first half of 2021:

- Wipro acquired UK technology consultancy Capco (a global management and technology consultancy provider) for US$ 1.45bn.

- PayPal’s acquisition of Israeli crypto wallet Curv for its new blockchain unit for a more inclusive financial system for less than US$ 200mn.

- Fiserv’s acquisition of Pineapple Payments (undisclosed value).

- Visa acquired Tink for US$ 2.1bn

- Rapyd’s acquisition of Valitor for US$ 100mn

- JPMorgan Chase’s acquisition of Nutmeg, a British digital wealth manager, for £700 mn.

- JP Morgan Chase’s acquisition of financial technology start-up OpenInvest for an undisclosed amount.

- JP Morgan Chase’s acquisition of a 40% stake in Brazil’s digital challenger C6 Bank.

- Cashplus, a UK-based challenger bank’s acquisition of icount’s current account portfolio.

- Stripe’s acquisition of Bouncer, a debit/credit card verification service provider.

- Sift’s (Digital Trust & Safety provider) acquisition of Chargeback, a pioneer in real-time dispute management for merchants.

The FinTech industry has grown significantly.

Almost every start-up is a fintech-related start-up. However, times have changed, even as start-ups, most of these firms have broad operational capabilities, a diverse range of products, and the ability to scale globally. The current set of fintechs have access to capital and a growing market which many companies lacked in the past.

Furthermore, the government and regulatory authorities of almost every country have been supportive of fintech companies’ growth. For example, the UK government’s Open Banking ecosystem to help fintechs grow their consumer base; and additionally extending financial support. The UK government has decided to unlock over £20 bn of investment over the next 10 years through the British Business Bank (BBB) for economic growth of small businesses, and fintech start-ups.

The Indian government’s Unified Payment Interface (UPI), Startup India, Digital India Programme, and several others. India is poised to realize a fintech valuation of US$ 150bn to US$ 160bn by 2025.

The Monetary Authority of Singapore (MAS) provided support of US$ 125mn to the FinTech sector as economic problems due to Covid-19 surged. The Authority also launched a US$ 6mn MAS-SFA-AMTD FinTech Solidarity Grant to help Singapore-based FinTechs sustain operations, retain staff, and offset operations-related expenses.

These are just a few examples of how regulatory authorities across the globe are lending support to financial and technology companies to help them scale their businesses and boost the economy.

Penser is a UK-based fintech and payments consulting firm with experience working for clients in the digital payments, digital banking, and mobile payments sectors. As an expert in fintech consulting and payments consulting, Penser tracks new trends in the industry.

Our services include:

- Conducting Commercial & Technical Due Diligence to guide business investment decisions

- Strategic Planning to drive growth and scale business

- Digital Transformation of businesses

- Assisting with restructuring and turnarounds to improve business operations and tackle financial challenges

Fintech start-ups are currently trending targets for acquisition, especially for banks and private equity firms. Contact us to learn how we can help you conduct due diligence related to mergers and acquisitions of FinTech firms and other companies.