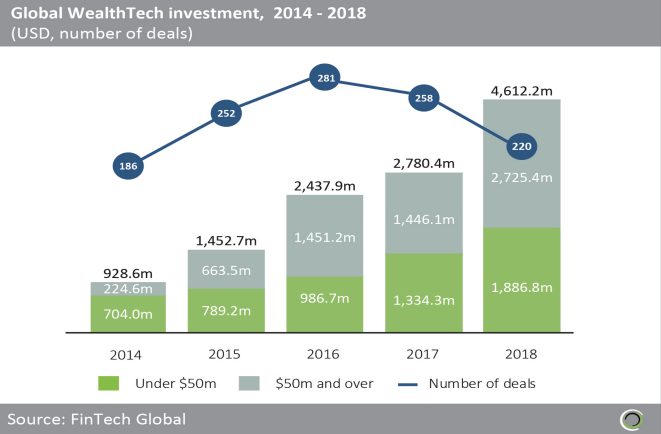

In 2014, the amount invested in WealthTech globally was US$ 928.6 million. However, by 2018 – a scant five years later – that number has almost quintupled, with total valuation globally hitting US$ 4.6 billion across 220 deals. What’s just as staggering is that this was an increase of 66% from 2017.

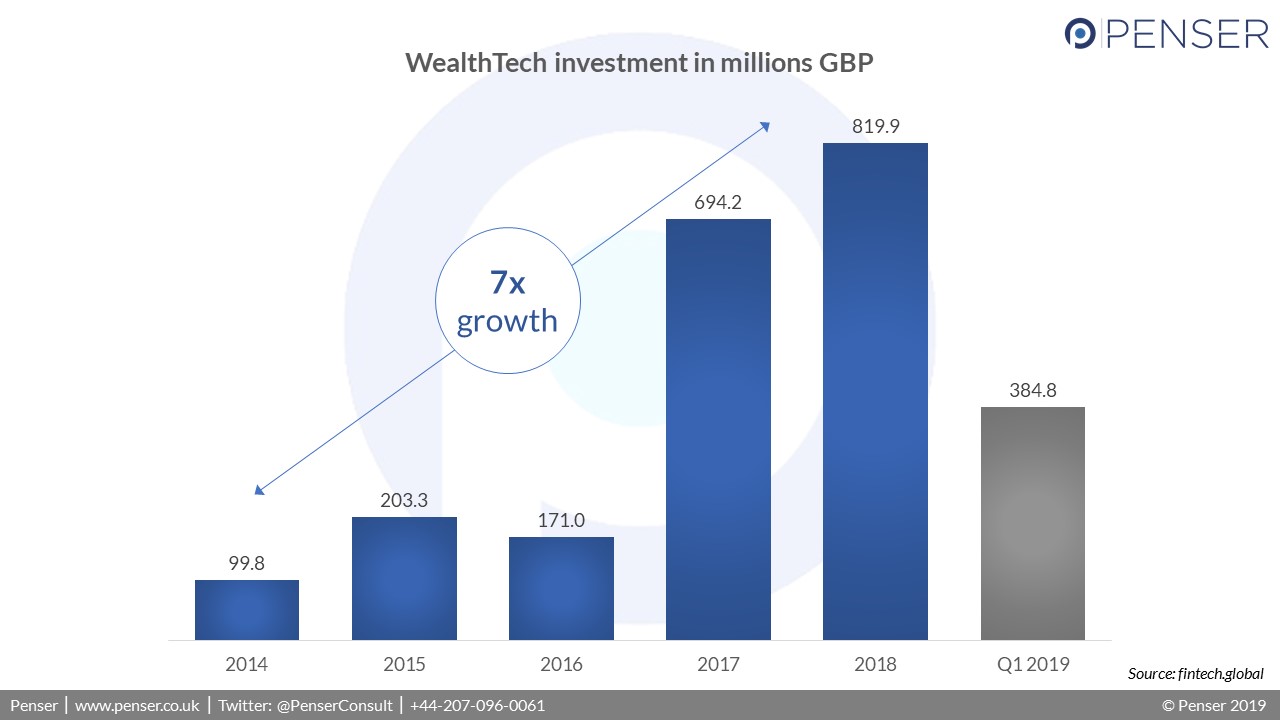

When we dive a little deeper and look at the data for the UK, we can see just how WealthTech has grown in the market. Over the same 5 years, investment in WealthTech in the UK has increased by a factor of 7, hitting a massive £819.9 million in 2018. In fact, in just the first quarter of 2019, investments have already £384.8 million, implying that this year is likely to hit even higher numbers.

Some of the largest WealthTech players in the EU market today* are:

- UK-based Nutmeg, valued at $317 million,

- Moneyfarm, another UK-based WealthTech firm, valued at over $300 million, and

- Germany’s Scalable Capital, valued at over $200 million.

*Source: Invyo Insights