Mobile Wallets in India

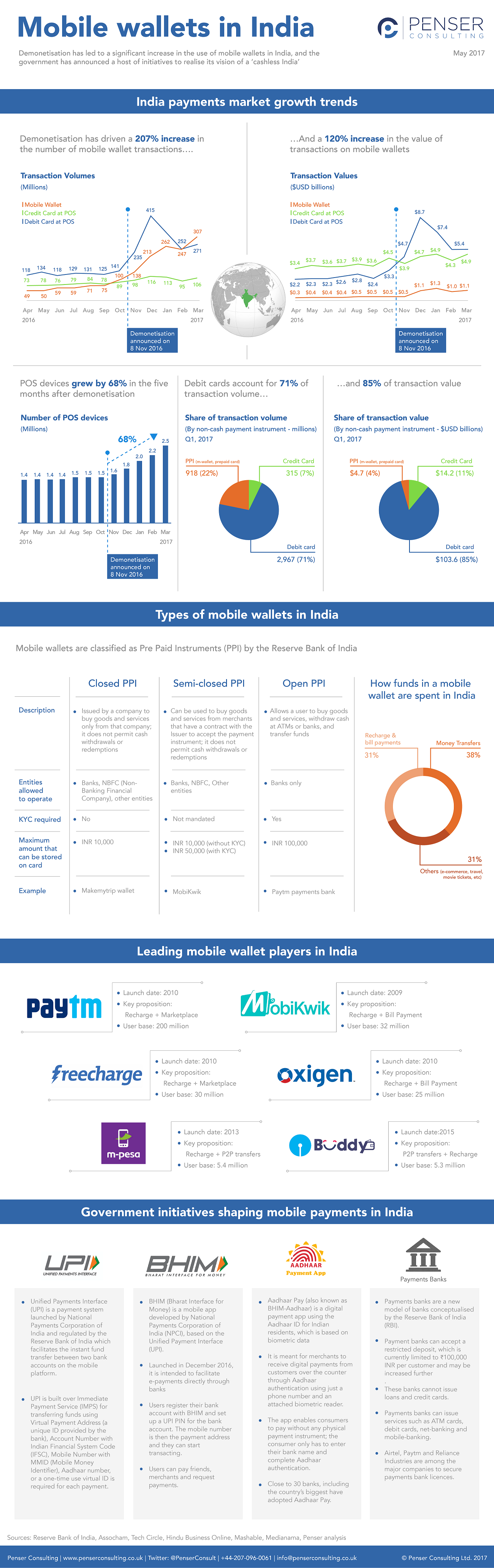

Demonetisation has led to a significant increase in the use of mobile wallets in India, and the government has announced a host of initiatives to realise its vision of a cashless India

Mobile Wallets in India

INDIA PAYMENTS GROWTH TRENDS

Demonetisation has driven a 207% increase in the number of mobile wallet transactions, and a 120% increase in the value of transactions on mobile wallets.

POS devices grew by 68% in the five months after demonetisation.

Debit cards account for 71% of transaction volume and 85% of transaction value

TYPES OF MOBILE WALLETS IN INDIA

1. Closed PPI – Issued by a company to buy goods and services only from that company; it does not permit cash withdrawals or redemptions

2. Semi-closed PPI – Can be used to buy goods and services from merchants that have a contract with the Issuer to accept the payment instrument; it does not permit cash withdrawals or redemptions

3. Open PPI – Allows a user to buy goods and services, withdraw cash at ATMs or banks, and transfer funds

HOW FUNDS IN A MOBILE WALLET ARE SPENT IN INDIA

38% – Money transfers

31% – Recharge and bill payments

31% – Others (ecommerce, travel, movie tickets, etc.)

LEADING MOBILE WALLET PLAYERS IN INDIA

– Paytm

– MobiKwik

– Freecharge

– Oxigen

– M-Pesa

– SBI Buddy

GOVERNMENT INITIATIVES SHAPING MOBILE PAYMENTS IN INDIA

– UPI: Unified Payments Interface (UPI) is a payment system launched by National Payments Corporation of India and regulated by the Reserve Bank of India which facilitates the instant fund transfer between two bank accounts on the mobile platform

– BHIM: BHIM (Bharat Interface for Money) is a mobile app developed by National Payments Corporation of India (NPCI), based on the Unified Payment Interface (UPI)

– Aadhaar Pay: Aadhaar Pay (also known as BHIM-Aadhaar) is a digital payment app using the Aadhar ID for Indian residents, which is based on biometric data

– Payments Banks: Payments banks are a new model of banks conceptualised by the Reserve Bank of India (RBI).

————–

For more infographics on mobile wallets, Click here