Open Banking users have grown significantly in the UK. Currently, there are more than 4 million individual and business consumers using open banking-enabled products and services to manage their financial situation. With 300 fintechs and innovative providers being part of this open banking ecosystem. Owing to this increase in open banking adoption rate, many companies have applied with the UK Financial (FCA) to obtain the AIS or PIS licenses to become a part of this ecosystem.

Let us delve more into these licenses associated with the UK Open Banking ecosystem.

UK Open Banking AIS and PIS Licenses

Account Information Service (AIS)

The Account Information Service (AIS) license provides service providers the permit to access the financial information, such as bank account details and expense information of individuals and businesses in the UK. However, this access is dependent on the consumers’ consent. These service providers can only access the financial data once the consumer has approved them. Once the service provider has access to their client’s financial information, their API software can conduct an analysis and recommend financial products, such as bank account type, credit card, and other financial products more suitable to the client’s financial lifestyle. For example, if the individual uses their credit card for making most of their payments, then the software could recommend a credit card that provides high reward points or discounts.

Payment Initiation Services (PIS)

The Payment Initiation Services (PIS) allows service providers to create new payment solutions that enable initiation of payments and financial transactions. These PIS service provides usually provide direct bank account to bank account-based payments/transfer service, which help lower the cost of making payments.

By using a PIS service provider, businesses can reduce the transaction fees expense significantly in comparison to card payments. This is possible due to the lowered operational cost involved in making a transaction using a PIS service provider.

Since, PIS-based transactions are direct account-to-account, it is extremely useful for small business-owners, who receive the funds within a short duration. Whereas, in the case of card payments, it would have taken a minimum of 3 to 5 business days to approve the payment.

UK Open Banking Insight

- According to the Open Banking website, as of August 2021, there are 327 regulated providers part of the UK open banking ecosystem. This includes 234 third party providers and 93 account providers.

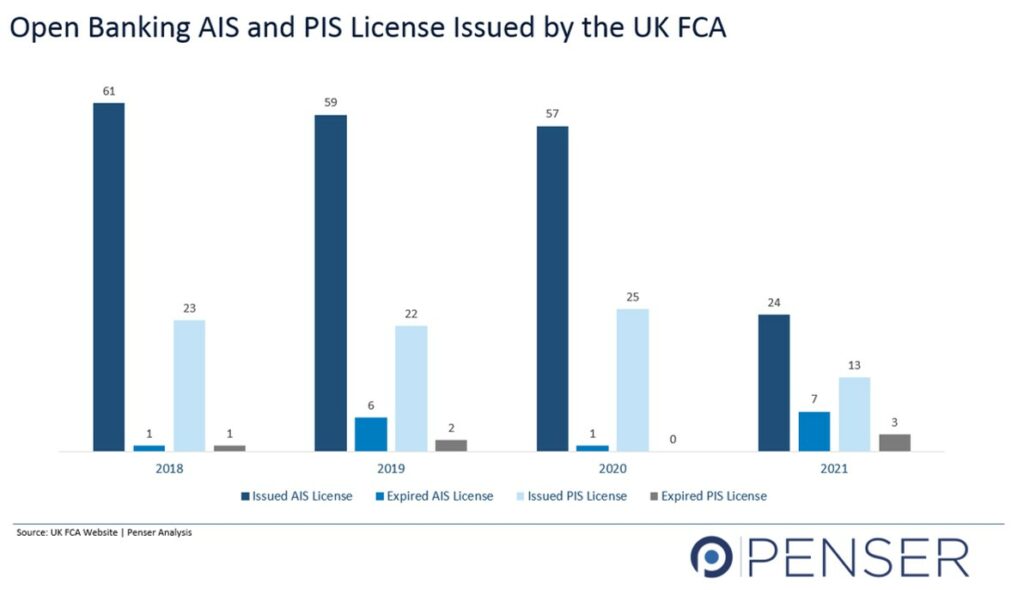

- In 2021 (so far), the UK Financial Conduct Authority (FCA) has issued 24 AIS license, and 13 PIS license.

-

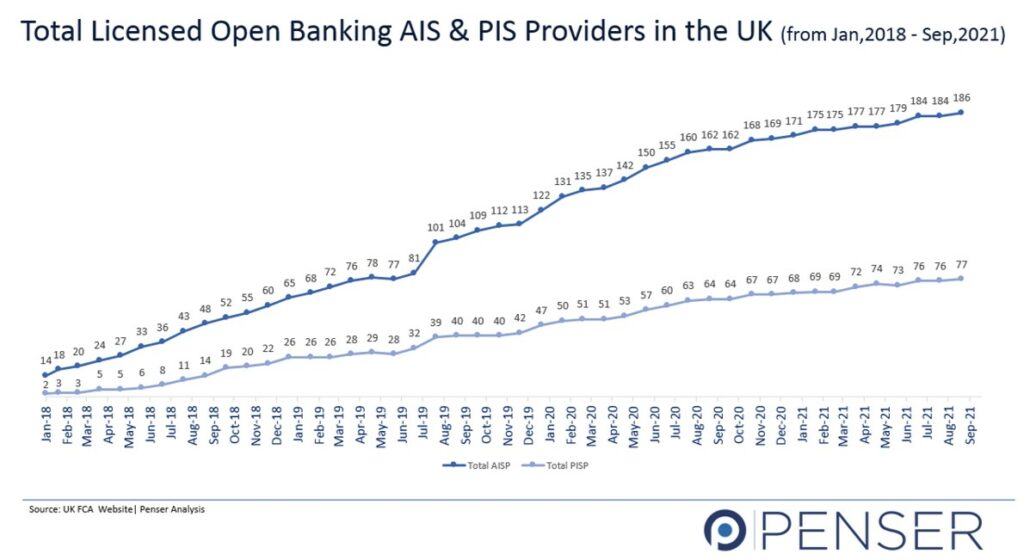

As of September 2021, there are 186 AIS license holders, and 77 PIS license holders that are part of the UK open banking ecosystem.

- Based on a research conducted by the UK Open Banking Implementation Entity (OBIE), ever since the COVID-19 pandemic started, more and more small businesses are utilising the services offered by open banking providers to future-proof their business operations.

- Due to the information that consumers are now able to access through open banking platforms, there has been an increase in product switching and small business borrowing. 46% of small businesses in the UK have taken a loan in the last six months. 2 out 3 business have been able to take advantage of government support schemes. While 18% of small businesses have relied on alternative lending.

- Based on a study conducted by TrueLayer and YouGov, t 74% of UK-based merchants are planning to offer instant bank payments via open banking, as part of their long-term business strategy.

According to Mr Gulamhuseinwala, individual consumers and small businesses are already seeing the benefits of the open banking ecosystem and functionality that is in place. However, there is a lot to be done. The existing work can serve as a natural blueprint for how the ‘open’ philosophy can be extended to everything from open finance to open telecommunications, thereby giving customers greater control and greater benefits.

Having said that many open banking service providers are constantly working on enhancing their platform’s user interface, and offerings to grow their open banking-related business. It is possible that open banking payments may replace debit cards as the default method of payment by 2027.

About Penser

Penser is a specialist fintech and payments consulting firm with experience working for clients in the digital payments, digital banking, open banking, and mobile payments sectors. If you are looking to diversifying your open banking products, expanding your open banking business globally, or learning more about how open banking could work for your business reach out to our team of highly skilled fintech professionals at hello@penser.co.uk