The world’s second-fastest-growing digital economy, India, is also developing into a fintech and payments hub. In recent years, a push towards developing a ‘Digital India’ has led to several initiatives across a variety of sectors, including the finance industry. According to the Ministry of Electronics and Information Technology, India’s digital economy could create $1 trillion in economic value in 2025. India’s current digital economy generates $200 billion of economic value.

As experts in payments consulting, we track emerging trends and technologies, especially in developing fintech markets such as India and China. In this article, we explore how India’s UPI system has been an unexpected success in the world of payments.

What is UPI?

United Payments Interface (UPI) is India’s real-time mobile payments system, developed by the National Payments Corporation of India (NCPI). Launched in April 2016, the interface facilitates inter-bank transactions and is regulated by the Reserve Bank of India. It connects multiple bank accounts into a single mobile application, allowing immediate money transfer and payments 24/7. The interface allows individuals to link their bank accounts to multiple peer-to-peer (P2P) payment apps, such as Paytm, Google Pay, PhonePe, MobiKwik, and BHIM (NCPI’s P2P app), among others. Individuals can use UPI to pay each other, as well as banks and institutions that are UPI enabled, via phone numbers, QR codes, account numbers and IFSC codes, Aadhar numbers, their unique Virtual Payment Address (VPA) or their UPI IDs.

UPI’s Impact

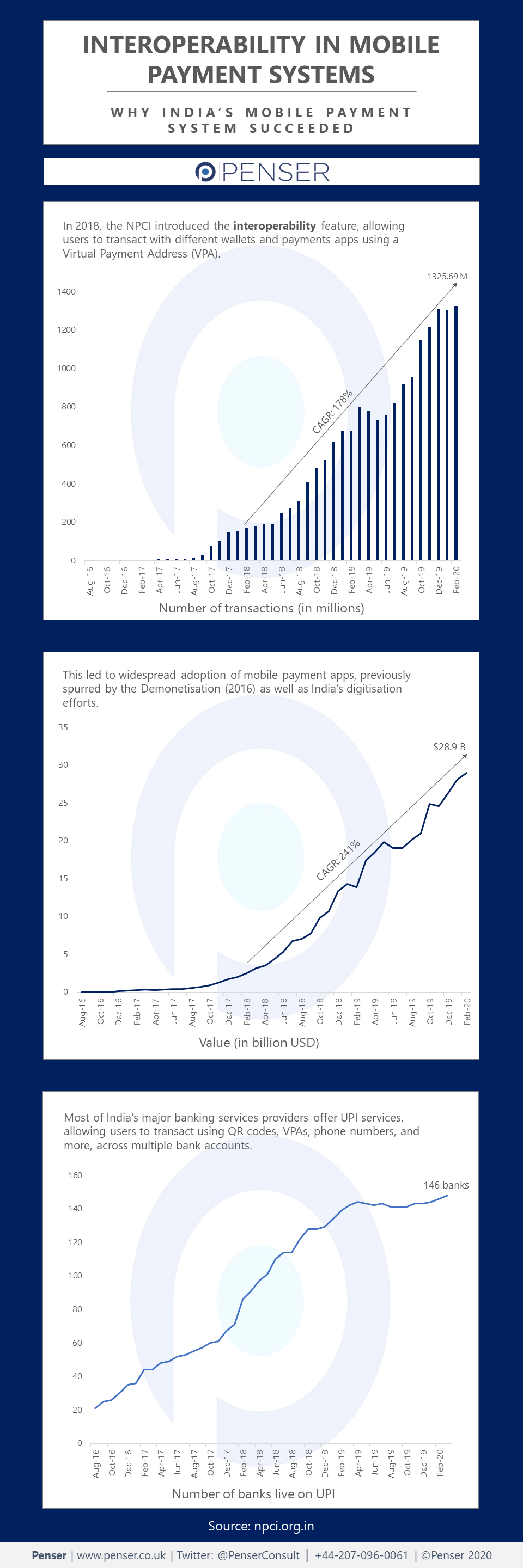

In October 2019, India’s UPI system crossed 1 billion transactions and over 100 million users, merely three years after its launch. UPI now fulfils more than half of all digital transactions in the country. In November 2019, India’s UPI went international, with demo transactions being tested in Singapore via the NCPI’s BHIM app. It is expected to launch fully later this year. According to reports, the Indian government is exploring launching the BHIM UPI app in the UAE as well, due to the large Indian expatriate population residing there. Both Singapore and the UAE have already opened their markets to India’s RuPay cards and, if the adoption of the UPI system goes through, Indian expats will have a cheaper and easier alternative to send their remittances back home.

Tech giant Google’s flagship payments app, Google Pay (previously launched as Tez), has witnessed immense success as UPI’s popularity has grown among Indian residents. Within two years of its launch, the app recorded 67 million monthly active users (MAU) followed by rival PhonePe (owned by Flipkart), at 55 million active users per month. Paytm, India’s homegrown unicorn valued at $16 billion, remains the market leader with 140 million active users per month

Across the world, several countries have marvelled at India’s success with real-time mobile payments. Following Google Pay’s success with UPI, in 2019, Google recommended that the U.S. Federal Reserve also implement a real-time payments platform, on the lines of India’s UPI.

Here’s a look at the growth of UPI through the years:

The Future of Mobile Payments in India

Given the largescale adoption of mobile payments in the country, particularly after 2016’s demonetisation, it is not a stretch to imagine that the entire country will one day be able to pay for goods and services via mobile soon. This is particularly inspiring as India is largely rural, and the mobile and internet penetration isn’t as high as some other developing economies. Even with such odds, India has displayed tremendous results with the adoption of the UPI system.

India’s urban population – a demographic that is more likely to use new technology and adopt new fintech practices – is growing rapidly. This, along with the ‘Digital India’ push, has resulted in a large mobile and digital payments opportunity in the country. With homegrown players such as Paytm morphing into super-apps, offering everything from ecommerce platforms, bill payments, investments, etc. within a single interface, to international players such as Google Pay and WhatsApp Pay entering the market, the Indian population is being targeted with different choices for their payments.

The main reason for UPI’s success in India was interoperability. Introduced early 2018, RBI’s interoperability mandate allowed customers to make and accept payments from users of different payment apps. This made it a national payments system, and users did not have to choose one app or payments provider to send money to their peers, pay their bills, etc. The interoperability creates healthy competition between rival payments providers (both domestic and international) in a bid to secure the loyalty of their customers.

Mobile payments in India have grown rapidly over the last few years, driver by particularly favourable regulations. However, since the RBI has now mandated the need for complete physical KYC verification, the scenario is likely to change. Previously, payments providers have enjoyed relaxed regulations, allowing partial or digital-only KYC mandates. Given the large volumes of registered customers these payment providers have, this has proven to be a difficult task.

Even so, the number of mobile transactions and their value continues to grow in India as more and more people adopt mobile payments. India is well on its way to becoming a cashless economy.

At Penser, we offer digital transformation, due diligence, and strategic planning services. We have worked with several mobile payments and digital payments companies across the globe, including India. Contact us to find out more about how we can assist your venture into mobile payments today.