To read our article about fintech trends in the first half of 2019, click here.

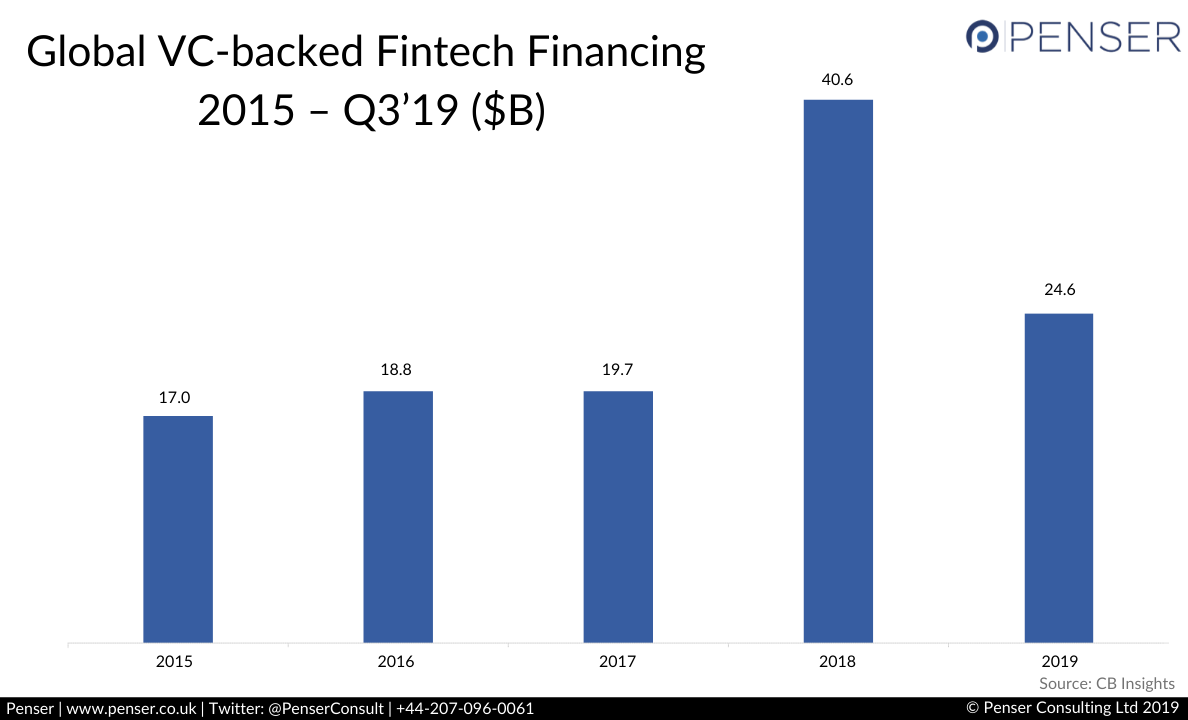

2019 has seen a dip in both funding and deals across the globe compared to 2018. But as of Q3 2019, fintech funding has surpassed 2017’s $18.8 billion and currently stands at $24.6 billion. This is still lower than 2018’s $40.6 billion, which was the highest amount of funding in the last five years.

Q3 2019 also witnessed the largest amount of funding in 2019 invested into the digital banking sector at $1.269 billion. In Q3 2019, there were 19 $100M+ rounds worth approximately $4B. In fact, challenger banks across the globe have raised over $3 billion in 2019 so far and $1.3 billion in the third quarter alone. Brazil’s NuBank raised a $400 million Series F, the largest reported equity investment in a challenger bank, which made it the highest-valued digital challenger bank with a valuation of approximately $10 billion.

While the number of fintech deals rose in the third quarter, it was still lower than 2018 — there were 456 deals in Q3 2019 compared to 501 deals in Q3 2018. It’s likely that 2019 will end with fewer VC-backed fintech deals compared to 2018’s numbers.

In comparison, VC-backed fintech funding hit a record high in Q3 2019 (excluding Ant Financial’s record deals) with almost $8.9 billion surpassing Q2 2019’s amount of over $8.7 billion. There were 59 mega-rounds ($100 million+) in 2019 YTD totalling $11.5 billion, where nearly every market other than Europe beat out 2018’s count record.

There were six new fintech unicorns in Q3 2019 and three in Q4 2019 (YTD). Five of them are based in North America (Hippo, Next Insurance, Dave, C2FO, and Riskified), one each in Europe (Deposit Solutions) and Australia (Judo Bank), while South America saw the birth of two new fintech unicorns (Ebanx and QuindoAndar) during this period.

As of November 2019, there are 58 fintech unicorns across the globe (up from 49 in H1 2019) which are collectively valued at approximately $213.5 billion.

Funding & deals across the globe

China & India continued to battle over the title of Asia’s top fintech hub: in the first half of the year, while India had more deals, China had more funding. In H2 2019, India saw $647 million in funding, narrowly beating China’s $661 million. China’s 55 deals, a 162% increase quarter over quarter overtook India’s 33 deals, reclaiming the lead.

In the West, the US saw the lowest number of deals in 11 months, compared to Asia, where the number of deals spiked in the second half of 2019. The US maintained its lead with 156 deals amounting to $3.9 billion, beating out Asia with 152 deals amounting to $1.8 billion, while Europe had the least number of VC-backed fintech deals with 90 deals which amounted to $1.7 billion in Q3 2019. Canada’s fintech funding topped $670 million across 46 deals, an annual high that is on track to set a new record.

Southeast Asia set a new annual record by raising $701 million across 87 deals in Q3 2019. The biggest two deals since 2015 occurred in 2019: Singapore-based Deskera, an ERP solution provider, raised $100 million during a Series B funding round, and Vietnam-headquartered MoMo, a mobile wallet, raised $100 million during a Series C funding round.

Alternative Payments

Several fintech startups targeting alternative payment methods raised significant amounts of funding — Bolt, an online checkout platform, raised a $68 million Series B, Rapyd, a mobile-first financial network provider, raised a $100 million Series C, etc. in this period. These investments included major payments giants such as Stripe, PayPal, Visa etc.

Lending & Real Estate

Across real estate & lending, fintechs are exploring innovative solutions. For instance, CB Insights reports that fintech startups are directly targeting 33 million student-borrowers and helping them pay off $1.7 trillion in loans. Summer raised a $10 million Series A, and has saved borrowers $8 million in payments in 2019 YTD. Real estate fintech startups beat 2018’s $1.1 billion funding by raising $1.9 billion through Q3 2019.

Even with a dip in both funding & deals compared to 2019, fintech has displayed impressive growth this year. Digital challenger banks have been witnessing increasing customer adoption, for instance, US-digital bank Chime boasts of 5 million customers and nearly $6 billion in valuation. According to experts, fintech in 2020 will focus on decentralized finance, increased adoption and use of cryptocurrency as well as growing collaboration between fintechs and traditional institutions with the implementation of open banking and PSD2 across the EU. As fintech grows broader and more dynamic in nature, with tech players such as Google and Apple entering the banking and payments sector, 2020 will witness major developments in the digital banking, payments, and cryptocurrency spheres.

As experts in the field of digital banking & payments we are constantly monitoring the dynamic fintech landscape. To know more about trends, news updates & innovation in the banking & payments sectors, check out our blog. We offer digital transformation, due diligence & strategic planning services.