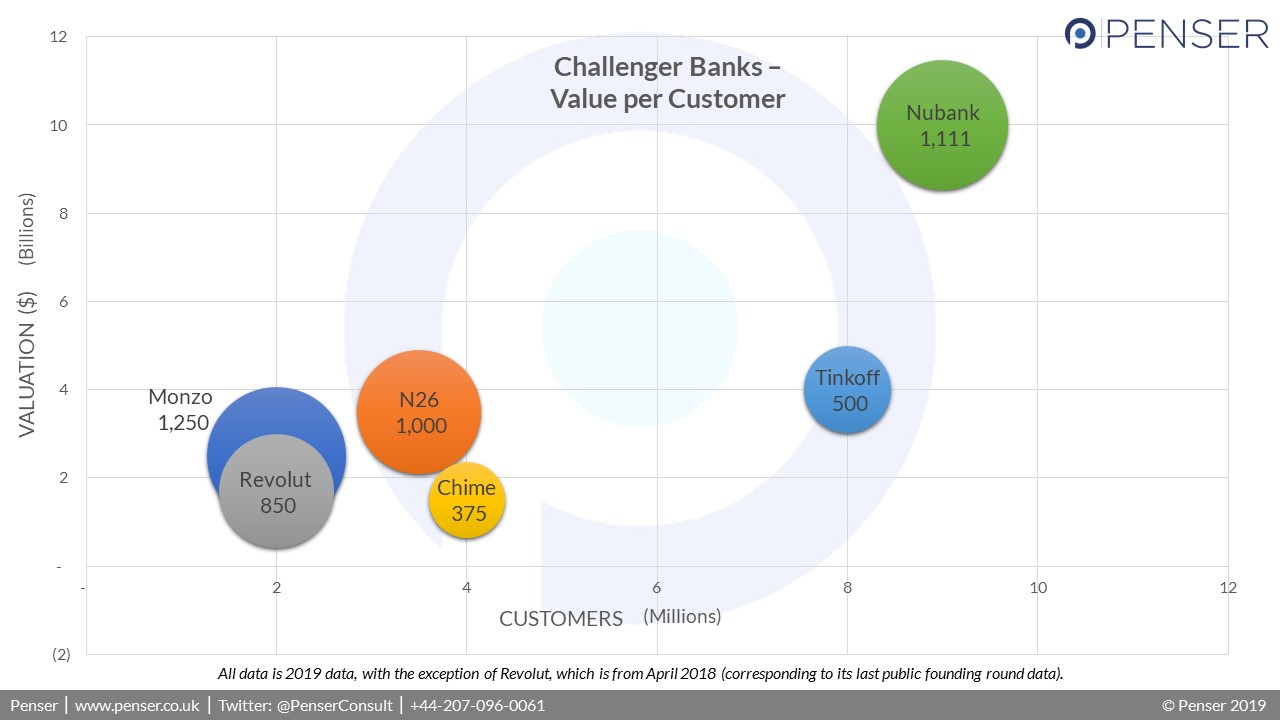

In recent years, digital challenger banks have rapidly established their value to customers, allowing them to grow in leaps and bounds. Players that aren’t even 5 years old have already established themselves as FinTech unicorns, forcing legacy players to sit up and take notice.

As experts in the FinTech space, Penser pays close attention to the increasing importance of these digital players. We wanted to see how valuable the customer is to these neobanks, and have compared the value per customer for six significant players below.