The European Commission enforced the PSD2 earlier this month (September 14th, 2019) which means banks & financial institutions have to share their customer data with other EU fintech companies. The Open Banking mandate of the directive specifies that banks need to follow a standardized procedure involving secure APIs & gather explicit consumer data to share their data with third-party providers. So far, only 24% of banks and 29% of fintechs that were asked said that they were ready to embrace PSD2.

While the UK was one of the first countries to introduce open banking in its banking and finance sectors, several countries across the globe have taken the initiative and formulated their versions of open banking to further innovation by increasing competition. Most recently, Australia and Portugal began their open banking journey, and the likes of South Korea, Japan, Hong Kong, Brazil and more are finalizing their legislations to usher in open banking.

(To know more about PSD2, Open Banking, AIS & PIS, check out our blog.)

Open banking has been formulated to develop innovative solutions to payments, banking & managing finance using the collaboration of fintech companies & traditional players. We explore some of the challenges of this initiative below:

Challenging old systems & legacy players

The implementation of open banking will need traditional players to revamp their current systems & change their way of working to include third-party fintech companies. According to the March 2019 EBA survey, 77% of financial institutions haven’t begun providing new services under PSD2. 12% offer both AIS and PIS services 8% offer only AIS and only 3% offer PIS.

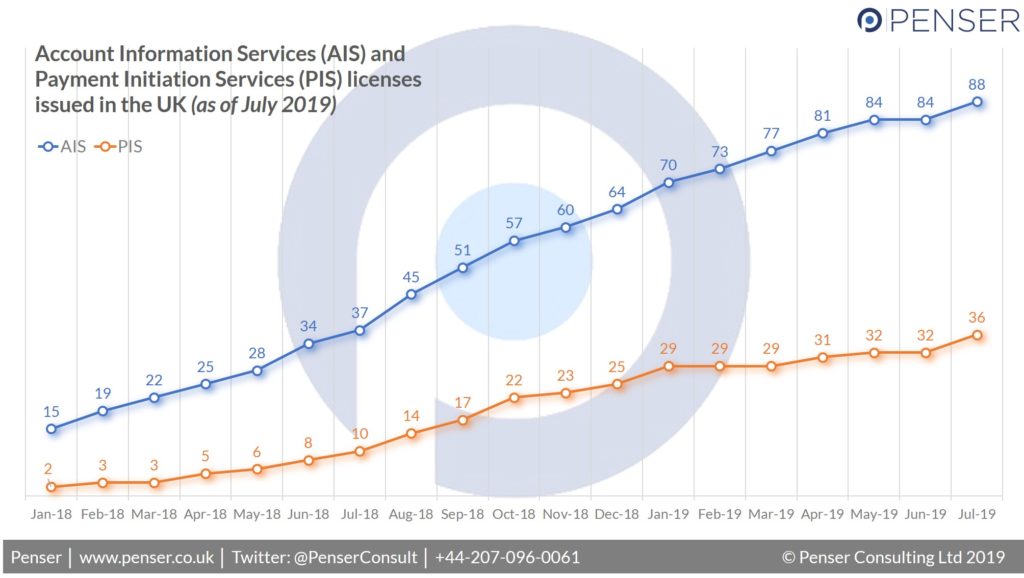

In the UK, compared to 37 AIS and 10 PIS licences issued in July 2018, there were 88 AIS licences and 36 PIS licences issued in July 2019, reflecting YOY increases of 37.8% and 160% respectively.

Traditional players will have to work along with fintech companies to drive innovation and provide customers with innovative payment and finance management solutions. The EBA report also indicates that “a significant number” of institutions have already applied to provide either one or both of these services in the near future and will be offering cross-border services across the EU.

Open banking is going to force traditional players to rework how they provide services to consumers if they don’t want to be edged out by new entrants in the market offering digital-only services & collaborating with third-party providers. This also means that traditional banks may need to consider a mutually beneficial relationship with fintech startups to provide innovative and intuitive services to their existing customer base. Consulting firm Simon & Kucher reports that nearly half (44%) of the customers they contacted said that they would like better services like personalisation, convenience & a dedicated contact person at the bank. Open banking can help traditional banks provide better high-touch services with third-party providers and the innovation they spearhead. When asked about integrating with existing bank systems, 40% of third-party developers mentioned instability, low stability and unreliability of banks and their open APIs as their main challenges. Developers pointed out that banks’ unwillingness to change and aversion to risks has been slowing down the progress of open banking.

Security & Privacy concerns

For banks and financial institutions to be able to share their customer data, they need a secure API as well as customer authorisation and consent. Simon and Kucher Partners’ report also included customer perspectives on data-sharing, which is an integral feature of open banking. North American (US & Canada) customers are wary of sharing their data — 39% (two out of five) said that they would reconsider using a service or feature if it required their bank to provide a third-party provider access. In comparison, the UK & Europe customer base is more open to data sharing, with only 53% mentioning they wouldn’t be likely to consent to data sharing. This might be because of the importance placed on privacy & data security by the European governments with the GDPR law.

47% of all customers surveyed said that they were unlikely to allow banks to share their data, which might prove to be a concern for third-party providers. But when it comes to willingness to pay, customers are quite open to paying for features such as “instant online account opening, pre-filled forms, access to credit scores, instant online loan approvals, and a consolidated view of their financial situation,” reported the survey.

Once the customer consent hurdle is bypassed and cleared, both banks and fintech businesses will have to make sure the data that is shared is securely stored and transferred. Hackers and fraudsters will be targeting the open APIs in a bid to gain access to sensitive customer data. When it comes to cybercrime & money laundering, stricter KYC & AML legislation and checks will help prevent financial crime and help protect customer data and assets.

Healthy Competition

In the UK, ING’s Yolt launched in April 2018 was one of the first to provide an account aggregation service, allowing customers to glace at their finances across multiple bank accounts in one spot. Traditional banks have tied up with third-party developers to offer similar features. HSBC’s HSBC Beta was turned into the Connected Money app in May 2018, after several months of beta testing. Similarly, another high-street bank in the UK, NatWest, recently offered its customers the ability to link their bank accounts from rival banks to provide a complete picture of the customer’s financial assets.

So far, the onus has been on traditional players to work with third-party developers to offer personalized & high-end services to attract customers, but neobanks such as N26, Monzo and Revolut who are leading players in the market are also due to release features using open banking.

The challenge with account aggregation is that it provides customers access to their information that was previously only with their banks, allowing them to compare and choose the service that works best for them. This could result in customers switching banks & choosing to migrate their accounts to a rival bank. Traditional and non-traditional players alike will compete with each other to retain customers.

While the current open banking account aggregation phase is read-only, allowing customers to link accounts in one app via an open banking API, the next one will allow customers to initiate payments and complete transactions from one app. Until now, the provisions made by traditional players have been basic and mediocre at best, giving smaller banks and digital-banking alternatives the chance to lure customers by providing more transformative financial services. When it comes to competition, a large proportion (3 in 5) of financial services believe their competitors are more ready for open banking than they are. This is a sentiment felt by 69% of banks compared to 52% of fintechs.

According to The State of Open Banking 2019, nearly 58% of banks and 65% of fintech companies have stated that open banking is currently their main commitment. Likewise, 94% believe that their business encourages digital innovation. With open banking, consumers will be provided with a clearer understanding of their finances and the value it holds for their banks & the businesses that want to engage with them.

The next phase of the open banking mandate rolls out soon, and we’re going to be tracking it every step of the way. Check back in to see how it impacts the UK and EU banking and fintech scene.

At Penser, we pride ourselves on the vast expertise of our team in digital banking and payments. We offer this expertise to our clients to help them on their digital transformation journeys, due diligence on new ventures and strategic planning for the future. To know more about what we can do for you, please contact us

Feature image: Source