In our previous article, we discussed the rise of credit scoring in the US, and how the impact of that system has rippled across various industries. The three largest global players – TransUnion, Experian and Equifax – have dominated this space and provided credit data to various industries. These credit scores are used for wide-ranging purposes; not only are they a big factor in lending decisions, but they are also used for determining insurance rates, assessing a tenant’s or a cellphone user’s ability to pay bills, and more.

Due to this wide-ranging impact, there has been an increasing focus on improving one’s credit rating. As a result, there has been an increase in fintech startups that provide consumers with access to their credit score, as well as educate them on how to improve their scores.

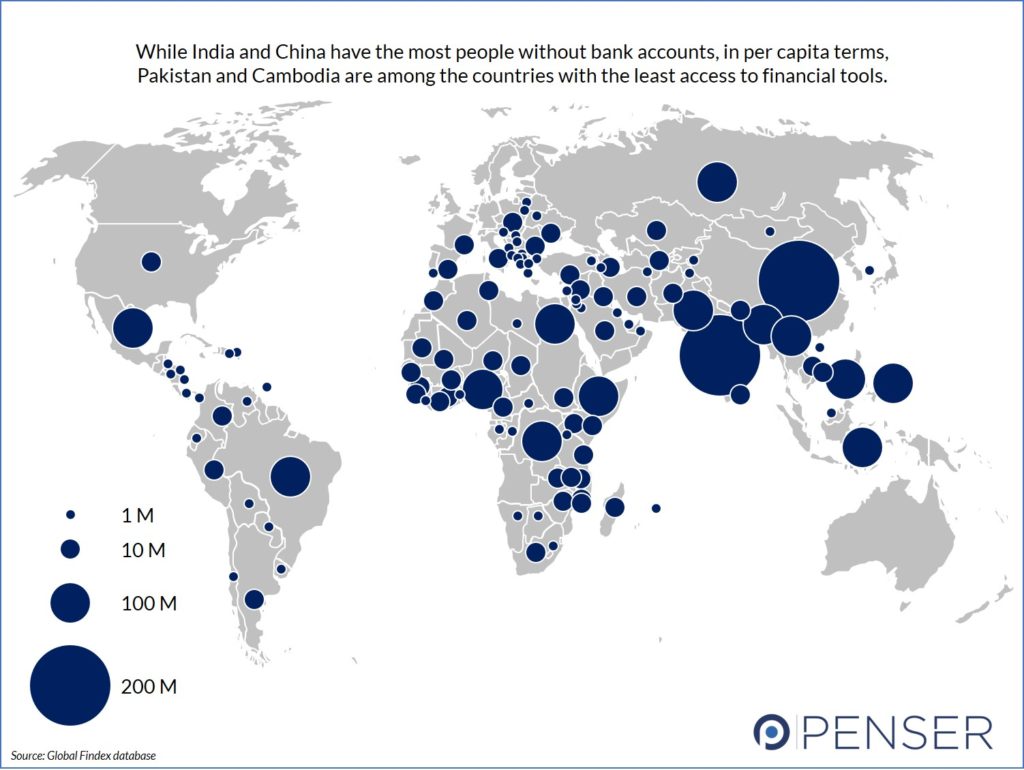

However, these startups have primarily focused on consumers that have an existing credit history. Globally, there are an estimated 1.7 billion unbanked adults, or adults that don’t have a credit history, which restricts their ability to secure loans and more. Therefore, there is a lot of potential for alternative systems that address this issue.

Here’s a closer look at five key FinTech startups looking to provide alternative credit scoring and finance solutions in emerging markets:

1. LenddoEFL

LenddoEFL grew out of research on psychometric credit scoring at the Entrepreneurial Finance Lab at Harvard in 2006. In 2010, the company became an independent organization, and by 2013, they had partnered with banks in emerging markets in Asia, Africa and Latin America with the explicit objective of developing low-cost credit screening tools for emerging markets. In 2017, they merged with Lenddo, a similar-minded startup whose aim was to provide access to credit to the emerging middle class through non-traditional data analysis. The newly-created LenddoEFL set its goals as providing one billion people access to financial products through alternative credit scoring and identity verification using their digital footprint.

LenddoEFL uses non-traditional opt-in data sources, including mobile phone usage, digital footprint, and behavioural and psychometric assessments, coupled with advanced analytics, AI and machine learning to turn large amounts of unstructured data into actionable insights. LenddoEFL also generates a Repayment Score, which allows financial service providers to evaluate the probability that the customer will be able to make a payment in 30 days, and an Income Score, which allows the provider to make accurate affordability calculations. Using this innovative scoring method, LenddoEFL has assessed more than 12 million people across over 20 countries and has enabled lending of over $2.5 billion.

2. Tala

Tala is a fintech company that offers a lending app that instantly underwrites and delivers credit to customers who have little or no formal credit history. Tala was founded in 2012, and first launched its lending app in Kenya in 2014. They then expanded to the Philippines and Mexico in 2017, before entering India last year.

Using Tala’s Android app, customers can apply for a loan and receive an instant decision, regardless of credit history, which would allow them to receive a loan between $10 and $500. Tala assesses customers with limited financial records through two main categories – their Android device data and their behavioural data. The former refers to the make and model of the device, the operating system it runs, the apps on the phone, etc. while the latter refers to how the user interacts with the smartphone app. Tala’s scoring model relies on about 250 data points that are then weighted and analysed using machine learning techniques.

Today, Tala has disbursed over $1 billion to more than 4 million customers, allowing them to build more stable financial lives. Tala also boasts to have a 92% repayment rate, and that its main customers are small businesses using these loans for operational capital. Tala has raised nearly $220 million from private investors and has been valued at around $800 million.

3. JUMO

JUMO is a transaction and predictive technology platform that partners with mobile network operators and banks to offer customers microloans and access to savings and insurance products. They are currently active in six markets – Ghana, Tanzania, Kenya, Uganda, Zambia and Pakistan – with plans to soon launch in India, Bangladesh, Côte d’Ivoire and Nigeria. JUMO has helped disburse over $1.6 billion in funding to small and micro enterprises, and has helped connect over 15 million people to credit and savings services.

JUMO builds its credit profiles using behavioral data gathered from mobile wallets, cell phones and transaction data. This creates a financial identity and credit rating for low-income individuals and enterprises, who can then access savings, loan and insurance products through a mobile interface. JUMO works with a number of mobile network operators and financial service providers, including Airtel, MTN, Telenor, Ecobank, Barclays Africa among others.

4. Branch

Like Tala, Branch is another fintech startup that assesses a customer’s credit worthiness via their smartphones. Their machine learning algorithms process thousands of data points to create personalised loan options quickly. Among these alternative data points, Branch examines handset details, SMS logs, GPS data, repayment history, contact lists, and more. Leveraging the smartphone allows Branch to detect behaviour patterns that correlate with repayment or default. As customers deepen their relationship with Branch, their credit history grows, and if a positive repayment behavior is observed, they can become eligible for higher loan amounts or better terms.

Branch claims to have 3x growth year-over-year globally, and now operates in five markets – Kenya, Mexico, Tanzania, Nigeria and, as of last year, India. Branch has now served over 3 million customers. They have issued over 15 million loans, with a total disbursement upwards of $350 million.

5. Konfío

Konfío helps micro-businesses in Latin America who don’t have access to credit obtain affordable loans. Using their propriety algorithm, they can use technology to measure creditworthiness, and disburse loans within 24 hours if needed. Founded in 2014, Konfío provides business loans from $100,000 all the way up to $6 million. They also provide a corporate credit card, a financial management dashboard, and insurance for businesses.

Konfío’s specialized algorithms allow them to quickly assess their customer’s market, as well as the income and expenses of the businesses, which is collected automatically from the business’s billing. They also look at the willingness to repay, which is assessed by examining the application, social data, e-commerce platforms, and other non-traditional data. This allows them to better estimate the loan amount needed.

Towards the end of 2019, Konfío successfully obtained a $100 million credit facility from Goldman Sachs, and was extended a credit line for up to $150 million by Victory Park Capital. They followed this with another $100 million from SoftBank. This infusion is likely to help Konfío maintain its 4x year-over-year growth, while also allowing it to explore new products, such as analyses of customers’ credit reports and expanding their online marketplace, Konsiento.

These five players have grown rapidly, with steadily increasing customer bases in their active markets, and have plans to expand into new markets. With each of these players securing millions in funding, it looks like the market is ready for new players, determined to address the unbanked masses.

As experts in the fintech sector, Penser keeps close tabs on how the market is adapting, with special focus on the key players and the innovations in the industry. We act as advisors to a number of financial clients on their digital transformation journeys, as well as support them with due diligence and strategic planning services. Click here to contact us for more information.