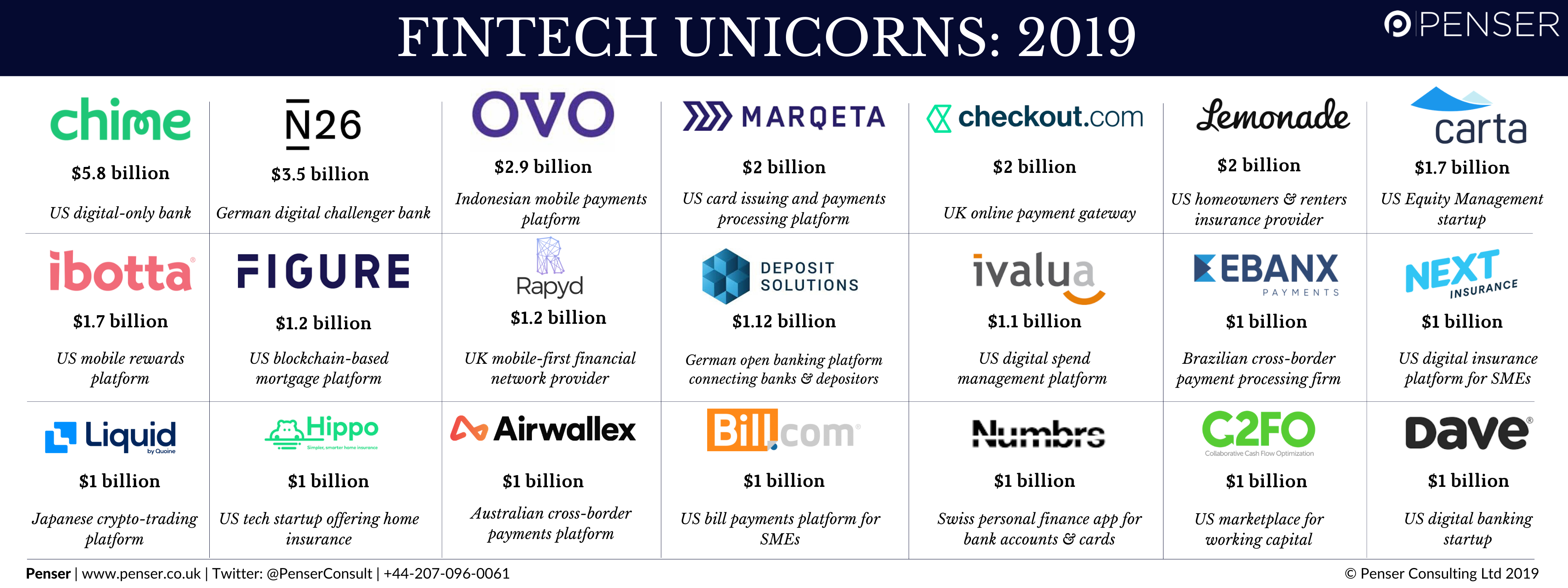

In Q’3 2019, funding in the digital banking sector was the highest at $1,269 million. We take a look at fintechs that received enough funding to catapult their valuations to $1 billion, landing them among the 58 global fintech unicorns, collectively valued at $213.5 billion.

Let’s look at each of these infographics in more detail:

N26

German digital-challenger bank N26 became 2019’s first fintech unicorn by raising $300 million, valuing the online lender at $2.7 billion. The funding was raised by U.S. private equity firm Insight Venture Partners with additional backing from Singaporean sovereign wealth fund GIC. N26’s other investors include Chinese tech giant Tencent, German insurer Allianz and PayPal co-founder Peter Thiel’s venture arm Valar Ventures. N26 is focusing on global expansion; it recently launched in the US.

Chime

US digital bank Chime raised $200 million in a Series D funding round, raising its valuation to $1.5 billion in March 2019. As of December 2019, Chime has raised an additional $500 million in a Series E, quadrupling its valuation to $5.8 billion within nine months. Chime’s latest funding round is the largest challenger bank funding round in 2019 YTD, surpassing Brazil neobank NuBank’s $400 million funding round earlier this year.

OVO

Indonesian payments app OVO became the fifth unicorn in the country, after raising funding that increased its value to $2.9 billion. OVO is backed by the Lippo group and Tokyo Century Corporation and has partnered with Tokopedia (which also achieved unicorn status in 2019) and Grab in order to further its reach.

Airwallex

Australian fintech Airwallex raised $100 million in a Series C funding round in March, which raised the company’s valuation to $1 billion and the total funding raised to $200 million. Notable investors include DST Global, Sequoia Capital China as well as Chinese tech giant Tencent Holdings. Airwallex facilitates cross-border payments for businesses and as established itself as a challenger in the global payments space by working with JD.com, MasterCard, CTrip and others.

Bill.com

US business payments software Bill.com raised $88 million which led to a valuation of $1 billion in March 2019. The funding round was led by Franklin Templeton and investors included Mastercard, Fidelity Investments Canada ULC, Kayne Anderson Rudnick, Temasek, Cross Creek, and FLEETCOR. Bill.com also announced a strategic partnership with MasterCard to offer virtual cards as part of its automated accounts payable service for SMEs.

Liquid

Global cryptocurrency platform Liquid, headquartered in Japan, closed a Series C funding round that valued the company at $1 billion, making it the second Japanese tech company to achieve unicorn status. Investment firm IDG Capital led the funding round which included major Chinese crypto mining manufacturer Bitmain Technologies.

Lemonade

US-based Lemonade, a digital insurance provider that is driven by AI & behavioural economics, raised $300 million in a Series D funding round in April 2019. This led to an increase in the fintech’s valuation, which was now valued at $2 billion. Japanese investor Softbank led the funding round which included investors such as Allianz, General Catalyst, GV (formerly known as Google Ventures), OurCrowd and Thrive Capital.

Checkout.com

UK’s first fintech unicorn in 2019, Checkout.com raised $230 million in a Series A funding round, the largest ever in Europe. Checkout.com boasts of an impressive client base, including TransferWise, Adidas, Samsung, Virgin, etc. This funding round increased its valuation to $1.5 billion. Investment firms DST Global and Insight Partners are some of the investors in the fintech.

Carta

San Francisco-based Carta raised $300 million in a Series E funding round which raised its valuation to $1.7 billion, landing it in the billion-dollar unicorn club earlier this year. This funding round was led by Andreessen Horowitz and other investors include Lightspeed Venture Partners, Goldman Sachs Principal Strategic Investments, Tiger Global, Thrive Capital as well as previous backers such as Tribe Capital, Menlo Ventures and Meritech Capital.

Marqeta

In May 2019, US-fintech Marqeta raised $260 million in a Series E funding round led by Coatue Management. This has led the fintech to increase its valuation to $2 billion. Marqeta has focused on European expansion, opening an office in London earlier this year. New investors included the likes of Vitruvian Partners, Spark Capital, Lone Pine and Geodesic. Marqeta’s existing investors include Visa, ICONIQ, Goldman Sachs, 83North, Granite Ventures, CommerzVentures, and Chinese fintech CreditEase.

Ivalua

Ivalua, a US-headquartered enterprise spend-management technology firm, raised $60 million in new funding, which boosted its valuation beyond $1 billion. This funding round was led by Tiger Global Management; Ardian and KKR are other investors.

Hippo

US home insurer Hippo which is backed by Comcast, raised $100 million in funding which led to its valuation hitting $1 billion. The funding round was led by well-known investment firm Bond Capital. This is Bond Capital’s second-ever investment, following Canva earlier in the year. Other notable investors include Propel Venture Partners and Horizons Ventures.

Ibotta

Leading mobile rewards platform in the US Ibotta achieved unicorn status by raising a Series D funding round at a $1 billion valuation. The funding round was led by Koch Disruptive Technologies, LLC (KDT) which included others such as Teamworthy Ventures and GGV Capital.

C2FO

Another US fintech unicorn, alternative business lender C2FO raised $200 million that catapulted its valuation to $1 billion. C2FO’s list of investors includes Union Square Ventures, Summerhill Venture Partners, Mubadala Investment Company, Allianz and Mithril Capital Management and the latest investment round was led by Softbank Vision Fund.

Numbrs

Swiss fintech Numbrs Personal Finance raised $40 million to hit unicorn status at a valuation of $1 billion. The latest funding amount brings the total amount raised to nearly $200 million. While the company did not offer the names of any current or previous investors, it has mentioned that Deutsche Bank AG head Josef Ackermann and private banker Pierre Mirabaud are stakeholders in the fintech. CB Insights reports that the Investment Corporation of Dubai and Centralway are two of the investors in the company.

Deposit Solutions

German Open Banking and Banking-as-a-Service (BaaS) fintech Deposit Solutions secured a $55 million investment which includes a 4.9% stake for Deutsche Bank that has increased its valuation to $1.1 billion. Deposit Solutions is Germany’s second fintech unicorn in 2019 and is eyeing US expansion in the future.

Dave

Only two years after launch, LA-based money management fintech Dave has achieved unicorn status with a valuation of $1 billion. Some of the notable investors include the likes of Section 32, SV Angel, and Norwest Venture Partners. In fact, Norwest funded Dave’s $50 million round, which helped increase its valuation.

Next Insurance

US digital insurance startup Next Insurance secured a $250 million Series C funding round which propelled its valuation to $1 billion. German reinsurance giant Munich Re was the sole investor in the round, increasing its stake in the three-year-old startup to 27.5%. Next Insurance’s previous investors include Zeev Ventures, Ribbit Capital, TLV Partners.

EBANX

Brazilian payments company Ebanx, that connects global businesses to Lat-Am customers, raised a significant amount from US growth equity investment firm FTV Capital, which increased its valuation to $1 billion. Ebanx is Latin America’s first fintech unicorn in 2019.

Figure Technologies

US-based Figure Technologies, a blockchain company that offers mortgages raised a $103 million Series C funding round that boosted its valuation to $1.2 billion in December 2019. This funding round was led by Morgan Creek Digital and included MUFG Innovation Partners as an investor. Figure Technologies boasted of an impressive investor list during its previous $130 million funding round, which included the likes of RPM Ventures, partners at DST Global, Ribbit Capital, DCM, DCG, Nimble Ventures, Morgan Creek and others.

Rapyd

London-based Rapyd, offering fintech-as-a-service, secured $100 million in funding, which has raised its valuation to $1.2 billion. This makes the firm the second British fintech unicorn in 2019. The latest funding round was being led by Oak HC/FT with participation from Tiger Global, Coatue, General Catalyst, Target Global, Stripe and Entrée Capital. Rapyd had also raised $40 million earlier in 2019, making this the fintech’s second funding round in the year.

As experts in the digital banking & payments sectors, we constantly track new developments in fintech. To read more about fintech trends in 2019, check out our blog.

We offer digital transformation, strategic planning, and due diligence services. Request a sample due diligence report today!