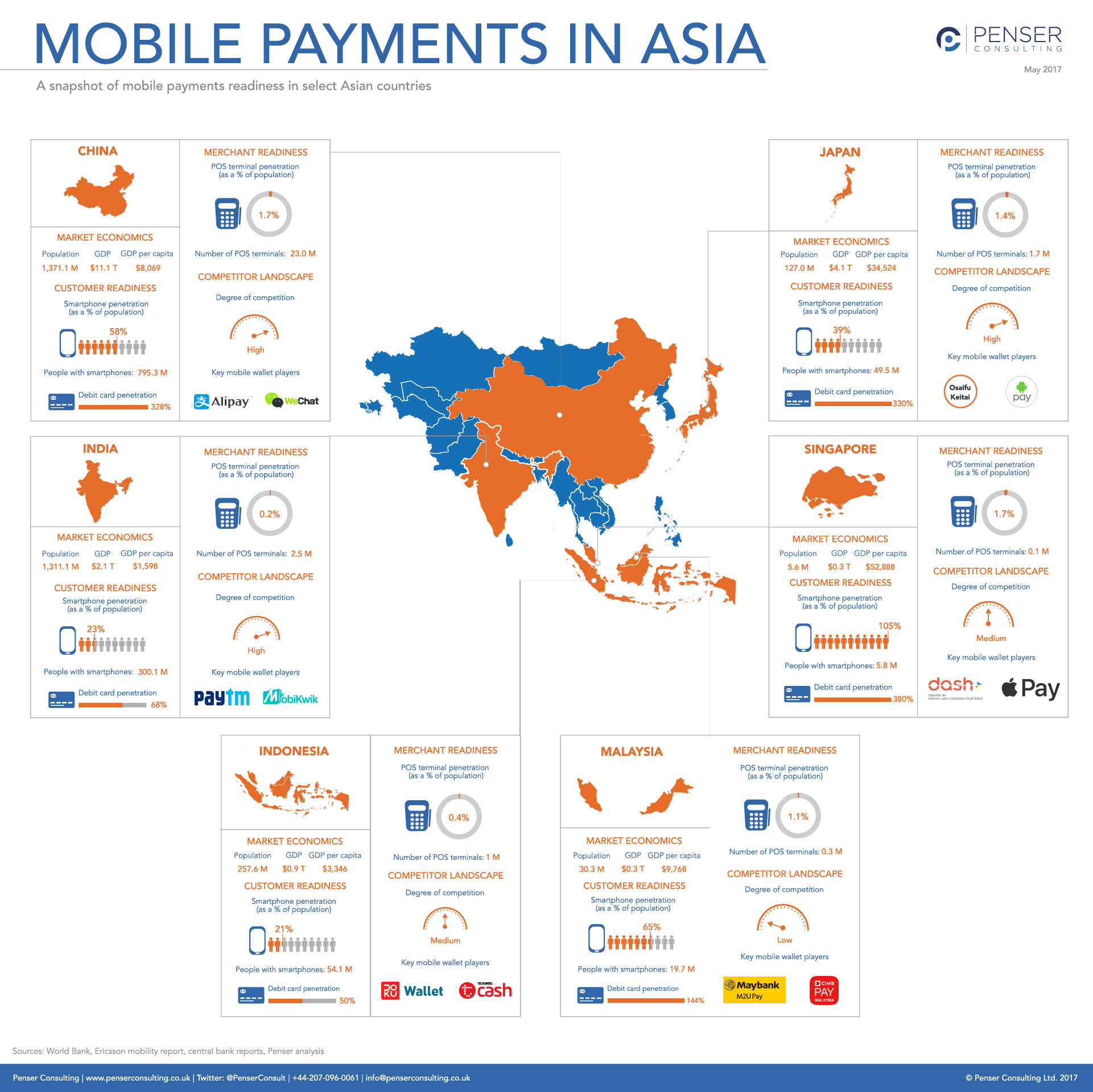

Mobile Payments in Asia

A snapshot of mobile payments readiness in select Asian countries

CHINA

MARKET ECONOMICS

- Population: 1,371.M

- GDP: $11.1 T

- GDP per capita: $8,069

CUSTOMER READINESS

- Smartphone penetration (% of population): 58%

- People with smartphones: 795.3 M

- Debit card penetration: 328%

MERCHANT READINESS

- POS terminal penetration (% of population): 1.7%

- Number of POS terminals: 23.0 M

COMPETITOR LANDSCAPE

- Degree of competition: High

- Key mobile wallet players: Alipay, WeChat

INDIA

MARKET ECONOMICS

- Population: 1,311.1 M

- GDP: $2.1 T

- GDP per capita: $1,598

CUSTOMER READINESS

- Smartphone penetration (% of population): 23%

- People with smartphones: 300.1 M

- Debit card penetration: 68%

MERCHANT READINESS

- POS terminal penetration (% of population): 0.2%

- Number of POS terminals: 2.5 M

COMPETITOR LANDSCAPE

- Degree of competition: High

- Key mobile wallet players: Paytm, Mobikwik

JAPAN

MARKET ECONOMICS

- Population: 127.0 M

- GDP: $4.1 T

- GDP per capita: $34,524

CUSTOMER READINESS

- Smartphone penetration (% of population): 39%

- People with smartphones: 49.5 M

- Debit card penetration: 330%

MERCHANT READINESS

- POS terminal penetration (% of population): 1.4%

- Number of POS terminals: 1.7 M

COMPETITOR LANDSCAPE

- Degree of competition: High

- Key mobile wallet players: OSaifu Ketai, Android Pay

SINGAPORE

MARKET ECONOMICS

- Population: 5.6 M

- GDP: $0.3 T

- GDP per capita: $52,888

CUSTOMER READINESS

- Smartphone penetration (% of population): 105%

- People with smartphones: 5.8 M

- Debit card penetration:

MERCHANT READINESS

- POS terminal penetration (% of population): 1.7%

- Number of POS terminals: 0.1 M

COMPETITOR LANDSCAPE

- Degree of competition: Medium

- Key mobile wallet players: Dash, Apple Pay

INDONESIA

MARKET ECONOMICS

- Population: 257.6 M

- GDP: $0.9 T

- GDP per capita: $3,346

CUSTOMER READINESS

- Smartphone penetration (% of population): 21%

- People with smartphones: 54.1 M

- Debit card penetration: 50%

MERCHANT READINESS

- POS terminal penetration (% of population): 0.4%

- Number of POS terminals: 1.0 M

COMPETITOR LANDSCAPE

- Degree of competition: Medium

- Key mobile wallet players: Doku wallet, TCash

MALAYSIA

MARKET ECONOMICS

- Population: 30.3 M

- GDP: $0.3 T

- GDP per capita: $9,768

CUSTOMER READINESS

- Smartphone penetration (% of population): 65%

- People with smartphones: 19.7 M

- Debit card penetration: 144%

MERCHANT READINESS

- POS terminal penetration (% of population): 1.1%

- Number of POS terminals: 0.3 M

COMPETITOR LANDSCAPE

- Degree of competition: Low

- Key mobile wallet players: M2U Pay, CIMB Pay Malaysia

Penser is a specialist consulting firm focused on payments and banking. To learn more about our work in blockchain, visit www.penser.co.uk

Keywords: china mobile payment, e-wallet, India, India mobile payments, India payments, Indonesia mobile payments, Infographic, Japan mobile payments, m-wallet, m-wallets, Malaysia mobile payments, Mobikwi, Mobile payments, Mobile wallet, payments, payments consultant, payments consulting, paytm, Point of sale, POS, pos terminal, singapore mobile payments, statistics