(To check out our article on key steps to building a successful digital bank, click here.)

The global digital banking market had an estimated value of $6,620 million in 2018 and is expected to generate around $8,646 million by 2025 at a CAGR of around 3.8% between 2019 and 2025. The banking industry has seen a boom in digital product offerings for both retail and business customers across the globe in the last decade. Several legacy players such as DBS, Mashreq Bank, RBS etc. have begun launching digital banks (Digibank, Mashreq Neo, RBS Mettle) to compete with fintech startups such as N26, Monzo, Revolut etc. which offer digital-only banking alternative services.

With rapid growth in the digital banking sector, several new digital banks are looking to break into the market, so, here are five critical aspects that financial institutions need to be wary of when building a digital bank:

Ignoring the ‘customer-first’ rule

Regardless of the type of financial service being offered, a digital bank has to customise its offering according to the type of customer it’s targeting. In the next five years, more than two-thirds of Europe’s banking customers are likely to be “self-directed and highly adapted” to the online world. But the entire world has not (yet) been acclimatized to banking digitally in the same way, so depending on location and target audience, the digital bank must be built accordingly. For instance, 80% of the customers surveyed by McKinsey in developed Asian markets said that they would be willing to shift to a digital bank, whereas in emerging Asian markets the number stood at 50%. For a digital bank to be successful, it has to address both local needs and customer preferences. For instance, during its digital transformation, DBS began by creating a startup mentality while adopting the agile approach to innovation and development. DBS’s subsidiary Digibank targeted the new wave of India’s smartphone users and offered the first digital-only banking service in the country.

Another important aspect to be considered is the demographic of digital bank customers. Today, the primary users of tech services are between the ages of 16 and 34. This means it would be useful to offer incentives for savings, easy investment options etc. Monzo, a UK-based digital bank with 3.1 million customers, offers ‘Savings Pots’ where customers can stash money towards multiple goals while earning interest, encouraging better financial health.

But when it comes to digital banking, it is also equally important to include the older generation in the digitisation process. Barclays’ Digital Eagles program offers online tutorials, in-branch sessions and more to increase their customers’ confidence while using their digital services.

From evaluating customer journeys, using behavioural analytics to understand their specific friction points, and personalising their banking experience, every digital bank needs to address its customers’ needs to be successful in the long run.

Ignoring technological needs & trends

It might seem easier to simply offer shallow digital offerings while still retaining traditional banking practices behind-the-scenes, but ignoring the tech revolution will only result in an unsuccessful digital bank. When it comes to building a digital bank, both financial institutions and startups need to do their homework on what technology is needed to build a platform that caters to customer demands. The idea of a digital bank is to make life easier for both customers and banks, so it is important to address the pain points of traditional banking when developing a new platform for digital banking.

Many banks that go digital eliminate the need for physical branches or outlets entirely. However, this might not be the best option for banks with customers to want to physically deposit their money. Another important aspect to consider while going digital is that customers should be able to register their concerns when they need to. Having 24/7-multilingual support is certainly useful, but incorporating AI and machine learning can reduce the margin of error by providing intelligent solutions and better channels of communication. It would be very useful to conduct beta-testing on a small cross-section of your digital bank’s desired/target audience, as it will offer scaling metrics while offering points of improvement and highlighting any problems from real-world results.

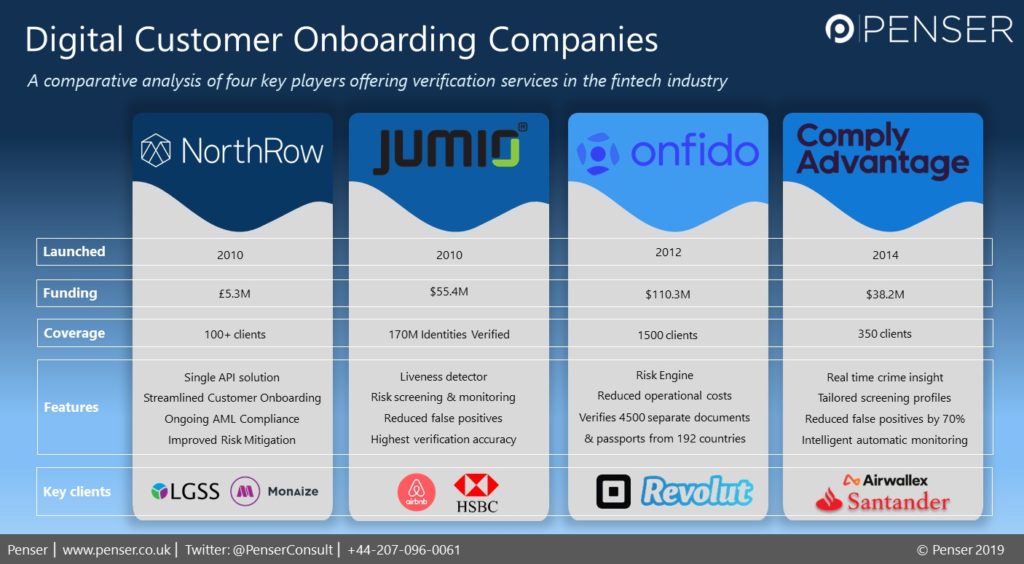

When it comes to incorporating tech, partnerships with digital verification and customer onboarding companies allow digital banks to reduce customer frustration with older methods (such multiple forms, time-consuming background checks etc.) without needing to build the software needed for it from scratch. When it comes to selecting an onboarding and verification partner, it is important that they adhere to KYC and AML compliance regulations and therefore protect both customers’ and the bank’s financial assets from cybercrime and fraud. Here’s an infographic that explores some of the key features & services provided by four UK digital verification and onboarding companies.

When building a digital bank, it is necessary to make sure that customers have an easy onboarding process but it is equally important that their financial data is safe, regulated, and protected.

Equally, the choice of back end technology platform to use is an important one. From more traditional companies such as FIS, Fiserv, Jack Henry to newer companies such as Infosys Edgeverve, Temenos, and startups such as Mambu, Thought Machine, TenX, and many more, this is a foundational decision that can define the agility and uniqueness of a new digital bank. (At Penser we specialise in helping companies make this build, buy, partner decision, develop RFPs and execute vendor evaluation and due diligence for clients building new digital banks).

Inspiration not imitation

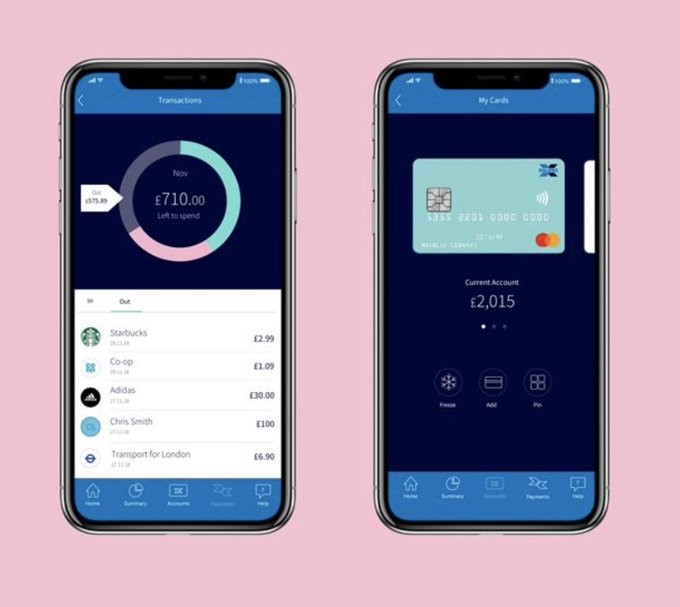

There is fierce competition between digital-only challenger banks and traditional banks, which means there is constant scrutiny over new services being launched. When it comes to building and maintaining a successful digital bank, being first is not as important as being reliable Traditional players attempting to build their digital bank may be tempted to simply copy their newer fintech competitors. This is not a good idea as this may imply that innovation is not your forte. For instance, traditional bank Halifax was controversially found copying Monzo and Starling’s visual identity earlier this year in an effort to rebrand itself as a digital bank.

It is always a good idea to find your individual footing and style when it comes to both marketing and products when it comes to building a digital bank, as customers are quick to recognize poor imitation strategies.

This is not to say that you cannot offer the same types of services. In fact, almost all digital banks share similar basic features: no forex fees, easy onboarding, an overview of finances etc. But the ability to build on these basic services and offer innovative options is the key to a successful digital bank.

Beware regulatory changes

The finance industry has undergone several regulatory changes in recent years and will continue to do so for a few more to come. If your digital bank is not equipped to endure changing regulations and license requirements, it will be difficult to maintain a loyal customer base. In addition, failure to adhere to important regulations will result in an inability to operate.

Europe recently passed the Open Banking mandate, which means that all financial institutions and fintech startups must collaborate using APIs that provide access to customer data. However, only 24% of banks and 29% of fintechs said that they were ready to embrace PSD2. According to Tink’s analysis in June, none of the tested bank APIs by June 14th were ready to meet the quality requirements set by PSD2 regulators. There have been multiple issues with integration of APIs, implying that there will most likely be a transition period until banks can provide high-quality APIs.

When building a digital bank, it is important to make sure it can quickly adapt to regulatory changes and use them to your advantage. The end goal of regulatory and licensing requirements is to provide customers with innovative financial services in a controlled, streamlined way that benefits both customers and financial institutions.

Not being adaptable/ flexible to changing trends

There have been more than 100 digital challenger banks that have launched across the globe in the last few years, according to McKinsey & Company’s Global Banking Report 2019. Customers now have a wide range of options to choose their digital banking partner. This means it is important that your digital bank is built to innovate and adapt to changing trends in the industry as well as customer needs. It is important to focus on refining customer sub-journeys (e.g. downloading the app, registering etc.) as it is important for overall customer satisfaction. Digitization extends beyond online and mobile experiences to excelling on customer experience across channels.

Failure to offer new products, measure customer satisfaction, and incorporate feedback will result in a stagnant digital bank offering. A good example of this in action is the DBS QR Ang Bao initiative. Following WeChat Pay’s highly successful red packets initiative, on January 25th, 2019, DBS launched their QR Ang Bao, “the world’s first digitally loadable red packets”, ahead of Chinese New Year. Over SGD 1.3 billion was loaded onto their QR Ang Baos with 64% of the users sending SGD 8 or above. DBS is known for being one of the many traditional banks that has successfully rebranded itself as a digital bank while also building digital-only banking alternatives in India and Indonesia: Digibank.

Digital banks need to adapt to customer needs, incorporate new technology while maintaining compliance in order to be successful. Going digital involves a considerable amount of planning, forethought, and understanding of the changing fintech space. It is important to be aware of banking trends while constantly monitor customer interests using analytics and other gauging metrics to offer a consistently excellent digital banking experience.

This is where we can assist you. At Penser, we have worked with financial institutions and fintechs during their digital transformation by offering strategic planning & due diligence services. We have extensive experience in the fintech industry across payments, digital banking, and more.

Feature image source.