SWIFT vs. Ripple – the fight for better, faster, cheaper Bank transfers

The way people send money from one country to another has not dramatically changed since the 1970s. Despite the advent of the internet and new digital tools, sending money across the world is still complicated: there is no visibility on what occurs during the process, settlements can take multiple days and are usually very costly.

San Francisco-based company Ripple, envisions a world in which value can be transmitted as quickly and cheaply as information. They have a compelling case: $180 trillion worth of cross-border payments are made every year with a combined cost of more than $1.7 trillion a year.

How cross-border payments are made today – SWIFT

As a financial messaging system that runs on a network of thousands of banks across the world, the SWIFT system allows banks to exchange information about financial transactions in a standardized way. Yet, SWIFT is just a financial information communication tool that tells one bank to debit an account and credit another, it doesn’t actually move money.

For banks to conduct cross-border transfers, a relationship between them needs to be established.

Banks with direct relationships have accounts set up at their partner banks over-seas. These foreign accounts are called nostro/vostro accounts and are pre-funded with foreign currency to enable cross-border transfers (ex. In Bank Of America’s eyes, its GBP account at Barclays in the UK is their nostro account – foreign currency account. From Barclays’ perspective, the same account is Bank of America’s vostro account – local currency account).

Anytime a transfer occurs, the SWIFT system instructs the sending bank’s nostro account to be debited and the receiving bank’s local account to be credited.

However, in order to facilitate transfers to all countries that their clients do business with, banks would need to hold multiple pre-funded nostro accounts across the world. The capital requirements of holding idle money in many countries would be prohibitively expensive, creating the need for correspondent banks. These banks act as intermediaries for smaller and medium sized banks and have partnerships with multiple international banks. When a money transfer is requested, the SWIFT system links banks via correspondent banks and instructs each bank along the way of which transaction to fulfill.

A transaction between a US bank account to a Japanese Bank account would involve the following:

- The US bank receives the recipient and transfer information from the sender

- The SWIFT system finds a link between the sending and receiving banks via their correspondent banks

- A SWIFT message is sent with transfer details to the sender’s correspondent bank. The USD account of the sender’s bank is debited and the correspondent’s account is credited – The US correspondent bank takes a fee for facilitating the transfer

- The sender’s correspondent bank exchanges the USD funds into Yen at a fee

- A SWIFT message is sent with the transfer details to the receiver’s correspondent bank who debits the receiver’s correspondent’s nostro account and credits its own account – The Japanese correspondent bank takes a fee for facilitating the transfer

- A SWIFT message is sent to the receiving bank with the transfer details. The receiving bank debits its correspondent bank account and credits its own account

- The funds are received in Japan

Such a transfer has multiple issues:

- Cost: Involving many intermediaries translates to increased costs:

- Correspondent banks charge a fee or commission, which can apply to both the sender and recipient, for facilitating the transfer

- The bank that conducts the currency exchange will do so at the prevailing foreign-exchange spread (usually unfavorable to the sender)

- As a result, the average costs for a bank transfer is 11.18%[1] for low value payments while typical business to business payments can cost up to $30USD

- Time: Transactions can take between 3-5 days to settle. Each step takes time and as most international banks operate different time zones, money can stay idle waiting for recipient banks’ business hours.

- Transparency: Usually, the sender has very little visibility on the whole process. Since SWIFT is a one-way messaging tool, it is only once the transaction is done that the sender can know how much they have been charged. The sender cannot “shop-around” for better deals

- Errors: The error rate of international transfer is around 5%. This is not surprising considering how many intermediaries are involved in the process.

[1] World Bank – https://remittanceprices.worldbank.org/sites/default/files/rpw_report_march_2017.pdf

Ripple: Disrupting the model

Targeting the money transfer pain points, Ripple is using a blockchain-based network to improve the way transfers are done. Ripple is a real-time gross settlement system (RTGS), currency exchange and payment network, built specifically for the direct transfer of assets. The company’s RippleNet is a singular, global network of banks and financial institutions that can communicate between each other in real-time, making cross-border transactions more efficient.

Ripple’s xCurrent

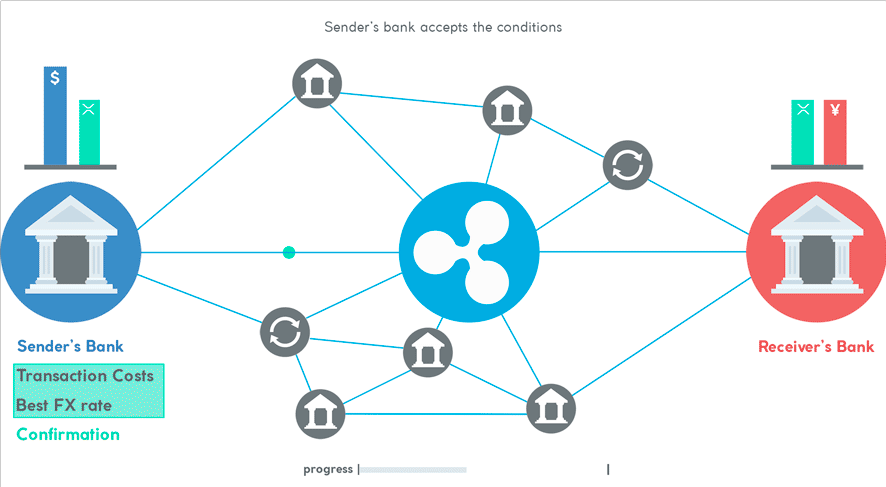

xCurrent is Ripple’s solutions to facilitate real-time settlements and tracking of cross-border settlements. It has four main components:

- Messaging System: Unlike SWIFT which is a one-way messaging system, xCurrent has bi-directional messaging capabilities which allows for institutions to communicate information about transfers. Sending banks communicate the payment details and receiving banks can communicate back fees, exchange rates. This bidirectional communication can identify any problems with the transfer in real-time and gives the sender complete transparency on the fees associated with their transfer

- ILP Ledger: The InterLedger Protocol is an open and neutral protocol that operates between different ledgers and payment networks. The ILP removes intermediaries and central authorities from the system

- FX ticker: FX Ticker is the component of xCurrent that facilitates the exchange between ILP Ledgers by enabling liquidity providers to post FX rates. This component provides the exchange rate between any pair of ledgers with which it is configured. Additionally, it keeps track of the account, currency and authentication credentials for each configured ILP Ledger

- Validator: This system includes compliance screening and account verification checks before the transfer is done, hence eliminating the risk of a failed transfer

In the same transfer example seen above, communication between is in real-time, proving the sender with details about the fees and FX rates provided for the transfer. The sender can then accept the transfer which then happens across all ledgers at once. Upon success, the sender receives a confirmation notification.

Such a system provides:

- Transaction clarity: the sender is aware of all the details corresponding to the transfer in real-time. He/she knows if the transfer is successful within minutes.

- Speed: the transaction happens almost instantly

- Lower costs: Money isn’t stuck in transit anymore, reducing the cost to the sender and to the bank (banks have short-term visibility and control over their nostro accounts, reducing liquidity costs). The sender also has clarity on the FX costs before the transfer and can coordinate accordingly

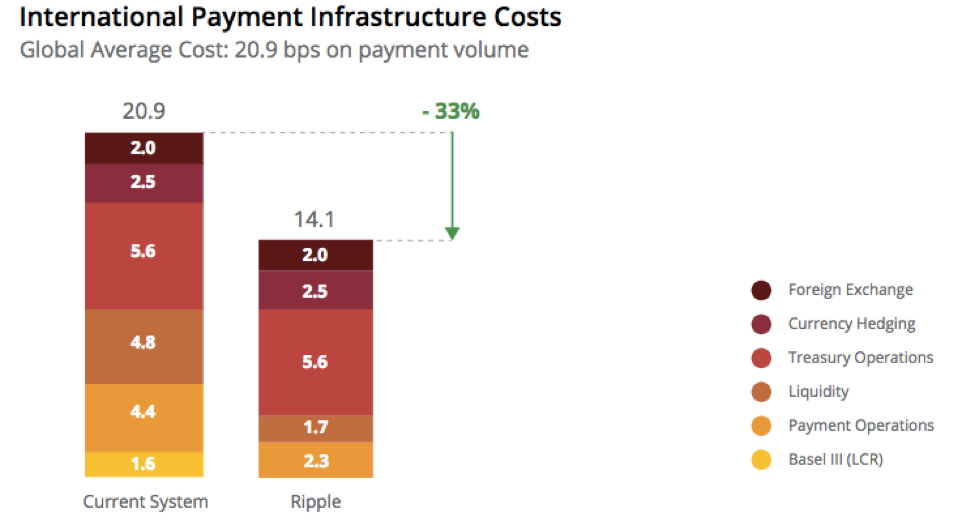

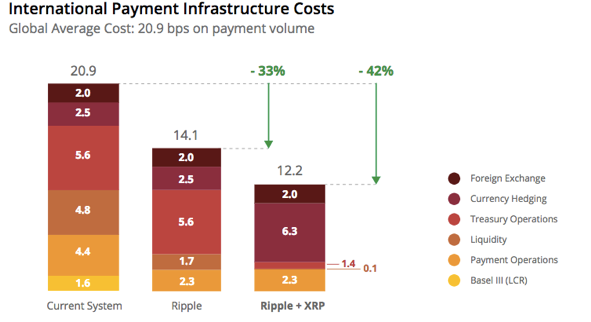

According to Ripple, banks that can minimize settlement delays and lower the operational cost of processing international payments can realize a 33% cost saving:

Source: Ripple.com

This system still requires steps that are similar to the old model. Senders and receivers still require intermediaries to provide foreign currency accounts and liquidity. The second Ripple product provides a solution to eliminate them.

Ripple’s XRP, a Digital Asset Solution

Digital assets are cryptographically-secured tokens that store value and can be transferred between two parties without the need of a central counterparty. To this day, corresponding banks are needed in the system to provide liquidity in different foreign markets and they require pre-funded accounts to operate. Banks who hold these foreign currency accounts suffer from the opportunity costs of their tied-up capital.

Ripple introduced XRP as the digital token that can act as a bridge currency to facilitate direct asset transfers between parties. XRP transfers are instant, extremely inexpensive (fractions of a cent) and can be done to any entity on the RippleNet willing to accept the token.

The use of a single asset allows banks to allocate less liquidity to service international money transfers:

- Instead of holding foreign currency in nostro accounts around the world, banks can instead hold XRP on their own balance sheets

- Banks only need to hold enough XRP to facilitate their largest payment obligation and by only holding one currency, freeing up idle money that they previously couldn’t use

- By having markets between local currency and a low volatility XRP, the markup on FX spreads are reduced over time

Ripple is a viable long-term solution to reducing the frictions in the way today’s cross-border transfers are done. The system can reduce costs by almost 60% and make transfer securely and instantly.

Source: https://ripple.com/files/xrp_cost_model_paper.pdf

So far, more than 100 financial institutions have joined RippleNet and intend to use xCurrent. Ripple and especially XRP open up countless possibilities for institutions to send assets between each other. Indeed, as long as there is a liquidity provider that is willing to convert XRP for assets and vice versa, financial institutions can use the platform to exchange more than just money but potentially any asset that holds value.

The rise of blockchain-based companies represent a direct challenge to incumbents such as SWIFT, who has launched initiatives to stay ahead in the game.

A response?

In response to Ripple, SWIFT launched the Global Payment Innovation Initiative (GPII) an initiative that improves on the base SWIFT system but includes a set of rules that make banks behaviors more reasonable when it comes to delays and opaque charging. Despite the improvements, the GPII technology still lags behind Ripple in all aspects of money transfers, so much so that SWIFT even considered developing a blockchain alternative themselves. After a failed attempt, the head of Banking at SWIFT recognized: “Blockchain technology is not straightforward to scale and it is not yet appropriate to do so”

To this day, SWIFT still has the advantage of having over 10,000 adherents on its network, but Ripple is catching up quickly: their latest partnership is with Santander, who wishes to offer frictionless payments between the UK, Brazil, Spain and Poland.

Payments is a two-sided network business and while little may have changed in the underlying ‘rails’ for international transfers since the 1970’s we are certainly on the cusp of seeing dramatic changes take place within the next ten years.

Penser is a specialist consulting firm focused on payments and fintech. To learn more about our work visit www.penser.co.uk