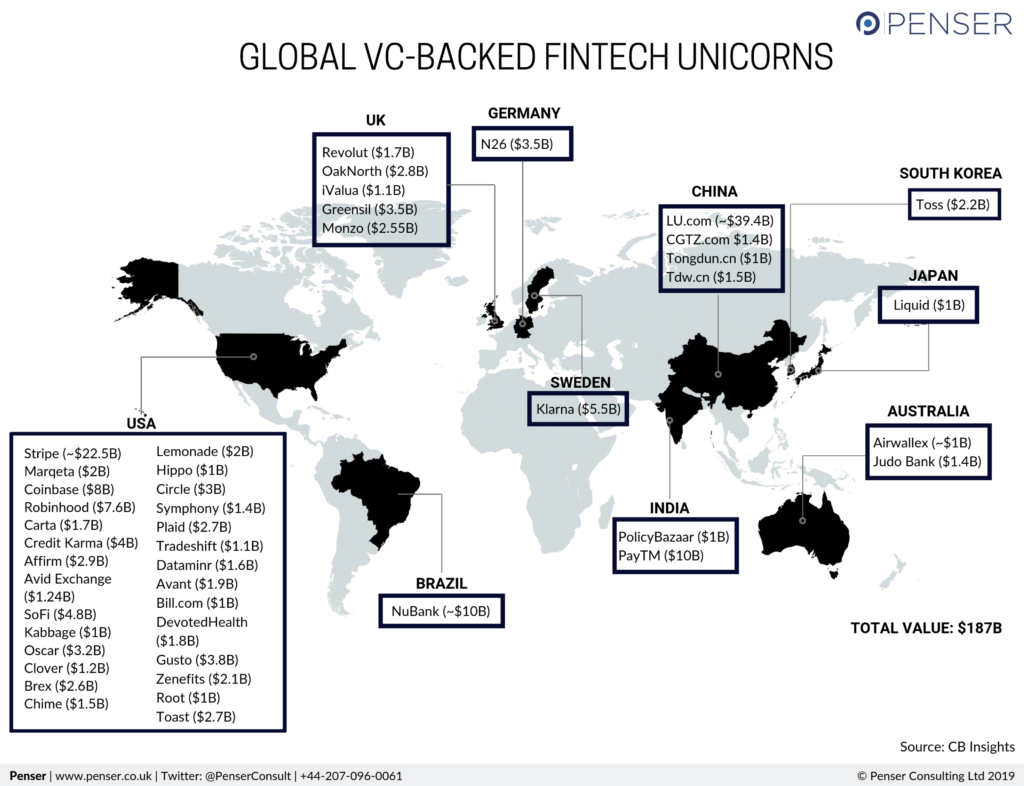

The fintech industry ended 2018 with a total of 39 VC-backed fintech unicorns with a combined worth of $147.37 billion. In the first ten days of 2019, N26 became the first fintech to enter the billion-dollar club, also establishing itself as the most expensive fintech startup in Europe. In the first half of 2019, ten fintech startups have achieved unicorn status. The total value of all 49 VC-backed fintech unicorns is nearly $188 billion.

Funding & Deals

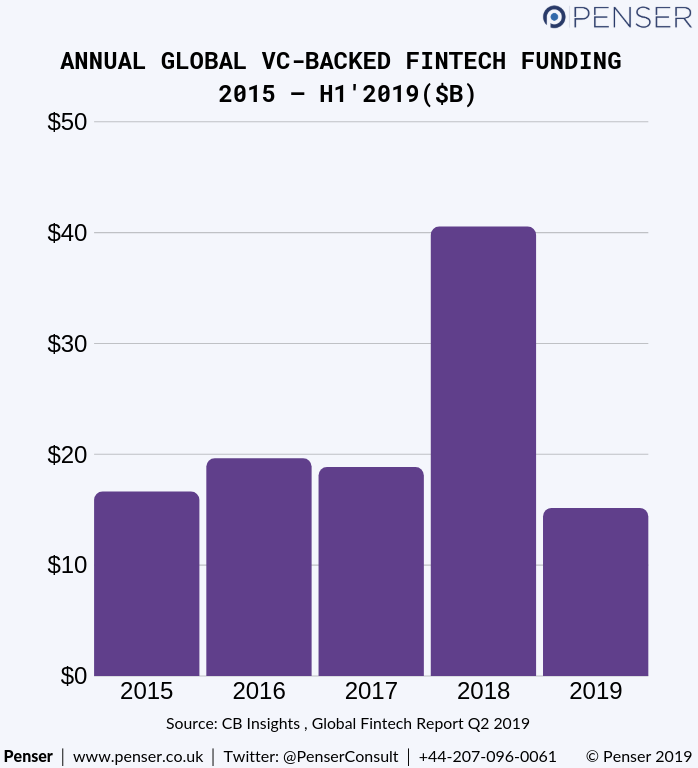

While 2019 started with a flourish, there was a global dip in deals – North America, Asia & Africa each saw five-quarter lows for fintech deals, with North American deals dropping 21% on a quarterly basis. However, the continent did see 15 mega-rounds ($100 million+) of funding in the second quarter, which also led to three of the four new (Marqeta, Lemonade, and Carta) US-based fintech unicorns.

In the US, there were 143 deals with a combined worth of $5.1 billion, which means 2019 could top 2018 total funding amount. The US had 8 of the 10 top deals in the second quarter. With 14 mega-round investments worth $3.3 billion, the US saw a new quarterly high. But the number of deals slipped to 143, the lowest since the last quarter of 2016.

In Asia, India surged to the top, overtaking China in fintech deals for the first time in history. China saw deals drop to a five-quarter low of 15 deals, down by 81% from the same quarter last year. There were 23 deals with VC-backed fintech companies in India, eight more than the number in China. When it came to funding, China managed to reclaim its spot for the top country for funding in Asia with $375 million, beating India’s $350 million by a close margin. Asia saw 82 deals worth $1.1 billion across the continent in the second quarter, and the CB Insights report states that both deals and funding are on track to fall below the 2018 total, with both close to historical lows. In contrast, Latin America surpassed both India & China across both funding and deals in the first half of this year. In total there were 23 deals worth $481 million across Latin America.

In Europe, VC-backed equity funding amounted to $1.5 billion across 107 deals, with both deals and funding on track to top new highs on the back of mega-rounds to fuel market growth. The UK maintained its position as the top fintech market in Europe with $892 million setting a new funding record but the number of deals in the UK dropped to 33. Europe’s $1.5 billion also beat out Asia’s $1.09 billion to become the second-top market for both deals and funding in Q2 & H1 of 2019.

Overall, there was a 22% dip in funding in the second quarter and has declined 23% compared to Q2 2018. Additionally, a five-quarter low in early-stage (seed/angel & Series A) deals (55%) contributed to the low funding numbers.

Digital Banking on the Rise

According to the CB Insights report, challenger banks’ funding has already surpassed 2018’s entire funding record of $2.25 billion by raising $2.48 billion in 2019. The first half of 2019 saw $1.4 billion in funding, with Q3 coming in strong with $997 million.

25 fintech startup across the globe have added more than 350 million customers, each with customer numbers over a million. More are likely to follow by the second half of 2019. When it comes to digital challenger banks, they are the fastest-growing fintech startup with a combined number of 30 million+ customers worldwide. Fintech startups achieving unicorn status in the US took eight of the ten spots of the biggest deals, they were all $200M+ mega-round investments.

Read more about which fintech startups entered the unicorn club in the first quarter of 2019 in our previous article.

With Brazilian fintech startup NuBanks’s $10 billion valuation, it looks like the second half of the year is also likely to see a boom in the digital banking funding & deals space.

We’re experts in the field of digital banking & payments and offer digital transformation, due diligence & strategic planning services. To know more about trends, news updates & innovation in the banking & fintech industry, check out our blog.

Feature Image: Source