Apple Pay recently overtook Starbucks to become the most popular payment platform in the US. According to eMarketer data, Apple Pay will reach 30.3 million users in the United States during 2019. Starbucks, on the other hand, will have 25.2 million users this year, followed by Google Pay at 12.1 million and Samsung Pay at 10.8 million.

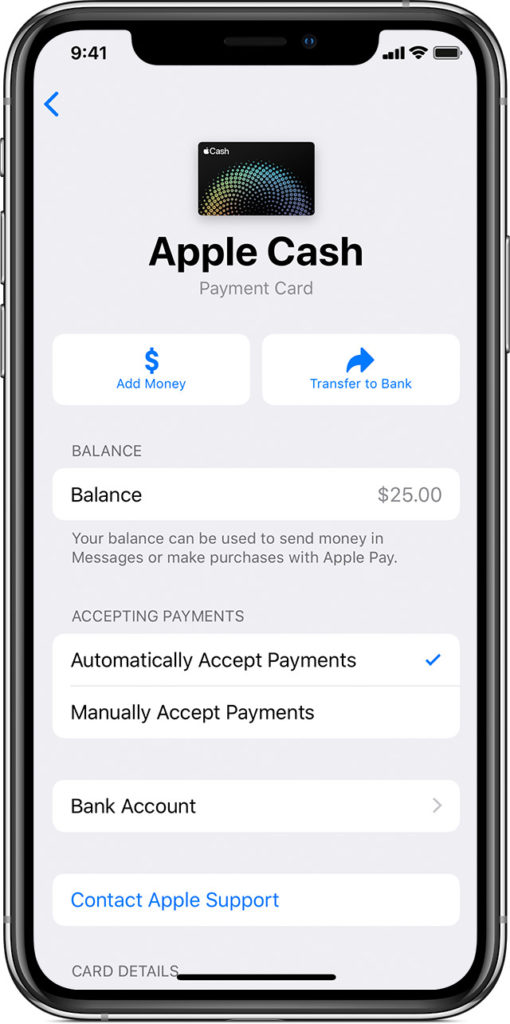

Apple has launched Apple Cash as “a prepaid debit card in your Apple Wallet” bringing another contender on the P2P payments scene. Apple Cash is only available in the US as of now and allows users to connect their debit cards and select an amount to load into their Apple Cash accounts.

Competing with players such as Venmo & Zelle, Apple Cash only works with debit cards and can be used to make in-store, in-app, and web purchases. The balance Apple Cash can also be transferred back to bank accounts. Cashback earned on transactions & purchases made with the Apple Card are Apple Cash and can be used similarly.

Users can see Apple Cash transaction history within the Wallet which provides a complete overview. They can also send their friends & contacts money using Apple Cash via iMessage. Apple Cash can also be used to pay off the Apple Card credit.