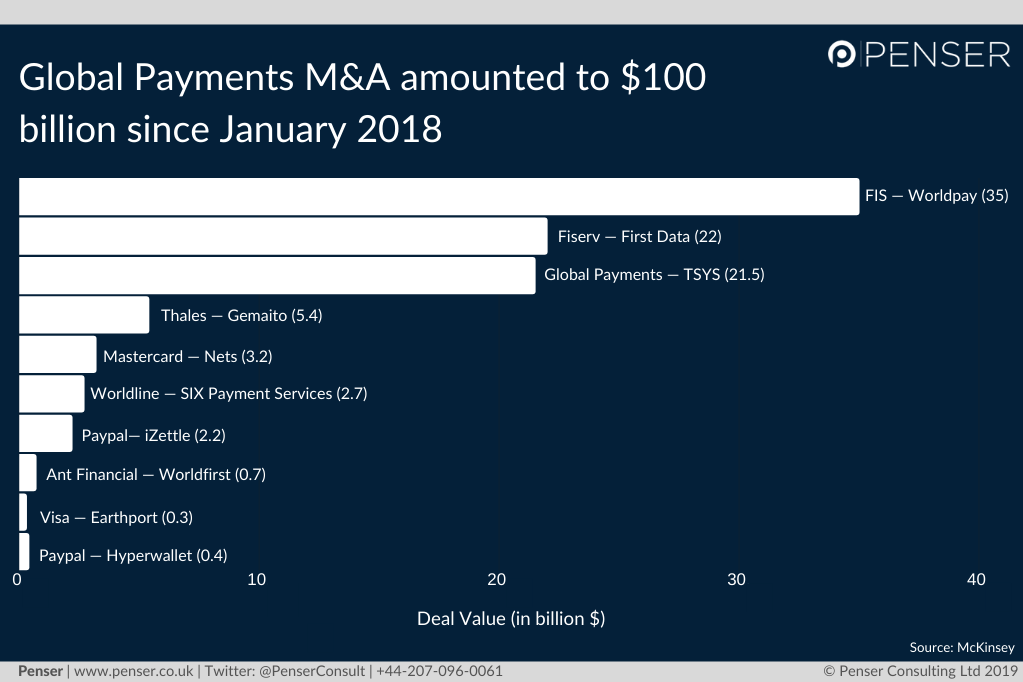

The last couple of years have seen rising payments M&A across the globe as leading players have sought to add value to their existing payments solutions and offerings by merging with other significant players in the market. Since January 2018, there have been 18 M&A deals in the global payments sector, largely driven by increasing cross-border payments and innovative payment solutions. These deals have seen $100 billion in payments.

In January 2019, Fiserv bought out First Data for $22 billion, making it one of the most lucrative deals in the entire fintech sector. This is one of the biggest acquisitions to take place in the digital payments market, along the lines of FIS’s acquisition of WorldPay for $35 billion last year.

Here’s a look at ten of the biggest m&a deals from January 2018:

At Penser, we are experts in the field of digital payments and fintech. We offer specialised M&A due diligence (m&add) services to guide investments as well as digital transformation and strategic planning services to ensure your business can expand into new territories smoothly. Contact us to know more.

Feature image: Freepik.com