The fintech market in the MENA (Middle East and North Africa) region will account for 8% of Middle East’s financial services revenue by 2022. This growth is propelled by rising fintech startups, growth of the Islamic banking industry, increasing internet and mobile phone usage. Another major factor is the fact that several traditional banks are undergoing digital transformations in order to reach more customers and compete with fintechs.

Digital Transformation in the Middle East

The number of fintech startups in the Middle East is expected to top 250 in 2020. As there are around 300 million people under the age of 24 in the Middle East, there is considerable opportunity to develop itself as a digital-first region when it comes to banking, payments, and financial technology.

Traditional banks in the Middle East will soon need to adopt full-scale digital transformations to compete with digital giants that are entering the market. Previously, these banks have adopted smaller digital transformation initiatives but the threat of new fintechs, as well as a changing banking ecosystem coupled with digital disruption across the globe, is demanding a more thorough digital transformation agenda.

Currently, there are only a few digital banks in the MENA region, all of which operate under an established lender’s license. Some of the popular ones include Emirates NBD’s Liv, Mashreq’s Neo, CBS’s Now, meem by Gulf International Bank, and Bank ABC’s newly launched ila.

There is tremendous scope for both new entrants and legacy players capitalise on the growing fintech market when it comes to digital banking and payments. In the last few years, several global payment solutions providers, such as Samsung Pay, Apple Pay, Alipay, and G-Pay, have entered the market. Even though cash is still king, digital payment transactions in the MENA region amounted to $41.4 billion in 2018.

The Growth of Islamic Finance

There are 1,389 sharia-compliant financial firms worth a combined $2.4 trillion in assets in 56 countries around the world. The Islamic finance industry grew 11% YOY in 2017 and is set to sustain this double-digit growth because of the growing adoption of fintech, particularly in the Middle East.

Some countries in the Middle East have developed an established model for Islamic banking regulations while others are actively implementing separate guidelines for Islamic finance. For instance, in the UAE, the establishment of the Higher Shariah Authority provides a regulatory framework for all Islamic finance practices. Several new international bodies such as the Accounting and Auditing Organisation for Islamic Financial Institutions (AAOFI) and the International Islamic Financial Markets (IIFM) have emerged in the last few years, playing a strong part in setting industry-wide standards and consistency.

The global Islamic finance industry was worth an estimated $2.05 trillion in 2017 across its three main sectors – banking, capital markets, and Takaful (Islamic insurance) – marking an 8.3% growth in assets. The market for Islamic bonds/investment certificates — sukuk —accounted for $426 billion in deals outstanding in 2017, with 19 countries issuing sovereign sukuk worth a combined $85 billion. As the largest sector in the Islamic finance industry, Islamic banking has seen tremendous growth in the Middle East in the past few years and contributes $1.72 trillion of the Islamic finance industry’s assets.

What is Islamic Banking?

Grounded in sharia (Islamic law), Islamic banking works on a no-interest principle. This means that there can be no profit (interest/riba) earned on money that is lent out as money holds no intrinsic value according to Islam. Islamic banks earn profits through equity participation which requires the borrower to give the bank a share of their profits rather than interest on the money borrowed. The two fundamental principles that Islamic finance is based on are the sharing of profit and loss, and the prohibition of the collection and payment of interest by lenders and investors.

Islamic banking also prohibits investment in businesses that are considered haram, such as businesses that deal with pork products, alcohol, etc. This is considered a form of ethical investing across the globe.

There were over 500 Islamic banks with over 207 Islamic banking windows offered by commercial banks across the globe in 2017. Sharia-compliant financial institutions represented approximately 1% of total world assets concentrated in the Gulf Cooperation Council (GCC) countries, Iran, and Malaysia in 2016.

Islamic Banking in the Middle East

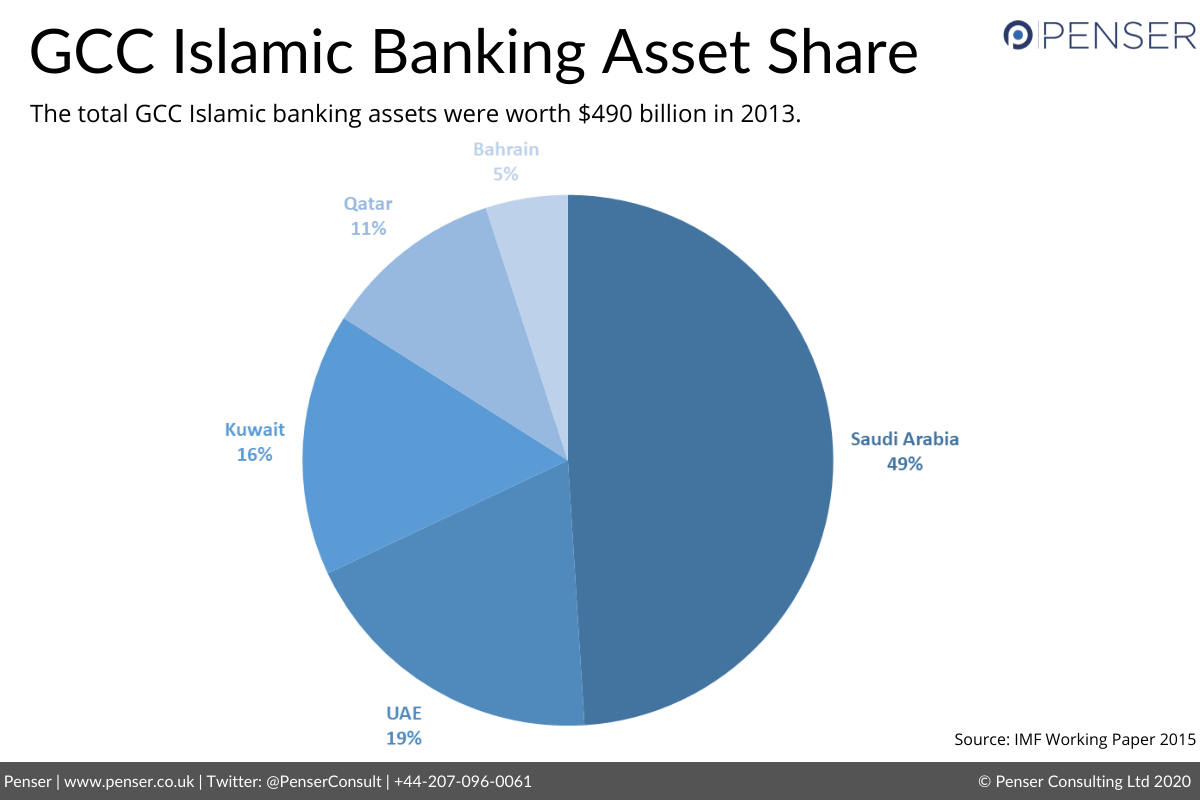

Among the GCC countries, the Kingdom of Saudi Arabia has the most number of Islamic banks at 16. KSA is also the second-largest Islamic finance market in the world. In the GCC, Islamic banking accounts for over 25% of the banking market. The total GCC Islamic banking assets were worth $490 billion in 2013, with KSA holding the dominant share (49%). This was followed by United Arab Emirates (19%), Kuwait (16%), Qatar (11%), and Bahrain (5%). In Bahrain, retail Islamic banking accounts for a 27% asset share in retail banking and a 13% asset share in total retail & wholesale banking.

When it comes to incorporating digitisation into Islamic banking, there are a few digital-only Islamic banks for users to choose from: in the GCC, Gulf International’s meem in Bahrain & KSA, and Turkey’s Albaraka Türk’s Insha in Germany and other European countries. In Kuwait, Boubyan Bank and Zain Telecom have partnered to create a digital-only Islamic finance bank.

Middle East Region Focus: United Arab Emirates & Saudi Arabia

The GCC countries have seen several new developments in the field of fintech over the last few years. In the past year, several countries have funded fintech programmes, adopted Open Banking mandates to encourage collaboration between fintechs and traditional financial institutions, and more. Let’s take a look at the two major fintech markets in the Middle East:

UAE

The UAE is one of the largest fintech markets, both in the Middle East and the world. The leader of the fintech market in the Middle East region, it has a mobile penetration of 173% (the highest in the world). 65% of the population are also active internet users, which offers a large customer base for any fintechs expanding into this region. When asked, 83% of UAE residents were receptive to adopting fintech solutions by non-financial institutions and 76% trust at least one technology company with their money over their banks.

The UAE is also home to one-third of the total number of fintech startups (46%) in the MENA region. The total number of fintechs is expected to reach nearly 1,900 companies by 2022 – an impressive increase of 230% from 559 companies in 2015.

The GCC is heavily dependent on outbound remittances because of the large number of immigrant workers and expats. When it comes to remittances, the GCC alone accounted for $101 billion (18%) of the world remittances. The UAE accounted for 5.2% of the GCC’s remittances in 2018.

Even though 70-75% of all transactions in the UAE are cash-based, the country plans to become completely cashless by 2021. The mobile wallet market in the UAE is expected to amount to $2.3 billion by 2022 as residents adopt digital payments.

Saudi Arabia

The Kingdom of Saudi Arabia (KSA) is one of the largest Islamic banking markets and has made several efforts to digitise its finance industry. Initiatives such as encouraging new fintechs to develop their products and services by offering funding, passing regulations conducive to fintech growth, offering licenses, etc. have been undertaken in the last few years. The country was recently revealed as one of the top digital banking markets in MENA, with over 75% of the banking customers using online banking or mobile apps. ArabNet’s survey of regional banking customers revealed that 76% of all Saudi banking customers use digital platforms and 60% use online and mobile apps, the highest in the region.

When it comes to encouraging fintechs, Riyad Bank (one of the largest financial institutions in KSA) has pumped around $26.7 million (SAR 100 million) into its newly-launched fintech startup investment programme. This will offer R&D support along with capital injections for fintech startups. The Saudi Arabian Monetary Authority (SAMA) has also granted 14 fintech firms permits to join the bank’s Sandbox experimental regulatory environment, bringing the total number of firms participating to 21. The SAMA also launched Fintech Saudi, an initiative which instigated the development of the fintech industry across the kingdom.

When it comes to incorporating fintech into traditional financial services, the GCC countries in the Middle East have made several strides by offering governmental support in the form of regulatory approvals and funding. The Middle East is expected to witness considerable changes to its banking, payments, and finance ecosystems in the next few years with the growth of fintech across the region.

Check out the second part of our Fintech in the Middle East article for some of the major fintech players, investments, financing, and more.

At Penser, we have extensive experience working with both traditional financial institutions and fintech startups across strategy, due diligence, and digital transformation.