The way a company chooses to onboard their customers is an important first impression that can make or break their business and growth potential. In the last couple of decades, digital customer onboarding has opened up several avenues for speedy and streamlined customer onboarding, while augmented intelligence and machine learning (coupled with human experts) have greatly decreased the probability of errors in the process.

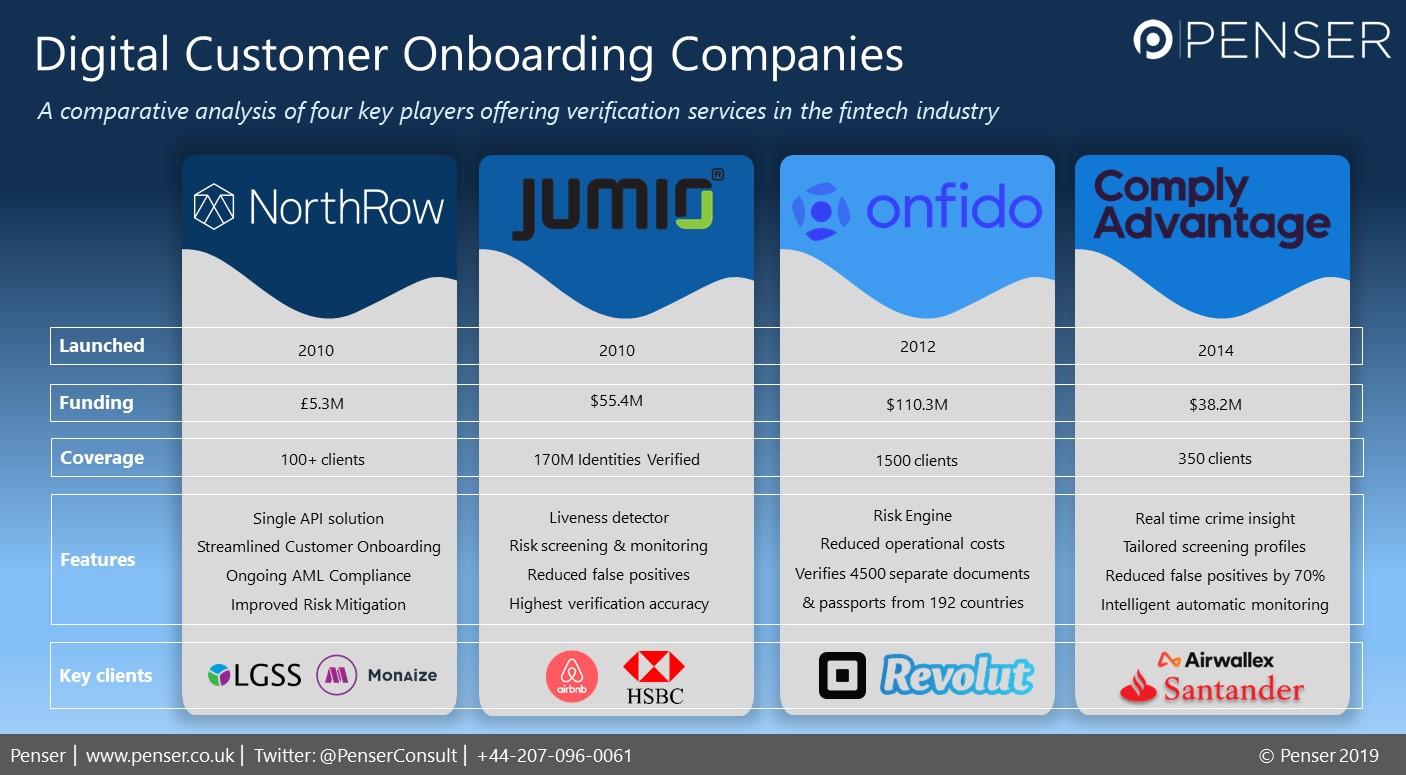

In the infographic below, the innovative features offered by four start-ups in the digital customer onboarding scene have been outlined. What sets them apart is that all four have been launched within the past decade. Headquartered in the UK (NorthRow, Onfido) and the US (Jumio, Comply Advantage), they operate globally, and have verified several hundred million identities combined. Working with huge clients in the traditional banking industry such as HSBC, Santander as well as new-age digital banks such as Revolut, these four provide verification services to some of the biggest names in the banking and payments industry.