Earlier this month, bitcoin payments start-up Lightning Labs raised $10 million in a funding round led by Craft Ventures. Investors in the earlier seed round included Jack Dorsey, co-founder of Twitter and Square, as well as the co-founder of Robinhood and the creator of Litecoin.

Along with this fundraising round, Lightning Labs also launched their first financial services product, Lightning Loop, which is designed to monetize the ‘layer-two’ payment protocol – the Lightning Network (or ‘Lightning’) – that operates on top of the blockchain. The Lightning Network is designed to facilitate micropayment channels at scale; by taking these transactions away from the main blockchain, it allows the bitcoin network to decongest and reduce associated transaction fees. Due to its potential to revolutionise bitcoin payments, other payment players have also started to dip their toes in the water. Square recently announced that its crypto offices were working on their own developer kit that would make building on Lightning easier.

By addressing the major issue of scalability, Lightning has been touted as having the potential to build a network that can compete with a traditional card payments network today, such as the one operated by Visa. With traditional bitcoin payments firms Bitpay and Coinbase also taking large strides in facilitating cryptocurrency payments, could we be looking at the start of the payments revolution blockchain has been promising for years?

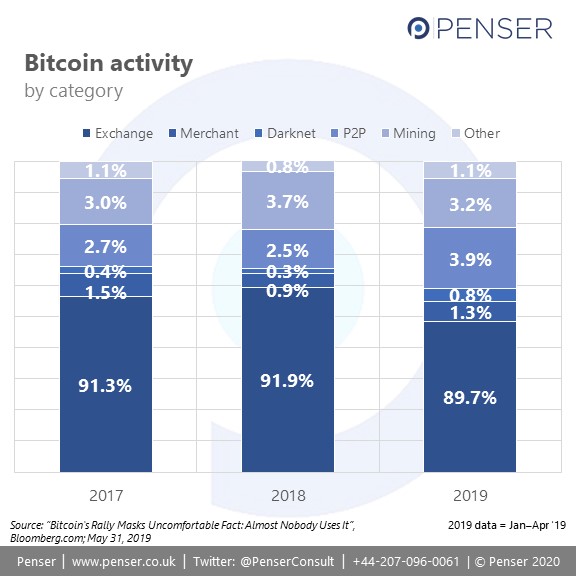

Well, maybe not just yet. The entire bitcoin ecosystem (including funds held by investors) totals only about $171 billion. Daily transactions on the entire bitcoin ecosystem are estimated to be only $30 million. Another report also discovered that, between January and April 2019, only 1.3% of economic transactions (a little over 674 million transactions) came from merchants, with transactions related to exchanges accounting for 89.7%. To give you a sense of the gap, Visa transacts an average of $22 billion a day (2018).

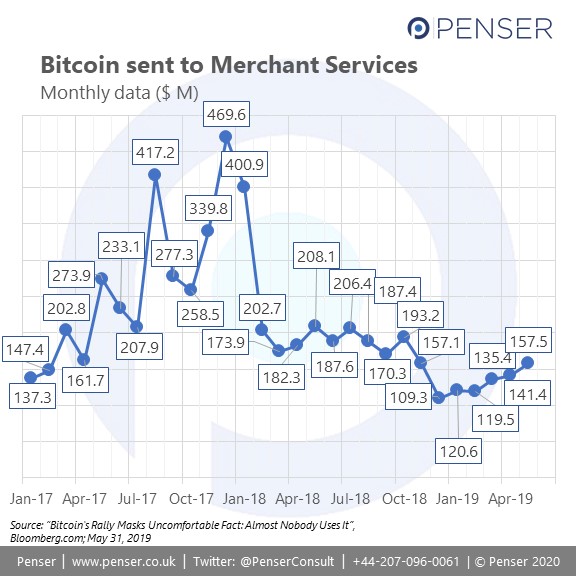

BitPay, the leader in traditional bitcoin payments, has reported over $1 billion in transactions processed in 2017, 2018 and 2019, and claims to have about 30,000 active merchant accounts. Another traditional bitcoin payment player, Coinbase Commerce, which launched in early 2018, processed $135 million worth of cryptocurrency payments in the last year.

These are impressive numbers, and may be driven by increasing adoption of cryptocurrency in less stable economies. Countries such as Venezuela, which has seen a period of hyper-inflation since 2016, consider cryptocurrencies a more stable alternative to the established currency, and an effective payment network could be instrumental in allowing these players to make definite strides in the market.

That said, the numbers touted by bitcoin payments players are dwarfed by today’s major card payment players like Visa, which processed almost half a billion transactions every day and handled $11.2 trillion in payment volume in 2018. Also, bitcoin can currently only handle about 7 transactions per second, while Visa can conduct as many as 65,000.

An important note

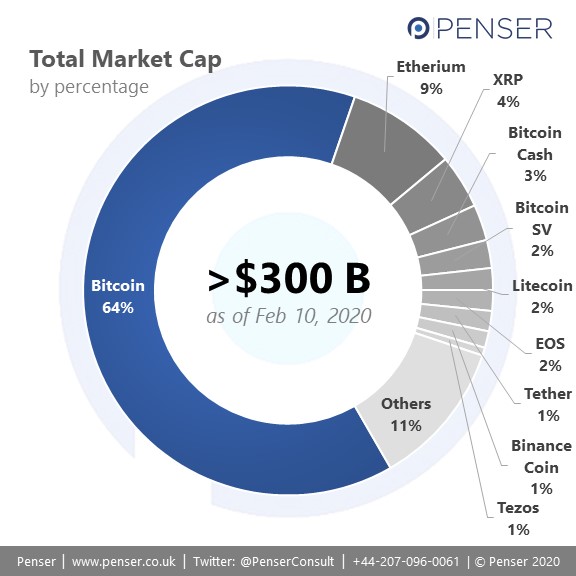

While we may use bitcoin and cryptocurrencies interchangeably in this article, it is important to understand that bitcoin is just one cryptocurrency player in the market. Bitcoin, however, is well ahead of the others in terms of market capitalization value and accounts for around two-thirds of the total market cap of cryptocurrency. Therefore, the term “bitcoin” has become almost shorthand for cryptocurrency as a whole.

This is where we come back to Lightning. As we mentioned earlier, by letting you take your transaction off the network (and on to the “second layer”) and transact with another party privately, Lightning has the potential to solve the scalability problem that bitcoin faces, with only the final result being recorded in the blockchain. Lightning consists of around 11,000 nodes that anyone can run, and the transaction capacity of each channel is about 0.167 bitcoin (~$1,500). However, developments are likely to be implemented soon that should significantly increase the transaction capacity of each channel.

While both are designed to facilitate low and high-throughput payments, card payment networks restrict protocols to trusted member institutions, while the Bitcoin protocol for payments has some challenges scaling with throughput. As Lightning is considered potentially the foundation of a bitcoin payments network that will eventually rival that of a traditional card payment network, let’s take a closer look at how these two networks stack up against each other:

Card Payment Networks versus Lightning Network

- Approach to security:

- Card payment networks follow a “walled garden” approach – they maintain a list of member entities with whom they have contractual agreements, after which they are given access to the network’s protocols. Each transaction then must go through the network.

Lightning, however, is an open network; its specifications are available to the public, anyone can join or leave at any time, and messages may be broadcast to the whole network or just restricted to specific nodes. - Lightning uses ‘payment graphs’ to allow nodes to connect with each other. In order to initiate a payment, nodes need to know about the entire graph.

Card networks, though, act as giant routers; as a result, acquiring banks only need to know about the merchant they’re working with and the payment network, not the details of the card issuing bank. - Card networks also use EMV chips to ensure secure transactions at points of sale. However, online transactions don’t have the same level of security usually. While two-factor authentication (such as 3DSecure) helps ensure security in online card transactions, adoption of this practice varies by country. For instance, countries in the EU and India have made it a standard practice, while the US has yet to fully deploy it. Mobile wallets like Google Pay and Apple Pay have started to implement this across their network, though, which is driving adoption rates up.

Lightning is inherently designed to secure transactions, as it is built on the decentralized blockchain network. Therefore, there are no meaningful distinctions between online and offline transactions.

- Card payment networks follow a “walled garden” approach – they maintain a list of member entities with whom they have contractual agreements, after which they are given access to the network’s protocols. Each transaction then must go through the network.

- Card networks differentiate between authorizations, which happen within seconds once the payment is initiated by the customer, and settlements, which are done once or a few times a day, in batches. They essentially follow a net settlement

Lightning, however, immediately settles transactions upon authorization. As a result, settlements can take as little as a few subseconds. They essentially follow a gross settlement principle. - Lightning payments may be declined if there isn’t enough liquidity in a channel along the way.

Card networks, though, usually only decline payments if there isn’t enough money in a bank account, or if the payment is considered fraudulent, or if the host is offline (as Chime discovered recently). - Card networks have a fixed transaction flow, with the merchant’s POS device initiates the transaction. It can also be referred to as a ‘pull system’. Lightning doesn’t have a fixed structure. Anyone can be a merchant, payer or an intermediary. As a result, the network is harder to imagine or to represent pictorially – here’s an interactive map that’ll give you a better idea. The user has control of the funds, and approves every transaction, essentially making this a ‘push system’.

- Currency conversion is another key feature of card payment networks. These allow you to use a card anywhere in the world, with conversions being done in the backend by the network or the card issuer. Lightning also works in much the same way, but with cryptocurrency. As a result, card networks don’t settle in crypto networks, and crypto networks can’t interact with card networks, and even cards that allow you to spend crypto does the conversion outside of the network.

- When it comes to liquidity, card networks don’t necessarily need issuing banks to maintain liquidity at all times, as settlements happen in batches. Therefore, transactions may proceed even if funds are low.

Lightning required locked-in funds to proceed with transactions. If a channel gets exhausted, payments will not be possible through that channel unless it is topped up. - Partly due to the above, card networks have to deal with chargebacks – disputed transactions that require resolution – which costs the network (and eventually the end-user) heavily.

Lightning, for better or worse, wouldn’t have this issue, as transactions are instant and irreversible, and can only go ahead with user authorization. Therefore, there is no option of chargeback. - Card networks have established complicated fee structures that they control. These fees generally include interchange fees, network fees, and acquiring bank fees.

Lightning, being open, operates on a free market principle; nodes can set their own fee per channel. This is expected to increase competition and therefore cost less.

These are just some of the higher-level differences between established card payment networks and the potential payment network built on Lightning. This should not take away from some of the new payment avenues that Lightning could offer, such as

- a better “pay per use” model, especially for streaming payment, where you can control your payments on a much more granular level and ensure that you pay for exactly as much as you need,

- allowing for nano-payments that are currently not practical because of the fixed costs associated with card payments, and

- giving you the option of privacy; the Lightning network would allow you to both confirm your identity without necessarily sharing your private information with the merchant and other intermediaries, thereby restricting the level of KYC information needed.

But these are early days still. While Lightning may eventually become the solution – or the foundation for the solution – that blockchain promised in the payments space over the last decade, it still has a long way to go before it’s proven as a concept, and is ready to be implemented at scale.

As expert payment consultants, we keep a close watch on developments in the sector, and how the market is shaping up in the near- and long-term. We have developed the industry expertise in fintech to be able to provide our clients with the guidance they need to make informed decisions in the banking and payments sector. Through our technical due diligence services, we have helped clients identify vulnerabilities and gaps in the business’s IT infrastructure. Our commercial due diligence services also provide clear, comprehensive reports that outline the strengths and weaknesses of the target company.

If you’d like to learn more about our due diligence services, request a sample report by clicking here.

We also provide consulting services in strategic planning and digital transformation. Find out more by visiting our services page.