Mergers and acquisitions along with billion-dollar funding rounds in fintech firms are on the rise. The questions that remain unanswered for many are – how is the monetary value of these start-up fintech firms determined? What are the steps involved in the valuation of a fintech? What role does the number of customers play? What is the average value per customer? How does this benefit the fintech and its customers?

Let us start with:

Determining a FinTech’s Value for M&A and Investment Purposes

Normally, in the case of traditional businesses with physical presence, a manufacturing firm, an asset management company, etc. factors like PE ratio, discounted cash flow (DCF) value, competitive advantage, assets under management (AUM) play an important role in the determination of a company’s value for M&A and investment funding purpose. However, in the case of fintech companies, especially those at the start-up level or still gaining traction, these ratios and/or multiples play a limited role.

Instead, the factors involved in fintech valuation are more logical rather than mathematical. Some of these questions involved are:

- What is the fintech’s service or product?

- What problems does the product or service resolve?

- Is the fintech’s product/service a one-of-a-kind breakthrough in technology?

- Can the fintech product/service scale across the globe without substantial funding, expenses, infrastructure, or even physical presence?

- What is the existing number of customers of the fintech, and does the fintech have the potential to acquire more clients especially in other countries where people’s lifestyles may vary from the existing customer base?

Answering these questions helps understand the total addressable market (TAM), i.e., the revenue opportunity for a product or service within a specific market.

What is the total number of customers, and the average value per customer?

A larger customer base in a significantly shorter duration of time helps conclude that the product or service offered by the fintech is in demand. This also helps conclude that the firm is better than its competitors. Additionally, the number of customers is important in increasing profits and ensuring that the business can pay for its business expenses without depending on capital from external sources.

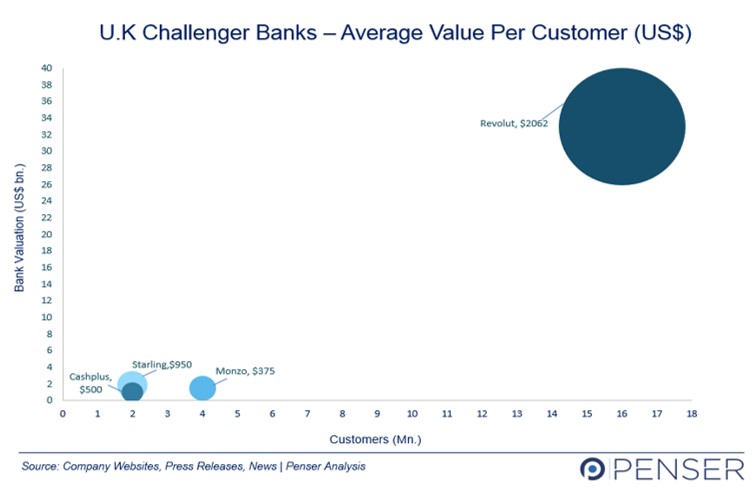

The average value per customer denotes the minimum value added by each customer to the business. Here is an insight into the average value per customer of the top UK challenger banks.

| Challenger Banks Value Per Customer | |||

| UK Digital Banks | Total Valuation (USD bn) | Retail Customers (Mn) | Avg Value/Customer (US$) |

| Revolut | 33 | 16 | 2062 |

| Monzo | 1.5 | 4 | 375 |

| Starling | 1.9 | 2 | 950 |

| Cashplus | 1.0 | 2 | 500 |

Fintech Valuation Methods

The Scorecard Method

The scorecard method was developed by Bill Payne. It introduces individually weighted percentages based on certain quantitative and qualitative factors.

Firstly, we will establish a foundation for the valuation. This is done by establishing an average industry pre-money valuation benchmark by studying available industry information.

The key factors in establishing weighted averages are:

| Factors | Weightage |

| Strength of the management team | 0 – 30% |

| Size of the Opportunity | 0 – 25% |

| Product/Technology | 0 – 15% |

| Competitive Environment | 0 – 10% |

| Marketing/Sales Channels and Partners | 0 – 10% |

| Additional Investment Requirement | 0 – 05% |

| Other factors | 0 – 05% |

The weight assigned will depend on an understanding of how the company is positioned competitively. Usually, if the start-up holds a “leader” reputation in the industry, it may result in the allotment of maximum weights. However, this is not mandatory, depending on the individual calculating the value of the company, he/she may assign a lesser weight for each factor as they deem necessary based on their understanding and expertise of the industry.

Depending on the individual’s expertise in the sector and additional extensive research.

Once the percentages have been allotted, multiply the weights and comparison factor, and add them all up to get the multiple-value.

Here is an example:

Assuming an average industry pre-money valuation of US$1mn, and the sample company as one of the best in the fintech industry.

Step 1: Assuming the higher-end weights as the score for each factor:

| Condition | Weight |

| Strength of the management team (0-30%) | 0.30 |

| Size of the opportunity (0-25%) | 0.25 |

| Product/technology (0-15%) | 0.15 |

| Competitive environment (0-10%) | 0.10 |

| Marketing/Sales channels and partners (0-10%) | 0.10 |

| Need for additional investment (0-5%) | 0.05 |

| Other factors (0-5%) | 0.05 |

Step 2: Determine the comparison factor for each weight:

| Condition | Weight | Comparison |

| Strength of the management team (0-30%) | 0.3 | 1.00 |

| Size of the opportunity (0-25%) | 0.25 | 1.25 |

| Product/technology (0-15%) | 0.15 | 1.50 |

| Competitive environment (0-10%) | 0.10 | 0.80 |

| Marketing/Sales channels and partners (0-10%) | 0.10 | 1.00 |

| Need for additional investment (0-5%) | 0.05 | 1.00 |

| Other factors (0-5%) | 0.05 | 1.25 |

Step 3: Multiply the weight and the comparison

| Condition | Weight | Comparison | Factor (WxC) |

| Strength of the management team (0-30%) | 0.30 | 1 | 0.30 |

| Size of the opportunity (0-25%) | 0.25 | 1.25 | 0.31 |

| Product/technology (0-15%) | 0.15 | 1.5 | 0.23 |

| Competitive environment (0-10%) | 0.10 | 0.80 | 0.08 |

| Marketing/Sales channels and partners (0-10%) | 0.10 | 1 | 0.10 |

| Need for additional investment (0-5%) | 0.05 | 1 | 0.05 |

| Other factors (0-5%) | 0.05 | 1.25 | 0.06 |

| Total Sum | 1.13 |

Step 4: Multiply the total value (1.13) with the average industry pre-money valuation (US$1mn) gives us a value of US$ 1.13mn.

The Berkus Method

Created by Dave Berkus, the Berkus method of valuation is a quick and easy method to value an early-stage start-up based on the parameters mentioned below. Each parameter is assigned a maximum valuation of $0.50 million, and given a maximum pre-revenue valuation of $2 million or a post-roll out value of $2.5 million.

| Condition | Max value ($mn) |

| Sound Idea (basic value) | 0.5 |

| Prototype (reducing technology risk) | 0.5 |

| Quality Management team (reducing execution risk) | 0.5 |

| Strategic relationships (reducing market risk) | 0.5 |

Risk Factor Summation Method

As opposed to the previous two methods, the Risk Factor Summation Method considers a much broader set of factors in determining the pre-money valuation of pre-revenue companies. This method forces investors to consider 12 important factors (below) and assign a value between +2 and -2 to them. Thereafter, the sum of these values is then multiplied by $0.25 million and added to the average industry pre-money valuation.

The 12 factors are:

- Management

- Stage of the business

- Legislation/Political risk

- Manufacturing risk

- Sales and marketing risk

- Funding/capital raising risk

- Competition risk

- Technology risk

- Litigation risk

- International risk

- Reputation risk

- Potential lucrative exit

So, assuming an industry average pre-money valuation of US$1 mn, and a score for each of the above factors for a growing fintech company as:

| Factors | Score |

| Management | 2 |

| Stage of the business | 2 |

| Legislation/Political risk | -2 |

| Manufacturing risk | -1 |

| Sales and marketing risk | 1 |

| Funding/capital raising risk | 1 |

| Competition risk | -1 |

| Technology risk | 1 |

| Litigation risk | -2 |

| International risk | -1 |

| Reputation risk | 2 |

| Potential lucrative exit | 2 |

| Total Score | 4 |

Therefore, the pre-money valuation for the company is US$1 mn + ((0.25) x 4) = $2 mn.

Cost to Duplicate Method

The cost to duplicate method is useful in valuing start-up companies that usually have a great solution or technology or team but are facing time and monetary crunch. The Cost to Duplicate method is almost similar to the replacement costs method. However, the key difference is that the focus is not on production capacities, but rather on assets, such as setup and technology team.

Venture Capital Method

This is an industry-standard method, which looks at calculating the post-money valuation and then adjusting by ticket size and anticipated dilution. This post-money valuation is based on the terminal value divided by the anticipated ROI.

If the terminal value is US$1 bn, with an anticipated ROI of 25x, then the post-money valuation:

- $1bn/25 = $40mn

Next, we deduct the investment amount (estimate US$10 mn approx.). Then the pre-money valuation is equal to $30 mn, $40mn less $10mn.

Furthermore, if the investment is expected to dilute by 30% in the near future, then the adjusted pre-money valuation will be pre-money valuation (adjusted for dilution) = $30mn x 70% = $21mn.

These are some of the basic methods useful while valuing start-ups and emerging fintech firms. Nevertheless, along with the above valuation methods, potential cash flow still remains the most critical determinant of a company’s value.

Determining the future value of a company is one of the initial and most important steps that companies and their prospective investors should take before investing in a company or looking forward to a merger or an acquisition. It is best practice to be informed about the current and future value of one’s own firm, or a firm that is being considered for investment purposes so that none end up with the shorter end of the stick.

Looking forward to getting an estimation of your company’s market value or considering investing in new companies, Penser could be of help. We are a UK-based business consulting firm with expertise in fintech and digital payments. Our clients expand all over the world and are from different sectors, ranging from digital banks, digital payments, financial services providers, and more. We have had the privilege of working with some of the leading companies in their sectors.

Our services include:

- Conducting Commercial & Technical Due Diligence to guide business investment decisions

- Strategic Planning to drive growth and scale business

- Digital Transformation of businesses

- Assisting with restructuring and turnarounds to improve business operations and tackle financial challenges

Contact us to learn how we can help you innovate and grow your business.