There is an involvement of several third-parties in executing a digital payment, such as: know your client (KYC) verification, an issuing bank, acquiring bank, payment gateway service provider, etc. A problem with either one of them could result in delays in the transaction. However, blockchain technology could help avoid many of these problems by enabling peer-to-peer transactions.

Blockchain technology is an open-sourced and decentralized digital ledger that enables each component, or block, within a transaction to be tracked and approved by everyone who is party to the transaction. Thus working like a digital record book accessible to everyone but cannot be modified or manipulated. Therefore, making blockchain technology safe to execute and maintain record of peer-to-peer transactions without the need for a middle person or agent to monitor the transaction.

According to a report from Grand View Research, the global blockchain technology market size was valued at US$ 3.67 billion. This is expected to grow further at a compound annual growth rate (CAGR) of 82.4% from 2021 to 2028. Let us investigate the various areas where blockchain technology could be applied to improve digital payments services.

Use of Blockchain Technology in Digital Payments

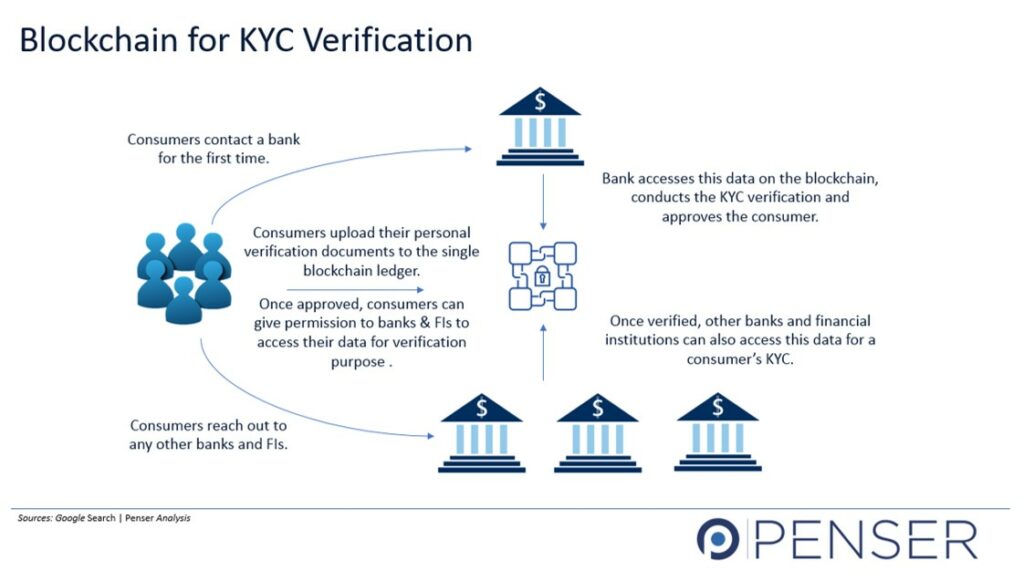

To Make ‘Know Your Customer (KYC)’ Process Fast & Affordable

According to recent estimates, the global spend on KYC was $1.2 billion approximately in 2020. Financial institutions spend a significant amount of money per year to ensure they have access to the best KYC service. However, unfortunately, the existing KYC processes are time-consuming and slow filled with risk of error and effort duplication. Blockchain technology, on the other hand, will enable the collection of data by one organization or resource which will work as a digital repository accessible by other organizations to verify their customers. This direct access to a single repository will help avoid duplication, save time and money, and accelerate the KYC process.

To Accelerate Transaction Processing Speed

As mentioned above, blockchain technology is open-source hence accessible to all. Similar to the usage of blockchain for KYC purposes, if all the banks use the blockchain ledger to maintain record of transactions, the time spent between banks trying to connect and gather information before processing a transaction can significantly reduce. This may enable faster processing of financial payments.

For example, while using the ATM of Bank A to withdraw money from Bank B, Bank A’s network would need to connect with Bank B to check the customer’s account details and balance before proceeding with the withdrawal. However, if this information is maintained on a single digital server accessible by all the banks, the time and cost involved in processing this withdrawal request would be significantly reduced. Also, this transaction would not be impacted by any temporary network issues that Bank B may be facing.

For Process Automation

Using blockchain technology based platforms and smart contracts, companies can automate their regular and frequent payments. This could be significantly useful in the case of B2B digital payments, where the payments are made frequently and in large amounts. A smart contract would ensure the authenticity of the deal without the need for a middle entity.

Enhance Security & Minimize Fraud

Every block of transaction needs to be approved by all the network members before being added to the blockchain. Once added, this information is visible to all but immutable. Every new transaction is recorded on the blockchain ledger which is again visible to the network members making it easy to identify any fraudulent transactions.

In order to tamper with the blockchain ledger, the hacker(s) would need to control significant number of systems simultaneously. This is close to impossible. Furthermore, blockchain network can be permissioned, i.e., the participation and visibility of the network can be restricted to only members. These members are invited and verified before they can contribute to the blockchain network/digital ledger.

Streamlining the Audit Process

The blockchain digital ledge is immutable, i.e., it cannot be altered or modified, although it can be viewed by anyone. This not only provides the required transparency of information but also makes the digital ledger safe and authentic. Thus, banks no longer need to keep audit trails of transactions. Regulators and auditors would be able to review the transaction flow and carry out the audit process without any hassle.

Digital Payments Fintech Companies Using Blockchain

Stellar

Stellar is a decentralized (open source) protocol. It works on blockchain technology and enables storage and movement of money. Using Stellar’s network, users can transfer digital currency to fiat money domestically and across border. Stellar has almost 3 million user accounts. Some of Stellar’s partners are Flutterwave, IBM, KlickEx, ICICI Bank in India, and MoneyGram.

Ripple

Ripple uses blockchain to process and secure their RippleNet payment network. With RippleNet, customers have access to a network of more than 200 banks (including American Express, BMO and PNC), and they can make cross-border payments instantaneously. The company’s blockchain helps to encrypt each payment and allows for each money transfer to be easily traceable.

Veem

Veem is a service for international business payments using a network of companies around the world. It works with small businesses, allowing them to make transactions in local currency. The services of Veem spans across 96 countries. The company uses proprietary technology, combining blockchain technology, treasury and existing rails to provide safe, trackable payments.

Mastercard

Mastercard Blockchain facilitates new commerce opportunities for the digital transfer of value by allowing businesses and financial institutions to transact on a distributed ledger.

It is safe to conclude to that the usage of blockchain technology for digital payments could drastically reduce business expenses related to the KYC and KYB processes. It would also accelerate transactions processing since multiple touch-points normally involved in executing a transaction would not be necessary.

Having said that, the use of blockchain technology is not limited to digital payments. Blockchain technology is expected to positively impact the crowdfunding, accounting, financial services, transport, hospitality, and several other businesses.

About Penser

Penser is a fintech and payments specialist consulting firm, based in the UK. As the digital payments sector continues to evolve, Penser tries to keep its clients and other businesses updated with the ever-changing world of financial technology (fintech) and digital payments.

We have experience working for clients in the digital payments, digital banking, and mobile payments sectors. We have some of the renowned companies as our clients.

Our services include:

Conducting Commercial & Technical Due Diligence to guide business investment decisions.

Strategic Planning to drive growth and scale business.

Digital Transformation of businesses.

Assisting with restructuring and turnarounds to improve business operations and tackle financial challenges.

To learn more about the various application of blockchain technology, and if it could be useful to improve or grow your business, reach out to our team of financial technology (Fintech) experts at hello@penser.co.uk.