Ever since the invention of the FICO score in 1989, credit scores have become the core method of evaluating a customer’s creditworthiness and ability to repay debt. In the US, three credit bureaus dominated this space – TransUnion, Experian and Equifax – and leveraged consumer credit data to provide credit scores to various industries. While initially providing this information to banking and lending players, other industries now also leverage consumer credit scores to impact their decisions. The success of these companies helped establish the credit score as a vital part of the modern economy, and in turn, spurred a number of fintech startups. Today, modern digital finance companies have adapted their own methods using alternative data sources to assess the creditworthiness of borrowers and provide advice on how to manage and improve one’s credit score.

The dawn of credit scoring

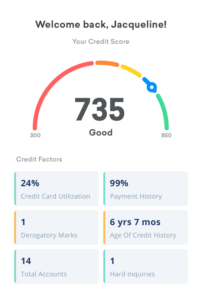

In the 1950s, Bill Fair and Earl Isaac established FICO (Fair Isaac and Company) and created an algorithm to evaluate credit. This became the FICO score in 1989 which allows impartial lending decisions to be made based entirely on factors that relate to the customer’s ability to repay loans. These scores range from 300 to 850, with scores under 550 being considered “Bad” and upwards of 750 being rated as “Excellent”.

There are five key factors that are considered:

- Payment History, which tracks whether a person pays their obligations on time. This counts for 35% of the FICO score.

- Total Amount Owed. This accounts for the percentage of credit that the consumer is currently using. This contributes 30% to the FICO score.

- Length of Credit History, which accounts for 15%. Consumers with a longer credit history are usually considered to be less risky.

- 10% of the FICO score depends on Types of Credit, which reflects the consumer’s mix of loans availed.

- The remaining 10% takes into account New Credit. This considers the consumer’s new accounts, how many recent credit application and credit inquiries.

The three major consumer credit reporting agencies

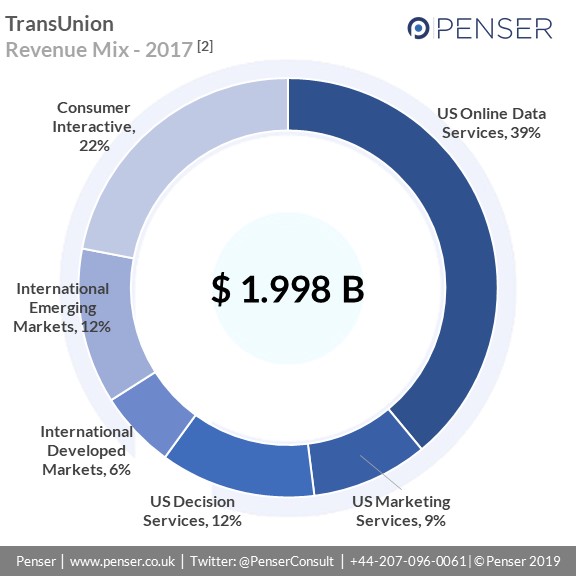

Founded in 1968 | Headquartered in Illinois | Market cap = $ 16.26 B [1]

Founded in 1996 | Headquartered in California | Market cap = $ 23.2 B [1]

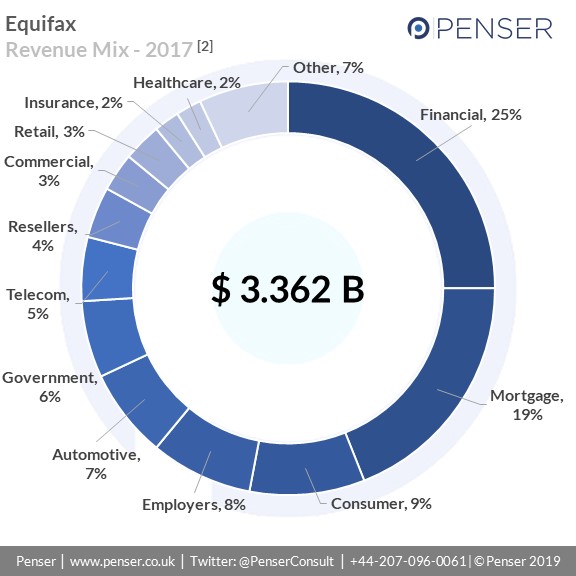

Founded in 1899 | Headquartered in Georgia | Market cap = $ 16.96 B [1]

The rise of free credit data

In 2003, the US passed the Fair and Accurate Credit Transactions Act. This act allowed consumers to request and receive one free credit report every 12 months from each of the three major consumer credit reporting companies Equifax, Experian and TransUnion. These reports detail how their score was calculated, and consumers can place alerts on their credit histories if fraud is suspected.

The impact of credit scores in the US

Credit scores were traditionally used for lending decisions, where the scores were used as indicators of the borrower’s risk and likelihood of repayment. Now, these scores are used in other decisions as well, such as

- Determining whether to underwrite insurance and at what rate;

- Assessing how responsible a potential employee is;

- Ensuring renters of utilities and cellphone services pay bills; and

- Deciding on whether to rent property to a candidate.

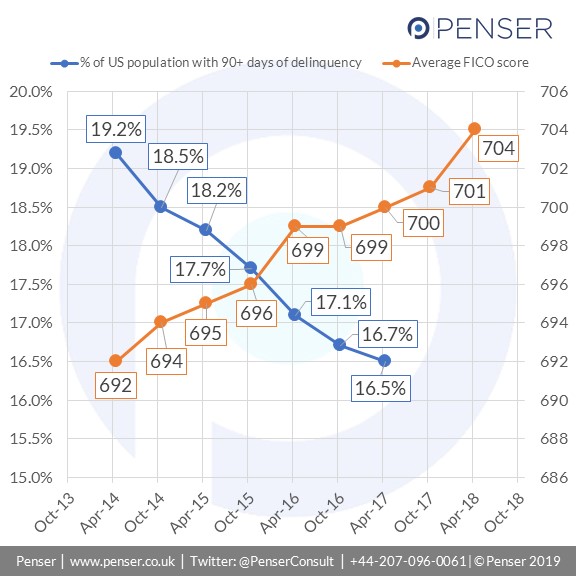

Due to its increasing importance, the US has seen a steady decrease in the number of delinquencies (which impacts payment history, a major factor in a consumer’s FICO score), and a corresponding improvement in average FICO scores.

Comprehensive credit lifecycle management solutions

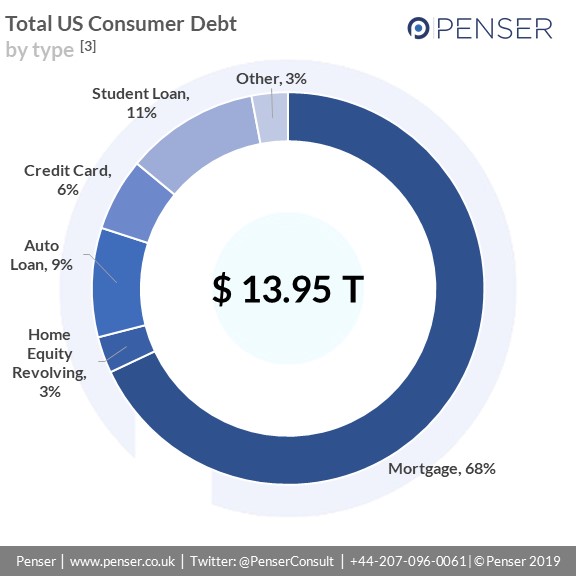

The total US consumer debt is at almost $ 14 T (Q3 2019) [3]. As a result of this, and the increasing number of applications of their credit data, consumers are more aware than ever of their credit score and are eager to understand how they can improve it and leverage it for better services. Companies will need to address these needs by offering a more comprehensive solution that manages the entire credit lifecycle.

A credit lifecycle management solution has four key parts:

- Access – Allowing consumers access to their credit data and score

- Comprehension and enhancement – Helping the consumer understand their score and credit data and helping them identify avenues to improve it

- Optimization – Letting consumers know how best to leverage their improved scores to get better rates and services

- Protection – Providing security measures that ensure that the consumer’s credit data is not threatened

Many new fintech entrants in the credit data space look to act as an all-in-one credit management solution. Through partnerships and/or their own algorithms, they provide consumers with access to their credit data and score, as well as educate them on how to improve and leverage it. They also provide security measures to ensure that customer data is protected and facilitate easy flagging of possibly fraudulent activity.

We take a look at four players making waves in this space:

4 significant new credit management solutions

Founded in 2007 | Headquartered in California | Valuation = $ 4 B [4]

Credit Karma is a free credit and financial management platform. It also supports consumers with tax filing preparation, auto insurance estimates, monitoring of unclaimed property databases and offers a tool to identify and dispute credit report errors. As of November 2018, they have over 85 M members.

Founded in 2010 | Headquartered in California| Valuation = > $ 1 B (expected) [5]

Credit Sesame is a credit and loan management platform. They provide consumers a credit score, credit monitoring, a credit report card, and identity theft protection, all for free. It uses a proprietary algorithm called RoboCredit which is based on the score provided by TransUnion, but also other factors that consumers can act on to improve their scores. They have 8 M users.

Founded in 2016 | Headquartered in California | Raised $ 142 M in total

Upgrade is a consumer credit platform that offers affordable personal loans and cards as well as credit monitoring and education tools that help consumers better understand their credit. They have launched the Upgrade Card this year, which turns outstanding balances into installment payments at the end of each month. They have over 100K customers.

Founded in 2013 | Headquartered in Utah | Valuation = nearly $ 1 B [6]

MoneyLion offers a free mobile app with personal financial management and lending tools for US consumers. They have partnered with TransUnion to offer free credit monitoring to all members. They have over 5 M app users.

The future of credit scoring

With the increasing capabilities of fintech, and the growing adoption of open banking globally, credit management is undergoing big changes. We’ve taken a look at some newer players that have made credit scores more accessible to consumers, and are providing advisory services to educate them and improve their scores. Most of this article has focused on the US, as most residents have some kind of credit history, and they have been able to develop scoring models that provide an accurate assessment of their creditworthiness.

However, globally, it’s a different story; it was estimated in 2017 that there are 1.7 B adults that are unbanked. This means that 1.7 B individuals do not have access to loans and key services because they lack the credit history that lenders look for. As a result, there is a massive opportunity for an alternative credit scoring system that can provide solutions to this audience.

One such example of an alternative credit scoring system is Zhima Credit or Sesame Credit, a private credit scoring system developed by Ant Financial. It uses data from Alibaba’s services to compile its score, which depends on a variety of factors, including social media interactions, purchases made on Alibaba websites, and payments made using the Alipay mobile wallet. Having a high score enables consumers easier access to loans from Ant Financial and a higher profile ranking on Alibaba’s e-commerce sites.

Another trend that may make an impact on the credit scoring industry is using blockchain. Start-up Bloom has been offering a blockchain-based end-to-end protocol for identity attestation, risk assessment and credit scoring since 2017. In their decentralized scoring system, statistical modeling and third-party attestations (i.e. banks, retailers, utility companies, family, etc.) are used to calculate scoring records. Using the blockchain also allows for greater transparency, letting borrowers know who is endorsing their creditworthiness and why, as well as help with transferring credit scores across borders. However, as the service is only two years old, it is still early to fully assess the impact of this innovation.

With innovative startups rethinking how credit scores are calculated and leveraged, we are likely on the cusp of a revolution in the credit management industry. As experts in the fintech sector, Penser keeps close tabs on how the market is adapting, with special focus on the key players and the innovations in the industry. We act as advisors to a number of financial clients on their digital transformation journeys, as well as support them with due diligence and strategic planning services. Click here to contact us for more information.

[1] As of 27th November 2019

[2] As per company’s 2017 annual report

[3] Federal Reserve Bank of New York, Center for Microeconomic Data, “Household debt and credit report (Q3 2019)”

[4] PYMNTS, March 29, 2018, “Credit Karma Now Valued At $4B Thanks To $500M Funding Boost”

[5] TechCrunch, August 31, 2019, “Credit Sesame, a platform for managing loans and credit scores, picks up $43M en route to IPO”

[6] Forbes, July 23, 2019, “MoneyLion Raises $160 Million At A Valuation Nearing $1 Billion”