The global fintech industry is currently valued at US$309.98bn. Last year, the fintech sector saw significant growth in interest and capital. With fintech companies receiving more than US$130bn in capital. The COVID-19 pandemic playing a major role in the growing interest and usage of fintech. Many businesses digitally transformed themselves, integrating several digital technologies in almost all areas of their business, from digital payments, to automating their work processes due to the sudden global travel restrictions.

So, what to expect from the fintech industry in 2022?

Fintech Industry Insight 2022

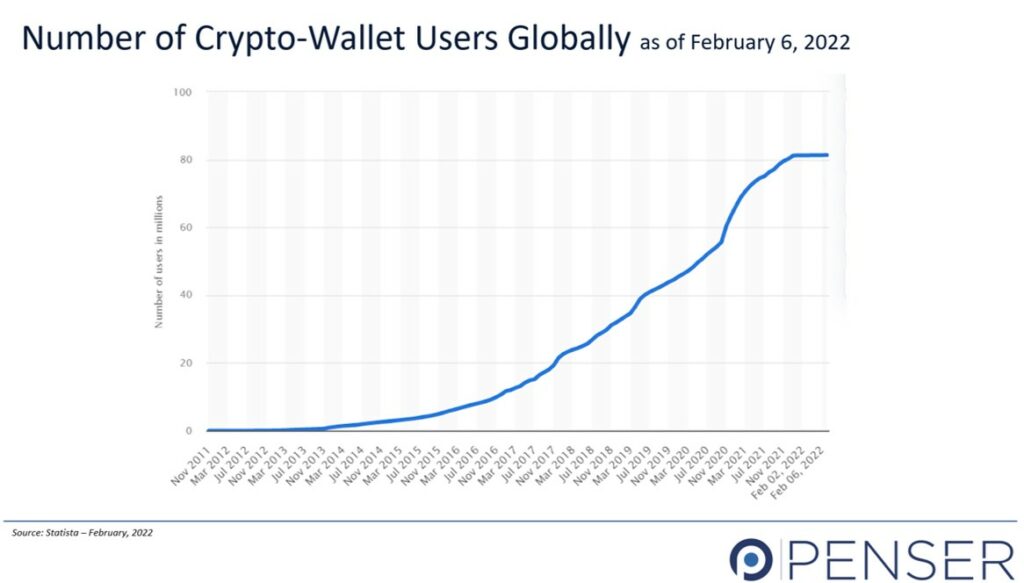

Increase in Crypto Wallets & Crypto Payments

Interest and investment in cryptocurrencies increased significantly in 2021. This also led to an increased adoption of cryptocurrency for making payments. Many companies have started accepting payments in cryptocurrencies from businesses (B2B), and retail consumers. Crypto wallets are necessary to store cryptocurrencies and execute payments. The fintech industry could see more cryptocurrency wallet service providers in 2022 as cryptocurrency wallet holders continue to increase.

More Embedded Finance and Other Services

Embedded finance is the easiest way for non-financial companies to integrate financial services to their platform. This could be embedded payments, or any other financial service. For example, Google Pay, Amazon Pay, or Apple Pay, all these technology companies have integrated payments services which provides them an opportunity to expand their consumer base, and strengthen the relationship with existing customers.

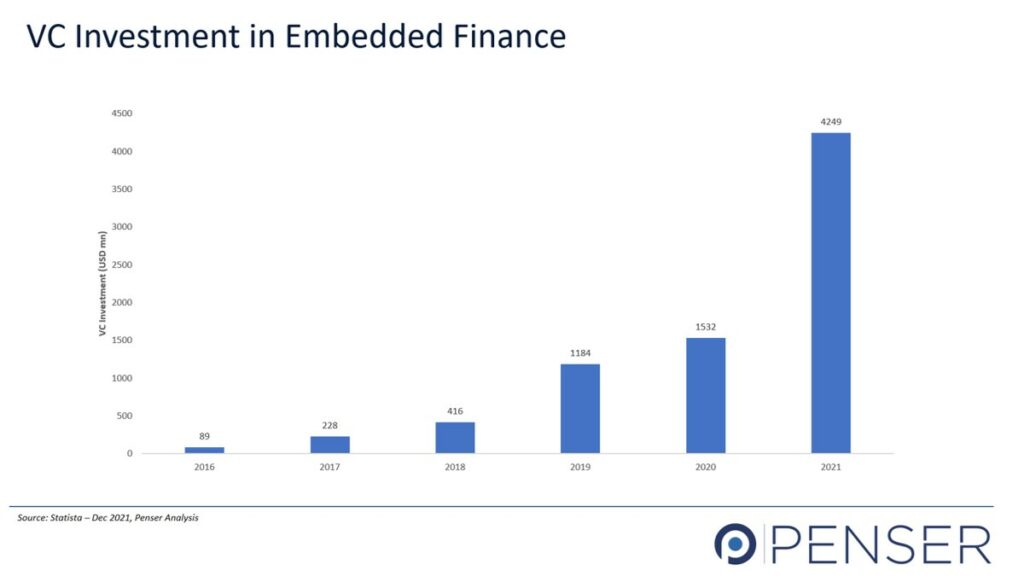

According to Pitchbook, last year, approximately US$4.25bn was invested by venture capitalists (VCs) in companies that deal with embedded finance. A 177% increase from the amount invested in 2020. It is likely that the fintech industry will see more new entrants in the market covering additional services such as embedded insurance, embedded lending and other services.

Stablecoins and CBDCs

With the increased usage of cryptocurrencies, central banks of many countries are working on their own central bank digital currencies (CBDCs) to enable digital retail and B2B payments. In 2022, we could see significant collaboration between regulatory authorities, central banks of various countries, and fintech companies.

Stablecoins are cryptocurrencies whose market value is pegged to external products, such as fiat currencies. For example, USDC whose value is pegged against the US dollar. Due to its less volatile nature, there has been significant growth in the total value of stablecoin assets. According to The Block, the total value of stablecoin assets grew approximately 495% from October 2020 to October 2021. The combined circulating supply of USD-pegged stablecoins on public blockchains was an estimated US$130bn in September, 2021, a 500% increase from 2020.

In 2022, we could see more fintech involvement in Stablecoins and CBDCs which could help make cross-border payments faster and also help reduce costs.

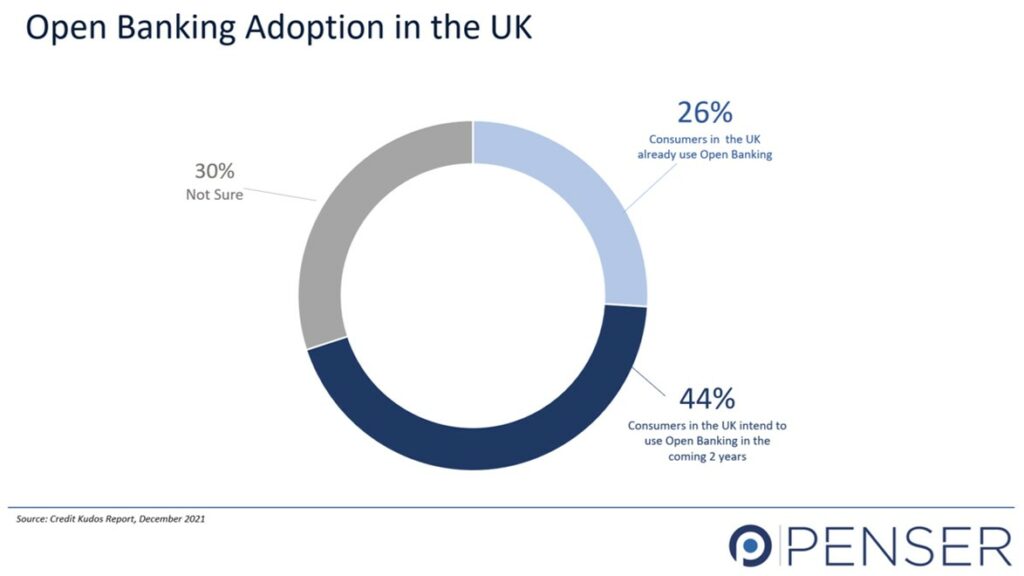

Enhanced Open Banking Platforms

According to an annual research report by Plaid, an open banking platform, UK consumers on average use 2.8 fintech products and services which is expected to increase to 3.5 fintech products per individual by mid-2022. An average UK user manages 67% of their finances online. 76% of Brits now feel confident using technology to manage their finances. UK’s open banking boasts of a consumer base of 4.5 million active users with around a million new users every 6 months, as per OBIE’s December 2021 report.

Given that consumers have rights and control over their financial data, they feel more comfortable using open-banking platforms. Open banking could see more innovations in 2022.

Decentralized Finance and Web3

Decentralized finance (DeFi) enables peer-to-peer financial transactions without the involvement of any financial intermediaries, such as: banks and other financial institutions. Thus, helping avoid unnecessary costs. These transactions are carried out using blockchain technology, hence making them immutable. Web3 which intends to decentralize the internet by using blockchain technology could help reduce the friction that decentralized finance currently faces. However, web3 is at a nascent stage and there is significant room for growth and improvement. Therefore, this year, we could see more Defi and Web3 related news.

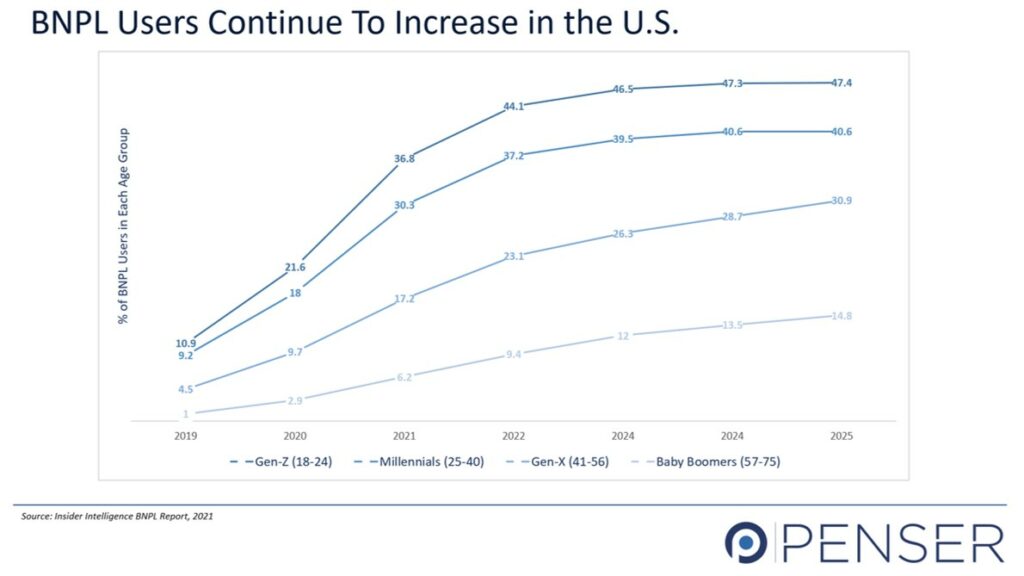

Buy Now Pay Later BNPL Fintech

Buy now, Pay later (BNPL) is growing in popularity and expected to hit $680 billion in global transaction volume in 2025. This represents an eye-watering compound annual growth rate (CAGR) of 13.23% from the $285 billion the industry recorded in 2018.

In the U.S. alone, 36.8% of Gen-Z and 30.3% of millennials used BNPL payment option to make purchases.

Currently, almost every business and individual consumer is using a fintech product or service, and as innovation continues and technology evolves, the fintech sector will continue to grow, be it in 2022 or in the years to come.

About Penser

Penser is a fintech and payments specialist consulting firm, based in the UK. As the digital payments sector continues to evolve, Penser tries to keep its clients and other businesses updated with the ever-changing world of financial technology (fintech) and digital payments.

We have experience working for clients in the digital payments, digital banking, and mobile payments sectors. We have some of the renowned companies as our clients.

Our services include:

- Conducting Commercial & Technical Due Diligence to guide business investment decisions.

- Strategic Planning to drive growth and scale business.

- Digital Transformation of businesses.

- Assisting with restructuring and turnarounds to improve business operations and tackle financial challenges.

To learn more about how you can scale or innovate your fintech business with the continued innovations in the fintech sector, reach out to our team of financial technology (Fintech) experts at hello@penser.co.uk.