The global Real-Time Payments (RTP) market size was valued at $6.9 billion in 2018 and is projected to expand at a CAGR of 29.3% from 2019 to 2025. In the last few years, the number of real-time payment or immediate payment solutions has risen exponentially across the globe. In 2014, there were 14 faster payment schemes across the world; by 2018, that number had tripled to 40. This increased adoption of digital payments is likely driven by an increase in smartphone penetration —there were 2.9 billion smartphone users in the world in 2018. Immediate payments present significant benefits for the economy when adopted, allowing for an increase in the execution speed of digital payments and, in turn, accelerating working capital.

What are Real-Time Payments?

Real-Time payments are an easier and faster way to transact & transfer money, especially across borders. Immediate payments allow consumers to send and receive money across the globe within minutes. Until a few years ago, transfers within the country would take days while international money transfers could take up to a few weeks to be processed. Real-time payments allow users to send and receive payments 24 hours a day, every day — this means that these digital payments are not subject to a bank’s working hours or a transfer company’s (such as Western Union’s) processing times. Several countries around the world have adopted real-time payments — such as Sweden’s BIS, UK’s Faster Payments, and Singapore’s FAST among others.

There were 500 billion cashless transactions in 2018; there is considerable opportunity for both real-time payment solutions providers and financial institutions work together to offer consumers quicker transactions. Across the globe, 78% of banks, 72% of billing organisations and 68% of merchants think that the combination of Real-Time Payments and Open Banking will lead to the decline of payment cards over time. Nearly 83% of companies with $1 billion or more in annual revenues report high levels of RTP awareness, which can also be expressed as readiness to adopt in 2020.

Global Adoption of Real-Time Payments

UK

In the UK, real-time payments are processed through Faster Payments which allows millions of businesses, charities, and individuals to transact and send money 24/7. Since its launch in 2008, there have been over 9 billion payments sent across the UK amounting to a combined value of over £6 trillion. The service boasts of 35 participating organizations along with more than 400 other financial institutions, giving 52 million current account holders in the country access to the service. The infrastructure is built & operated by immediate payment solutions provider, Vocalink.

India

In 2019, India’s real-time payments platform, IMPS was rated as the world’s best real-time payments system. Launched in 2010, the service is managed by the National Payments Corporation of India (NPCI) and includes 53 commercial banks, 101 Rural/District/Urban and cooperative banks, and 24 prepaid payment services in its network. As of December 2019, the platform processes over 250m transactions amounting to $20 billion every month.

Regulated by the Reserve Bank of India, the Unified Payments Interface (UPI) is another major real-time payments platform, built specifically for mobile transactions. Since its launch in 2016, more than 140 banks have joined the network with a combined transaction volume of nearly 800 million, valued at $19 billion. UPI has also facilitated the adoption of real-time payments apps such as Paytm, Google Pay, Apple Pay, and more in India while also launching its own P2P app, BHIM.

Singapore

FAST (Fast and Secure Transactions), Singapore’s immediate payments platform, is built and operated by the same company that built the UK’s Faster Payments — Vocalink. Within the first couple of days, there were 33,000 transactions with a combined value of almost $48 million (SGD 64 million). Currently, the service processes almost 100,000 transactions per day with a value of nearly $147 million (SGD 200 million) transferred daily. Built upon the same network, Singapore’s PayNow app was launched in 2017 as a P2P fund transfer app for retail customers. The PayNow corporate app, launched in 2018, allows companies as well as governmental institutions to pay and receive funds instantly by linking a Unique Entity Number (UEN) to a Singapore bank account.

Companies & networks spearheading Real-Time Payments

Vocalink

Acquired by payments giant Mastercard in 2018, the company currently operates the Faster Payments platform in the UK and processes over 90% of salaries, more than 70% of household bills, and nearly all state benefits. Vocalink’s solutions also power the UK’s settlements and direct debit systems, as well as the country’s network of nearly 60,000 ATMs. Responsible for building the infrastructure of the immediate payment platforms in the UK and Singapore, Vocalink also offers payment solutions in the US, Thailand, and Sweden. It recently partnered with Saudi Payments (a subsidiary owned by SAMA, the Saudi Arabian Monetary Authority) to power the country’s real-time payment solutions.

The RTP Network: The Clearing House

In the US, The Clearing House, collectively owned by 25 financial institutions, provides the technology for the US’s immediate payments platform. Launched in late 2017, the network is open to any federally insured depository institution. The organisation reaches over 50% of US transaction accounts.

The Zelle Network: Zelle Instant Payment Service

Backed by 30 major US banks and powering payments for financial institutions such as Wells Fargo, Chase, Citibank, Bank of America, and others, the Zelle Payments Service was launched in 2017. In 2018, the Zelle Network processed $119 billion in payments across 433 million transactions in 2018. In comparison, in 2017, the payments platform processed 247 million transactions with a combined worth of $75 billion. In comparison, the payments platform he network has 229 participating financial institutions with over 60 that are live and processing transactions.

Visa & Mastercard: Embracing Real-Time Payments

Payments giants Visa and Mastercard have long dominated the field of money transfers across the globe. With the rise of digital and immediate payments, both companies have been investing in fintechs that offer innovative solutions when it comes to digital payments.

Mastercard’s investment and subsequent acquisition of two powerful companies handling real-time payments, Vocalink and Nets, in 2017 and 2019 respectively, is a step in the direction of a cashless world. Mastercard bought Vocalink for $700 million and paid $2.6 billion (€2.85 billion) to acquire Nets. Mastercard has also partnered with ecosystem partners such as PNC Bank to pilot Payment on Delivery, a solution that allows businesses to pay suppliers in real-time when receiving goods or services. It also launched Mastercard Bill Pay Exchange with partners that include ConEd, Vaidya Bank, Aliaswire Inc., OSG Billing Services and Transactis. This facility allows customers to view, manage and pay bills that span telecom, utility, rent and mortgages without setting up separate accounts and juggling multiple passwords.

Establishing itself as a multiple-payments rail company, Mastercard now offers payments in almost every form: online transactions, card payments, bank account transfers, cross-border payments, mobile wallets, and more.

In comparison, competitor Visa offers Visa Direct powered by Visa Net that allows real-time funds delivery directly to financial accounts using card credentials. Visa has only recently entered the real-time payments race. Visa acquired US fintech Plaid for $5.3 billion in January 2020. Plaid powers the network that allows users to share their financial data with third-party apps including real-time payments apps like Venmo, TransferWise, and others. Visa also acquired Earthport, a fintech that facilitates cross-border payments for $322 million (£247 million).

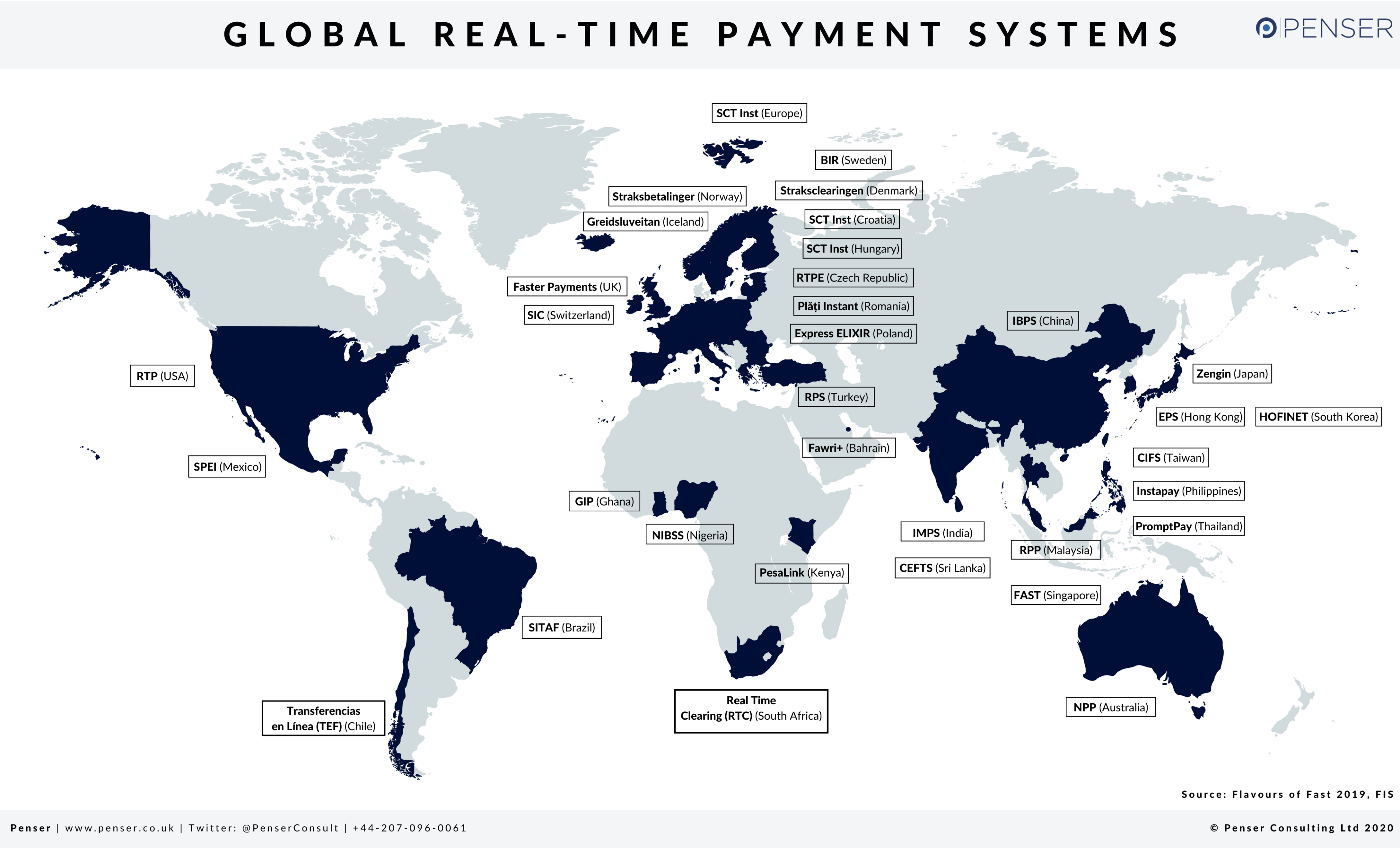

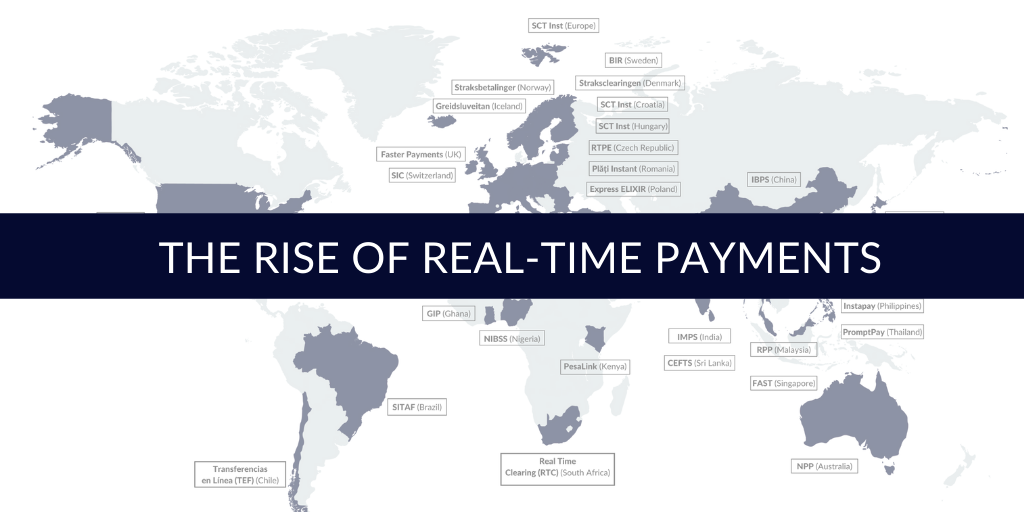

Global Real-Time Payment Systems

It is not surprising that both Mastercard and Visa are exploring immediate payment solutions as the volume of real-time payments continues to grow globally. Real-time payments are set to disrupt retail & eCommerce payments as more and more countries around the globe adopt and offer immediate payment platforms. Currently, there are over 50 countries that have activated real-time payment systems, a 35% increase from 2018 and four times the number from 2014.

Here is an infographic depicting the real-time payment systems currently live across the globe:

As experts in fintech and payments, Penser closely tracks the developments taking place in these sectors. Contact us to know more about how we can help you. We offer digital transformation, growth strategy, and due diligence services.