HSBC is Hong Kong’s largest bank, and is a subsidiary owned by HSBC Holdings. The latter has headquarters in both London and Hong Kong, considering both as home markets. The seventh largest bank in the world in 2018, HSBC was set up over 150 years ago and has a revenue of $32 billion.

With 39 million customers across 66 countries and territories, here are some of the major initiatives that display HSBC’s commitment to digital banking:

HSBC Hong Kong

HSBC is one of the only three banks in Hong Kong that is authorised to issue bank notes, along with the Bank of China (Hong Kong) and Standard Chartered Bank (Hong Kong). Nearly 68% of all notes issued in Hong Kong are by HSBC, making it the most prolific issuer in the city.

With 220 branches in Hong Kong SAR, the bank is one of the few offering online banking services along with physical branches to its customers. To battle the onslaught of neo-banks recently receiving digital banking licenses, the bank has rolled out several digital transformation initiatives.

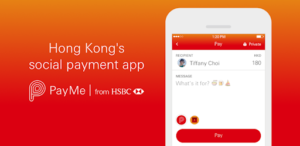

PayMe: Hong Kong’s P2P Payment App

Launched in 2017, PayMe is HSBC’s foray into digital wallets and peer-to-peer payments services. The app allows users to sign up using their Facebook account or HK mobile number and then link their local bank account to top up their account with funds. As a standalone app, users can link their bank account or Visa and MasterCard credit cards from any bank, not necessarily HSBC. PayMe offers customers the ability to send payments to those without PayMe accounts, offering direct deposits into bank accounts via shareable social media links (or a new PayMe account). The app has gained traction among HK residents, attracting over 1.5 million customers in two years.

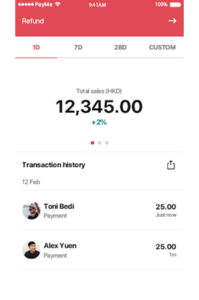

PayMe Business: SME Digital Wallet

HSBC recently rolled out PayMe Business which allows merchants to collect payments from over a million PayMe accounts or via face-to-face QR codes. With a 1.5% fee per transaction, which doesn’t apply until 30 June, 2019, PayMe Business can be used by any HSBC commercial banking customer.

The initiative has received thousands of applications and already has 3,000 registered users since its April launch. To attract businesses, HSBC has promised to make data from PayMe’s base of 1.5m Hong Kong consumers available to them.

Fintech Funding

In June 2019, HSBC announced that it was creating an $880 million tech fund to provide financing capital to early stage companies. This is part of its strategic commitment to helping entrepreneurs and the new economy thrive across the HK Greater Bay Area (GBA). The fund will support enterprises in e-commerce, fintech, biotech, robotics and healthcare tech in China, Hong Kong and Macau. The GBA+ technology fund will provide senior debt financing to companies that are likely to have received funding from VC or private equity firms. It aims to provide entrepreneurs that have viable business models with liquidity to finance growth and not just to fund proof-of-concept work in the earliest stages of a start-up’s journey.

To read more about the rapidly developing fintech sector in Hong Kong, click here.

HSBC USA

HSBC has 230 branches across the United States and is headquartered in New York. Earlier this month, HSBC announced that they are pursuing a retail expansion across the US, adding 50 branches and over 300 employees to their existing 43,000 employees. With several digital initiatives ranging from the use of AI in physical branches, to workshops and online interactive courses to increase financial literacy, HSBC USA is investing considerable time, money and effort into developing itself into a digital bank.

Pepper the Robot

Embracing AI in their physical branches, HSBC was the first US bank to employ the services of Pepper the Robot. First used in their Manhattan Fifth Avenue branch, Pepper is now a part of four HSBC branches in the US. There has been a 60% increase in business at the new flagship branch and a five-fold increase in foot traffic. Across all of HSBC’s Pepper devices, there have been almost 25,000 consumer interactions.

A sophisticated digital device, the robot aids customers by using natural languages processing to understand multiple languages (including accents). The touch screen on its front shows tutorials and instructions on depositing cheques via the mobile app or details on product features and promotions. Pepper also provides information related to about 300 actions, including opening an account and applying for a credit card.

HSBC Wealth Track™

HSBC has partnered with leading digital wealth management platform Marstone Inc. to develop a software-based investment advice platform. This will allow customers to instantly create a diversified portfolio at low costs for both retirement and non-retirement accounts. Expected to launch in 2019, the platform will be available to retail banking customers with at least $5,000 in an individual retirement account and $10,000 in discretionary accounts.

Digital Lending

In an effort to expand their current customer base, HSBC USA has partnered with online lender Avant, to employ its end-to-end technology platform Amount, to meet the borrowing needs of its customers. The service will offer loans up to $30,000 with terms up to five years. Customers will be able to apply within minutes, and if approved, have the money in their account within a day. The interest rates range from 5.99% to the low-20s. The Amount platform has been customized to HSBC’s specifications, including their proprietary risk models.

Digital Mortgages

Announced in June 2019, HSBC USA is partnering with digital lending platform, Roostify, and will offer customers a streamlined application and fulfilment process for both purchase mortgages and refinances. Customers can submit their loan requests online, share documents digitally and securely with the bank and track the status of their loan application.

HSBC Financial Wellness Centre

The HSBC Financial Wellness Centre, powered by leading educational tech company EVERFI, is a digital, interactive platform that serves to empower and educate individuals, community organisations and corporate partners about financial literacy. The service is available to all, both HSBC customers and non-customers. HSBC’s corporate partners can also avail the service for their employees. The platform offers a series of modules on a variety of topics, including savings, banking, credit cards & interest rates, credit scores, financing higher education, renting vs. owning, taxes & insurance, consumer protection, and investing.

‘Your Money Counts’, a workshop program offered by HSBC staff is a financial capability program for individuals and families. Topics include budgeting, credit and identity theft.

This digital financial literacy initiative by HSBC is similar to Barclays UK’s Digital Eagles initiative. You can read more about Barclays’ Digital Transformation here.

In the last few years, HSBC has started offering several products and services to make its mark in the digitally disruptive banking industry. In an effort to fend off competition from app-based challenger banks, it is reportedly developing a standalone digital banking startup for small business customers.

The $166 billion money lender is smartly developing itself as an important retail banking choice across the globe in the current digital banking era. In June 2018, the bank announced that it would invest $15-$17 billion in technology-based services as part of a new digital growth strategy.

Digital Transformation Spotlight: DBS & PNC

Penser is a specialist consulting firm focused on FinTech, payments and open banking. We provide strategic planning, digital transformation, and due diligence services.