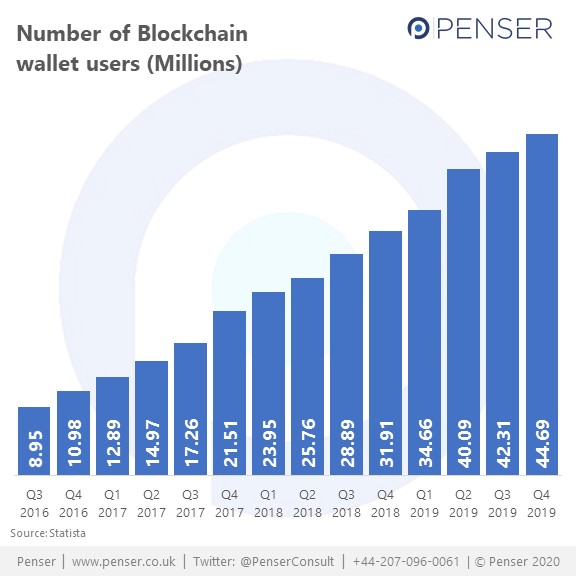

As expert payments consultants in the fintech space, Penser tracks the increasing importance of cryptocurrency in modern transactions, and as a result, we also monitor instances of cryptocurrency-related crime. With the number of blockchain wallets continuing to steadily grow and cryptocurrency adoption becoming more widespread, cryptocurrency-related crime has also grown.

In January 2020, Chainalysis released its annual report on crypto crime. We take a look at some of the more interesting takeaways from this year’s report.

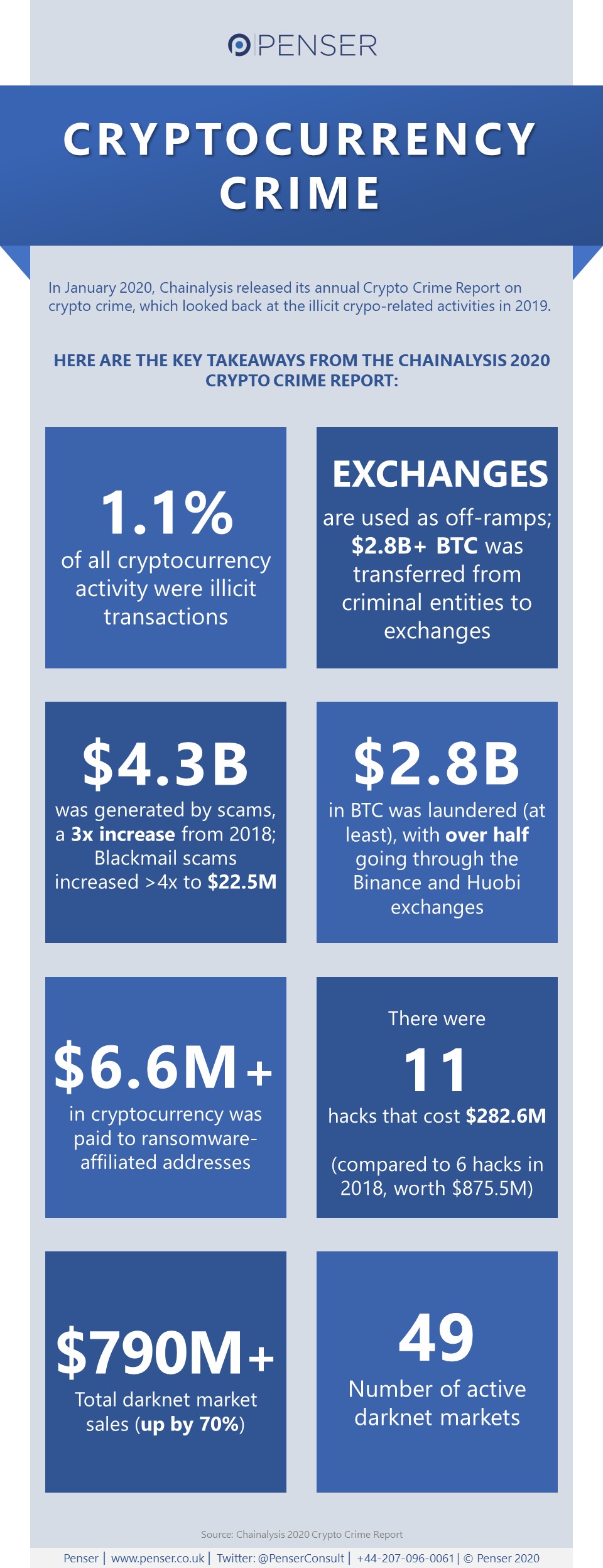

The key takeaways from the Chainalysis 2020 Crypto Crime Report

- In 2019, illicit transactions accounted for 1.1% of all cryptocurrency activity, almost thrice as much as its share in 2018.

- Exchanges and mixers are extensively used to cover criminal tracks, with exchanges continuing to be a popular off-ramp for illicit cryptocurrency. Over $2.8 billion in Bitcoin being transferred from criminal entities to exchanges.

- Scams are the biggest threat in cryptocrime, accounting for a large majority of all cryptocrime in 2019, more than tripling their revenue from 2018 to $4.3 billion. 92% of this was driven by Ponzi schemes. Blackmail scams nearly quadrupled from 2018, hitting $22.5 million in revenue.

- Chainalysis tracked at least $2.8 billion in Bitcoin money laundering, with over half of this going to two specific exchanges – Binance and Huobi.

- Multinational manufactures and US city and county governments spending over $176 million in response to ransomware attacks in 2019. This is likely to only increase going forwards, as an August 2019 report found that ransomware attacks more than doubled year-on-year. In 2019, over $6.6 million in cryptocurrency was paid to ransomware-affiliated addresses. This was largely driven by the attacks carried out using the Bitpaymer, Ryuk and Defray77 ransomware strains.

- There were 11 hacks that cost $282.6 million in 2019. While this number is almost double that of 2018, they didn’t compare in scale to the latter’s Coincheck hack ($534 million).

- Total darknet market sales grew 70% in 2019 to over $790 million worth of cryptocurrency, the highest it’s been since 2013. Darknet markets also doubled their share of all incoming cryptocurrency transactions (from 0.04% in 2018 to 0.08% in 2019).

- Although eight darknet markets closed in 2019, eight new ones opened, keeping the total number of active darknet markets steady at 49.

Penser has acted as fintech consultants to clients across the world and have helped them make more informed decisions regarding their investments. If you’d like to know how we can help you, please contact us.