Due Diligence Case – Summary

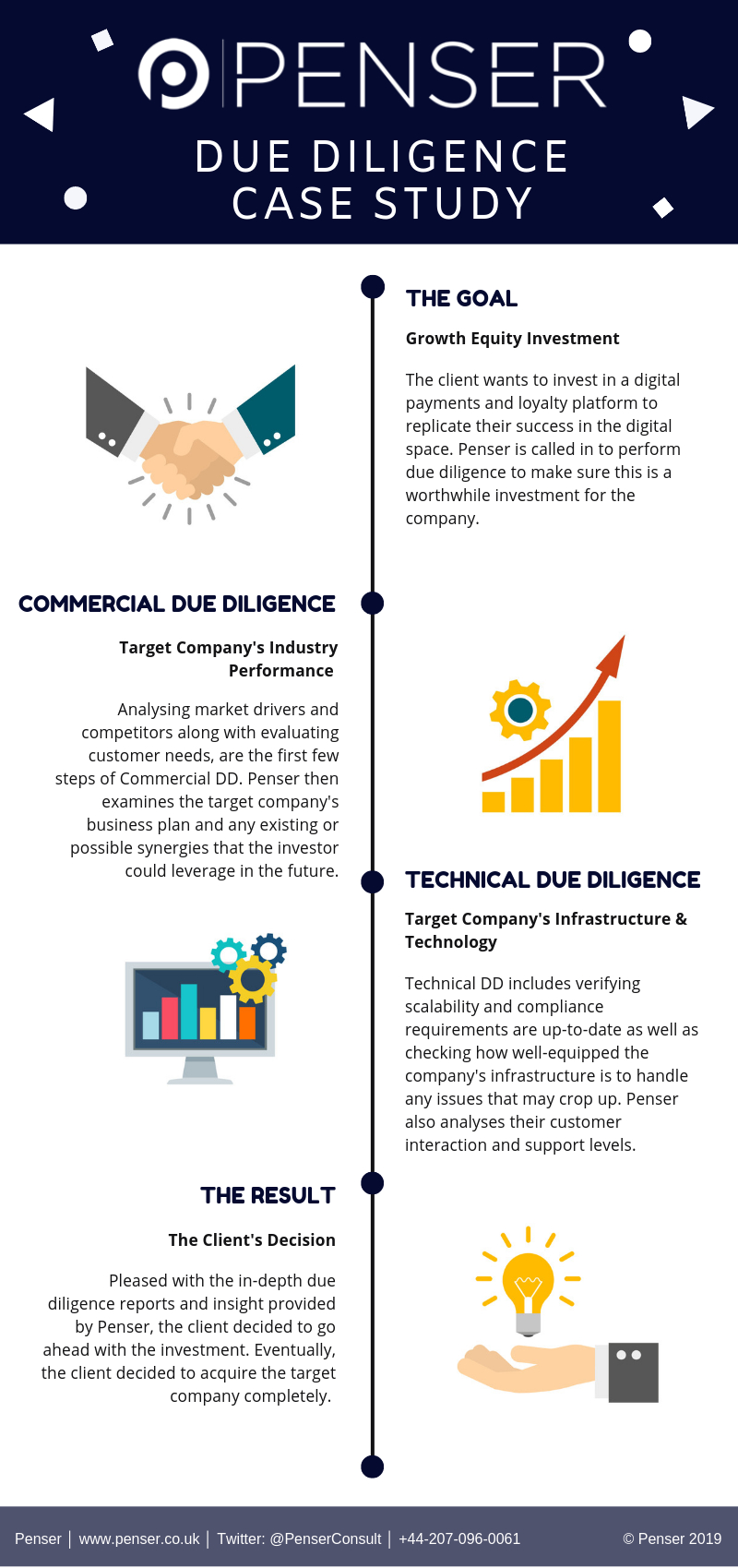

Recently, Penser was approached by a large conglomerate in the EMEA region to assist with a growth equity investment. The client was looking to strengthen their foothold in the financial services market by investing in a payments and loyalty platform.

Over six weeks, Penser conducted technical & commercial vendor due diligence (VDD) on the target company. Working along with the client and the target company, Penser engaged in thorough in-depth due diligence (M&ADD) to understand the value of the investment opportunity, resulting in an investment by the client.

The Client

The client, a global holding company in the CEMEA region that operates within financial services, property, retail and leisure spaces were looking to expand and cement their current position as industry leaders.

Background

The digital fintech scene has changed rapidly over the last few years, with a significant increase in the use of digital payments technology. In fact, according to the World Payments Report 2018, the CEMEA region was one of the chief drivers in the rise of global non-cash transactions at 17.1%. Global e-wallet transactions were estimated to be $41.8bn in 2018, comprising almost 8.6% of all non-cash transactions.

With growing mobile penetration and digital technology, governmental financial inclusion measures, and a rising young population, non-cash transaction volumes in the CEMEA is expected to grow at a CAGR of 20.2% to $131.3 billion in 2021, making it 14.98% of global volume.

Recognizing a favourable shift in the market towards digital payments early, the client was interested in investing in a payments and loyalty platform to gain a first-mover advantage. In order to make sure that their investment would be beneficial in the long-run, they needed a partner well-versed within this sphere to support them through their digital transformation journey across their active markets.

The client was considering a growth equity investment in a leading e-wallet and digital payments app focused on the EMEA region. In order to replicate their physical-world success into the digital space, they needed a due diligence (DD) partner with a focus on gaining insight and knowledge. That’s where Penser came in.

Why Penser?

Over the last decade, Penser has established itself as an industry-leading consulting firm in the FinTech space. With a dedicated focus on the payments and loyalty platform sub-sector within the digital transformation sphere, Penser has developed an immense depth of knowledge in the industry and built a wide global network of experts that can be leveraged for local market insight when needed.

The ability to work with tight deadlines and turn projects around quickly, coupled with comprehensive due diligence analysis and reporting have been appreciated by several Penser clients in the past.

Penser accomplishes this by:

-

Solely dedicating resources to their project:

Creating a team of highly-experienced professionals to work exclusively on the client’s project in order to eliminate any distractions or hiccups due to other commitments.

-

The team that wins your confidence is the team that works on the project:

In some larger firms, the experienced resources present the strategy and solution, but the bulk of the work is actually assigned to junior resources. While this might work in other industries where one can learn on the job, the fintech space does not lend itself to this approach.

At Penser, the client works with an experienced team from the get-go, making sure that the best support is provided in order to gain maximum insight and knowledge into the project.

What We Do

Penser specializes in due diligence services in the banking and payments industry. Therefore, when the client was looking to invest in the space, we were a natural fit.

Penser provides both commercial due diligence (CDD) and technical due diligence (TDD) services. This needs both a strong understanding of the business environment as well as of the underlying technology the business is built upon.

- Commercial Due Diligence:

This involves understanding how the target company performs in the industry today and what its future prospects will be. This means we spend time with them to see where they are today, where they aim to be tomorrow, and how feasible their plan is.

- Technical Due Diligence:

Technical due diligence, also commonly referred to as IT due diligence (ITDD) is a specialised service that requires a deep dive into the target company’s technology. To be effective, we have to examine the platform and the infrastructure they have in place and probe it for any weaknesses.

(For more information on our process, check out our article on commercial and technical due diligence)

What We Did

Penser worked very closely with the client and the target company to examine the target company for any potential weaknesses that the client needed to be made aware of.

The due diligence period was split between the commercial and technical due diligence. The period was spent both onsite and off, ensuring that we were always on hand for any discussions and to present findings.

We work hard to make sure that our client is kept in the loop throughout the process, and we make it a point to raise any major issues at the earliest. Therefore, at the midpoint of the due diligence process, we share an interim report that highlights red flags (if any). However, in this case, there weren’t any, allowing us to allay the client’s concerns, and proceed with our in-depth analysis.

From a commercial point of view, we assess the target company’s ability to grow and meet its future business plan, considering the external payments industry market forces, competitive dynamics, and its internal product set. Technically, we assess the scalability, security and flexibility of the target company’s technology platform, including payments, loyalty and data analytics.

To facilitate this, we conducted a combination of primary as well as secondary research. The primary research involved internal interviews with the client and the target company, as well as discussion with external resources and merchants and vendors. The secondary research drew upon our extensive experience, allowing us to do a competition assessment, validating the projections shared, and compiling external market data.

This resulted in a comprehensive report that covered the following:

-

Market overview and growth:

We examined the status of the market for payments, mobile wallets and loyalty, taking into account both local and global perspectives. We also examined customer behaviour and adoption rates. Highlighting key trends and current market data, we were able to make an informed assessment of the market’s growth potential.

-

Product overview:

We next provided an overview of how the product functions, and how the target company generates revenue from the product’s usage. This involved identifying the product’s value proposition for both the consumer as well as the merchant and detailing out the value chain involved. To complete the picture, we also took into account the product reviews shared by the target company’s customers.

-

Competitor assessment:

Understanding the competitive landscape is a crucial part of our due diligence process, and we provided a detailed comparative analysis of the players in the market.

-

Business plan assessment:

Penser then dived into the target company’s business plan. We identified the financial drivers and what the target company has defined as its Key Performance Indicators (KPIs). We also assessed how those KPIs translate into revenue generation and growth prospects.

-

Market expansion potential:

As per the target company’s plan, we examined its potential for expanding in other markets within the region and without. We dived into each of these potential markets and evaluated how feasible the expansion was, and what that would translate into in terms of costs, revenue and customer lifetime value (CLTV).

-

Technology analysis:

Our 150-point assessment of their technology is thorough and forward-looking. We examined the stability of the technology infrastructure and understood how it would react to scaling up. We also determined the strength of their security measures and how well their data is protected against system failures and external attacks. As per this assessment, we made recommendations that we think are necessary for improvement and outline a possible technology roadmap for the future.

-

Potential for synergy:

We compared the client and the target company’s customers, revenues, transactions, and more to clearly identify where the two complement each other and which assets of the target company could impact the client’s business.

This comprehensive report is then presented to the client, along with our recommendation. In this case, we saw that there was a definite value in the investment, and we recommended that the client go ahead.

The Result

At the end of our due diligence (DD), we presented an exhaustive report of our findings, their implications, and the pros and cons of the investment, answering questions and providing clarifications as needed.

The report was very well-received by the client, and they appreciated the depth of our analysis as well as the breadth of insight we shared, especially in framing the investment in a more global context.

Based on our recommendations, the client successfully went ahead with the investment. In fact, the relationship proved so fruitful, the client eventually acquired the target company entirely, folding it into its vast portfolio and integrating its services across its network.