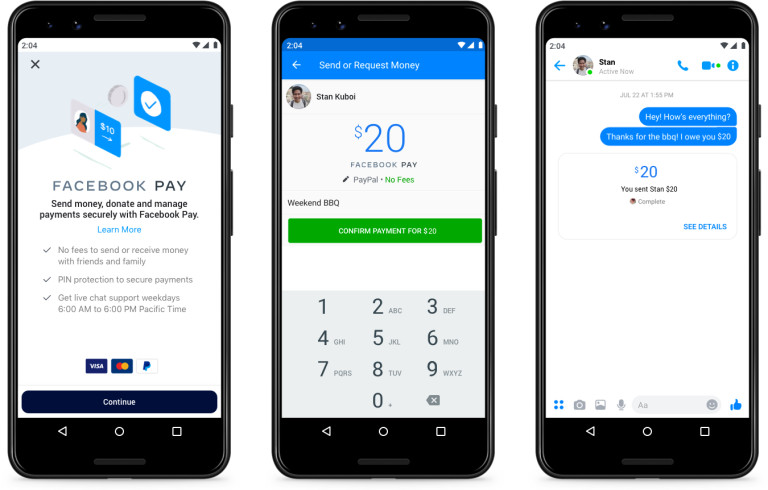

Last week, tech giant Facebook launched Facebook Pay on Messenger & Facebook. Currently only available in the US, Facebook Pay allows users to make payments and send money across to other users using a variety of methods including credit and debit cards, as well as online wallets such as PayPal. Facebook Pay will also be available on WhatsApp and Instagram in time, and the company noted that international users will soon be able to use the same to make payments.

What is Facebook Pay?

Facebook Pay takes on current US players such as Venmo, Apple Pay, and Zelle, while integrating other payment giants such as Stripe & PayPal to process payments. According to the release, Facebook Pay can be used to make payments for fundraisers, in-game purchases, event tickets, and purchases from select Pages and businesses from Facebook Marketplace. Person-to-person payments will also allow users to simply transfer money to one another over Messenger & Facebook itself in a matter of seconds.

Facebook claims that it has processed more than $2billion in donations since they launched their fundraising payments. Collectively, Facebook also owns major messaging apps Messenger & WhatsApp as well as the social networking site, Instagram. Facebook Pay has the potential to reach six billion users across the four apps.

WhatsApp Pay to launch in India

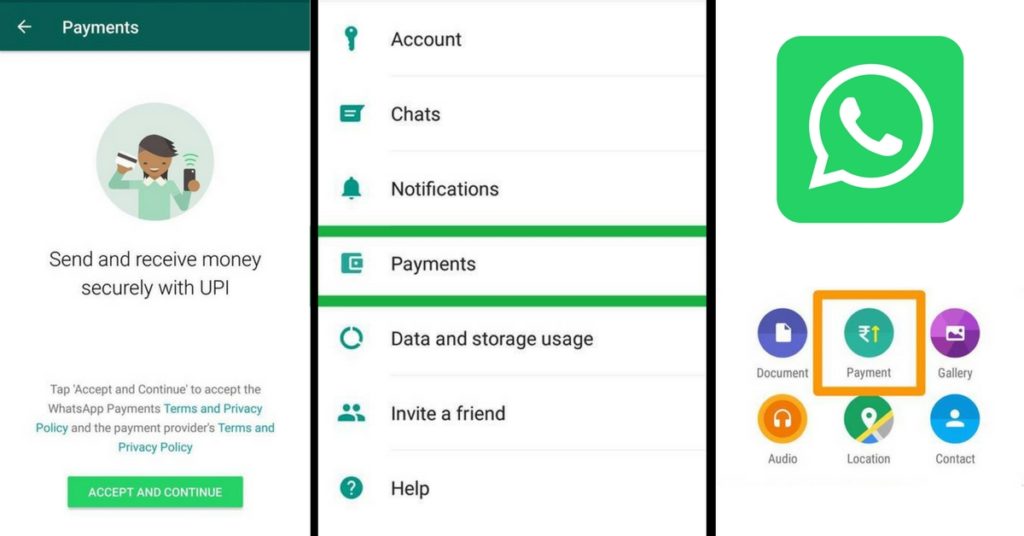

This not Facebook’s first foray into the payments’ ecosystem — Facebook founder & CEO Mark Zuckerberg recently announced that WhatsApp Pay would be launching in India very soon. With 400 million users, India is WhatsApp’s largest market & has beta-tested WhatsApp Pay with one million users in 2018. During its beta-test, WhatsApp Pay offered users the ability to make P2P payments by linking their bank accounts.

WhatsApp Pay is Facebook’s attempt to enter the Indian payments sector, where there will be stiff competition from established home-grown players such as Paytm and PhonePe, as well as global giants such as Google Pay and Amazon Pay. The payments market in India is estimated to hit $1 trillion by 2023. WhatsApp Pay is due to launch soon, once it clears data regulations & completes compliance.

Facebook has 241m users in India; it overtook the US by a million to become the global networking site’s largest market.

Facebook Libra

Facebook also announced that Facebook Pay would be distinct from its cryptocurrency offering Libra, and the Calibra wallet which runs on a separate network. The Libra Association secured 21 signatures at the inaugural charter meeting last month in Geneva, Switzerland, after seven companies including PayPal and Stripe withdrew their support.

The Penser Perspective

Facebook is venturing into the payments landscape — both retail & crypto with Facebook Pay and Libra. It is interesting to note that the tech company faces a lot of criticism in regards to (not) safeguarding consumer data, and that its venture into payments & holding consumer’s financial data is under a lot of regulatory & data scrutiny. There are also several other established players such as Venmo for mobile payments, PayPal for digital payments on the web etc. making Facebook Pay one in a thousand payment alternatives. Facebook Pay has competitors within its app-family itself, with WhatsApp Pay and Instagram Checkout.

We will track Facebook’s movement in the payment ecosystem, so check back for updates!

Penser is a fintech consulting firm focused on payments & digital banking offering expertise & services in digital transformation, strategic planning, and due diligence.