Over the recent decades, fintech has come into its own as a breeding ground for innovation and rapid growth, and it feels like each year, a new fintech unicorn is born. That’s nowhere more true than in the UK, where challenger fintechs, such as Revolut and Monzo, have taken on the established Barclays, Lloyds, et al. and proven themselves to be serious players.

As consultants in the fintech and payments space, we’ve spent years studying and observing the market, understanding trends, and ensuring that we always have one eye open. With Revolut’s impending fundraising round, rumours abound that this round might see the challenger bank hit a valuation of $5 billion, making it the most valuable UK fintech company, and knocking out current leader, TransferWise (valued at $3.5 billion).

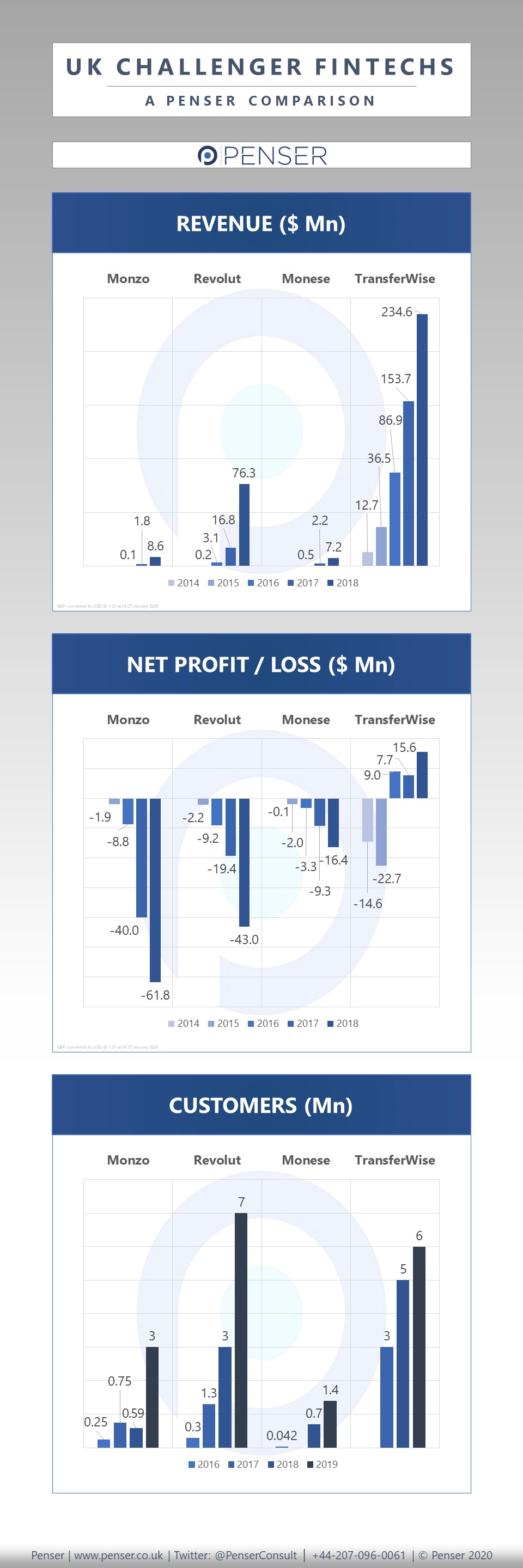

With comparisons being drawn between these two behemoths, we thought it would be interesting to see how they’ve grown in the last few years. The Penser team, therefore, put together an infographic comparing challenger banks Monzo, Revolut, Monese, and payments giant, TransferWise. We combed through public information and have shown their growth in revenue, their net profit (or loss), and their number of customers between 2014 and 2019.

Penser is a specialist consulting firm focused on the payments and fintech industry. Based in London, UK, we work globally for clients ranging from private equity investors and their portfolio companies, to large retailers, telecom operators and global financial institutions. We provide due diligence, digital transformation and strategic planning services. Click here to contact us.