Every time you whip out your card to pay for something in a store, you pay through a Point-of-Sale (POS) device that is developed by companies such as Square, Ingenico, and Verifone. These three companies also offer technological solutions for electronic payment transactions, thereby providing a holistic solution-set for businesses to accept payments from customers. Let’s take a closer look at each of these:

Square

Headquartered in California, Square entered the market with POS devices in 2009. The company’s first product, the Square Reader, allowed payments to be accepted via mobile phone. At a cost of only $10 against the prevailing $200 to $300 market price of card terminals it capitalised on the fact that expensive compute power was already in the hands of the user, in the form of their own mobile phone. The early version of the Square card reader was inserted into the mobile phone through its 3.5mm headphone jack and served to capture card information transmit the data to the card acquirer. Square had landed squarely in the crosshairs of an industry that was complacent and duopolistic. While early versions of its product did not adequately encrypt data and drew criticism from incumbents such a Verifone, it was quick to innovate.

Since then, Square’s portfolio expanded to POS devices that accept payments from chip and contactless cards, as well as digital payments from mobile wallets like Apple Pay. Square’s product suite also includes the ability to create tailored customer profiles and integrated loyalty programmes, including both virtual and physical gift cards. Square Capital, the company’s lending service, offers loans to SME merchants using Square to facilitate payments.The company has also expanded to include services such as online bookings for SMEs and introduced Square Payroll, a service that automates a business’s payroll payments, tax filings, and withholdings. Their latest offering allows Square merchants to develop custom interfaces for the platform using an API.

Square also owns Cash App, a P2P payments app that boasts 7 million users. Previously called Square Cash, it began as a service tailored towards businesses, allowing them to accept payments using a unique username.

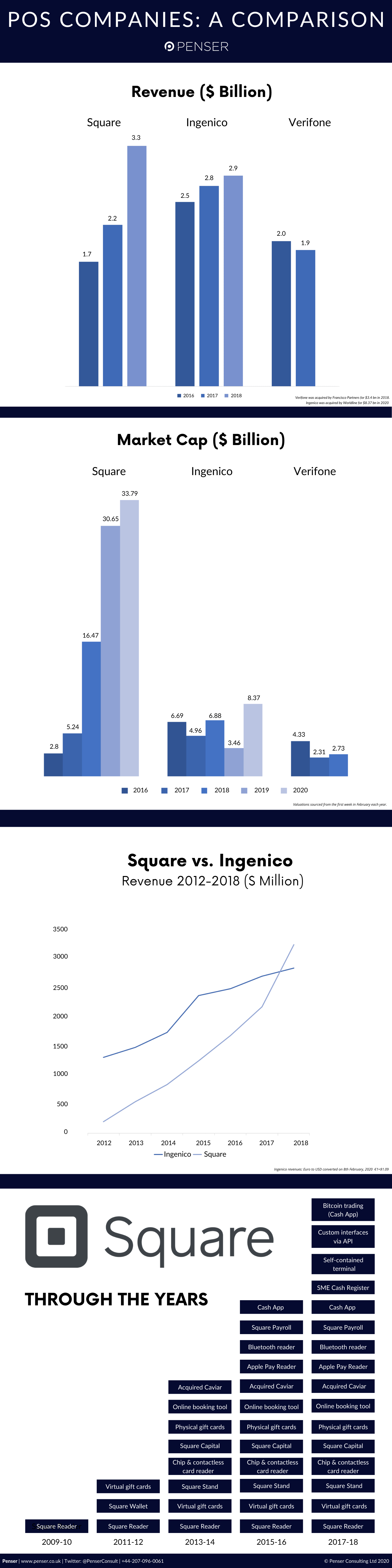

Since its launch, Square has raised more than half a billion dollars ($590.5 million) across multiple funding rounds from investors including the likes of Sequoia Capital, Citi Ventures, Khosla Ventures, Starbucks, Goldman Sachs, and others. The startup went public in 2015 with a valuation of $2.9 billion, considerably lower than its previous valuation of $6 billion in 2014. As of 7 February 2020, it has a market capitalization of $33.79 billion.

Ingenico

Founded in 1980, Paris-headquartered Ingenico is a market leader in the manufacturing & development of POS devices but has expanded to providing payment solutions for digital and mobile payments. Ingenico has acquired several payment platforms throughout the years, strengthening both its product offering and its global reach. Starting with the purchase of Ogone in 2013, it has been making a deliberate move away from being a ‘box shifter’ of hardware terminals to a company with transaction-based revenue from payment processing – a move that often pitted it as a competitor to the banks and acquirers that were its own customers.

In 2017, it acquired Sweden’s Bambora, a successful payments group, for ~ $1.6 billion (€1.5 billion) and Spain’s IECISA Electronic Payment System to expand its offering via its direct-to-retail channels. Ingenico’s major acquisition, Belgium’s Ogone, an online payment platform and payment risk management company specializing in eCommerce & cardless transactions, led to the development of Ingenico’s digital and mobile payments and fraud prevention services. Ogone, currently named Ingenico Payment Services, provided payment solutions in more than 80 countries and had 77,000 clients in 2014. This made Ingenico a global leader in POS and digital payment solutions. As of 2020, Ingenico has 30 million terminals across the globe in over 170 countries. Ingenico was acquired by Worldline for $8.37 billion on February 3rd, 2020.

Verifone

Similar to Square, Verifone is a California-headquartered company that began its journey with POS devices and has since expanded to electronic payment solutions. Founded in 1981, the company was acquired for $3.4 billion by private equity firm Francisco Partners in 2018. Verifone’s products include POS, merchant-operated, consumer-facing and self-service payment systems for multiple industries. Like its competitors Ingenico and Square, the company’s product line also includes electronic payment terminals that accept card payments, software application, mobile payment solutions and more.

Verifone processes over 10.3 billion transactions annually and is present in more than 150 countries around the globe. 46% of all non-cash transactions in the world are made through Verifone’s products. At the time of its IPO in 2005, Verifone was valued at $650 million but only raised $154 million. Before its acquisition in 2018, Verifone had a market capitalization of $2.7 billion.

While all three companies dabble in the same products, it is interesting to note that Square entered the market decades later but still boasts a far higher market capitalization than both Ingenico and Verifone put together. It has also overtaken them in revenue, doubling its 2016 revenue two years later.\

The Penser Perspective

The global POS terminal market size is expected to reach USD 125.9 billion by 2027, at a CAGR of 7.5% over the forecast period. The decline in cash payments across the globe has necessitated the growth of both card payment and digital payment processors. Companies offering in-store payment processing need to offer more than standard services of accepting payments and processing them. Businesses now depend on such payment processors to analyse their customer’s spending patterns and to gain insights on how to optimise their sales by personalizing their marketing efforts. It is interesting to note how new entrant Square capitalized on this strategy by expanding into accounting software, integrated loyalty programmes, and now allows customized interfaces via APIs. Both Verifone and Ingenico have been acquired but even at their peak, their revenues and valuations were far behind Square’s current valuation, largely thanks to Square’s diverse and recurring revenue streams, strong brand and focus on software solutions for a large and underserved market, the small business.

Square is a great example of the issue famously described as ‘The Innovators Dilemma’ by the academic and strategy consultant Clayton Chistensen where technology changes create opportunities for start-ups to enter a market with a low-end product that is ‘good enough’ then rapidly move upmarket while incumbents are not caught flat-footed trying to protect their cash cow business and unable to move quick enough to compete with nimble startups. While Verifone and Ingenico have made to innovate on their product lines and software services, it proved to be too little too late…and now Square finds itself as the formidable incumbent competitor for anyone wishing to enter the payment processing market.

At Penser, as experts in fintech and payments, we constantly track new developments in these sectors. To find out how we can boost your product offering and help your business grow, contact us for strategic planning, due diligence, and digital transformation services.