Corporate cards are an integral step to the growth of a business and have been essential to managing corporate expenses and providing financing for corporate transactions. This has traditionally taken the shape of a physical card that is issued to the company, with specific personnel being given access to use it as necessary. This naturally creates some logistical challenges, especially if the card is required for multiple transactions at the same time.

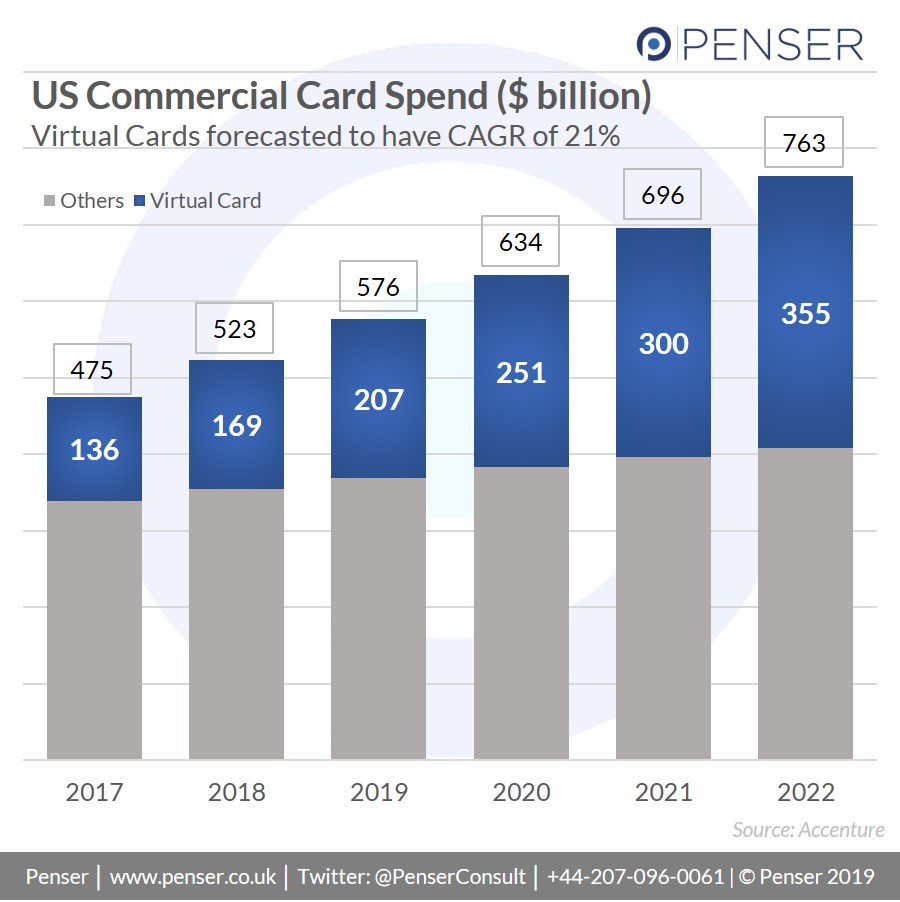

According to a report released earlier this year, corporate cards in the US market is continuing to grow at a rapid rate. In 2017, corporate cards spend volumes were over $460 billion. This number grew to over $500 billion by the end of 2018 – a remarkable jump of 9.3% in just one year – with expectations to grow by a further 68% ($343 billion) by 2022.

This growth is driven by a number of factors, but one of the key drivers is the rapid adoption of virtual cards.

Virtual cards – cards that are generated and controlled through an app – can be better integrated into the business’s processes and streamline the transaction process. Through increased security, visibility across transactions, and the ability to control spending and simplify reconciliation, these virtual cards are fast becoming a major area of growth in the space. Some virtual cards even offer the option to issue one-time cards that can be used for specific transactions, allowing for further control and fraud prevention.

According to the same report, in 2014, virtual cards and e-payables accounted for $68 billion of the corporate card pie. This number is expected to skyrocket to $233 billion by 2021. In 2018, some banks even reported growth rates of 195% over the previous year.

This trend is being tracked by other observers in the market as well. Another report released in November 2018 predicted a 21% CAGR in virtual card spending from 2017 to 2022 (this excludes consumer, small business, and fleet card spend).

However, because of the existing limitations on issuing a corporate card and the liability of the business owner, these cards do not cater to smaller businesses today. This creates a potential opportunity in the market – a savvy challenger bank with the right business model and technological foundation could carve a significant niche for itself in this booming space. As experts in the payments and fintech space, Penser guides clients to rapidly develop working solutions that focus on specific segments. To learn more about Penser’s services, visit our Digital Transformation page.